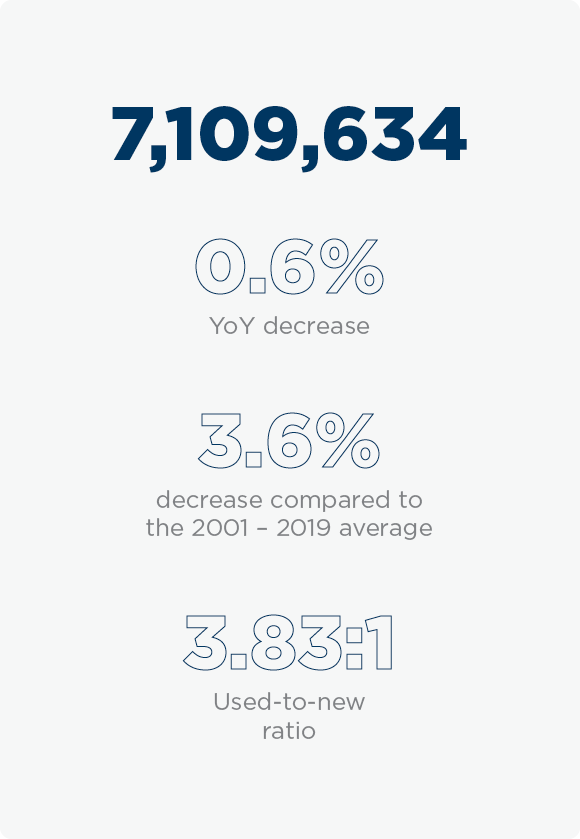

Drawing on data going back to 2002, the UK's average annual used vehicle transactions (i.e., changes in ownership registered with the DVLA) have stood at 7.4 million. Over this two-decade period, the UK exceeded eight million transactions just twice, once in 2016 and again in 20171. These peaks were primarily driven by the gradual recovery from the global financial crisis, at a time when interest rates were low while financing and credit availability were high.

The average ratio of used-to-new transactions in the period since 2002 was 3.37. The pause in new car production caused by the pandemic and subsequent supply shortage, saw this ratio increase to 4:1.

Regarding the ratio between used and new vehicle registrations in the same timeframe, the average hovers at around 3.37:1 However, this was only at the onset of the pandemic, which severely disrupted new vehicle supplies, that the UK achieved a ratio of more than 4:1.

The question often asked is whether the UK's used car market will ever return to the eight-million mark. But in reality, this figure represents an outlier rather than the norm. Considering the headwinds and significant global production shortages that have affected used vehicle supplies worldwide, we believe our 2023 forecast of 7.15 million transactions demonstrates the market's resilience.

Showing strong resilience throughout the years, the UK used vehicle market’s data underline a consistent pattern. While the elusive eight-million transactions remain an outlier, the market’s ability to weather global headwinds and supply challenges is undeniable.

In 2023, an insatiable appetite for used vehicles, driven by OEMs re-entering the market, has sparked a shift back to a 'push' model. As the business sector works to replenish ageing fleets and rental stocks, the market's dynamic nature is on full display, offering promise and adaptability in the face of evolving circumstances.

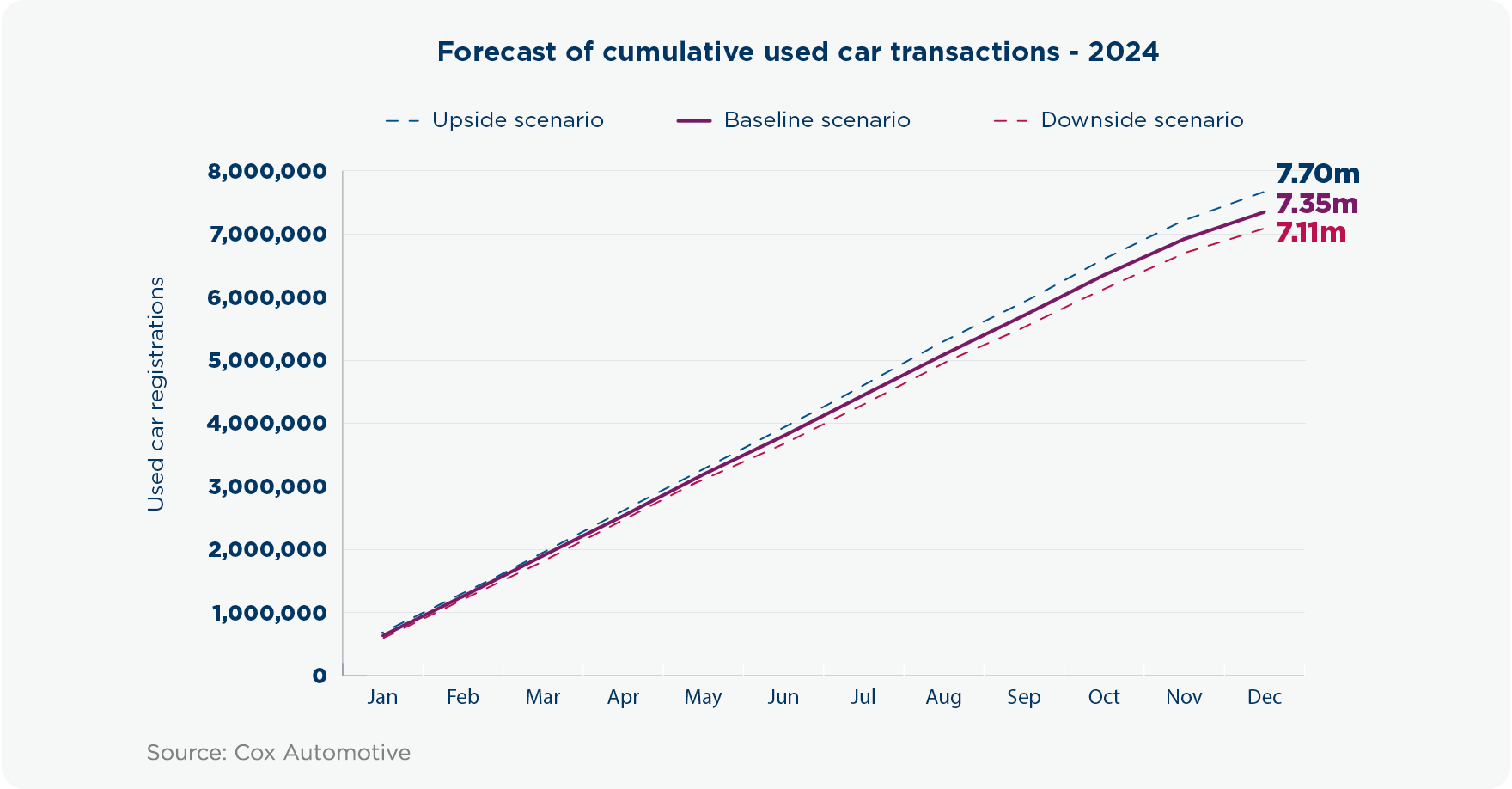

2024 used car forecasts

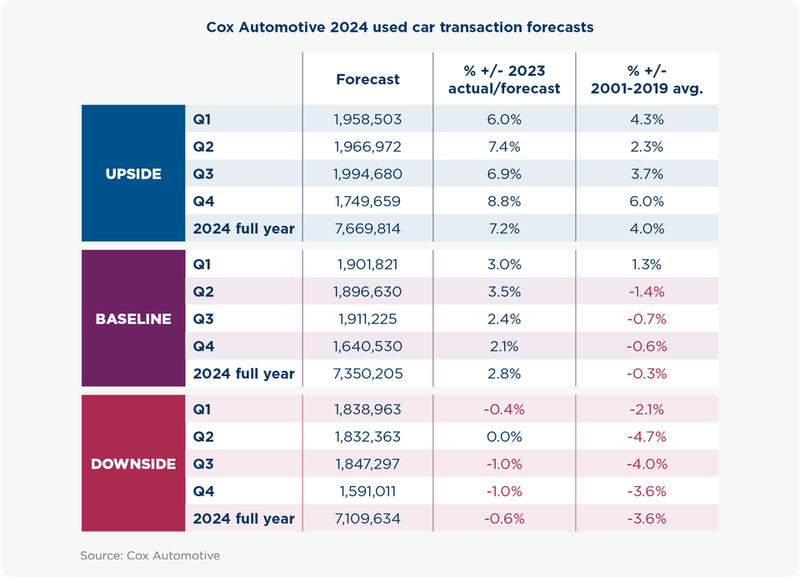

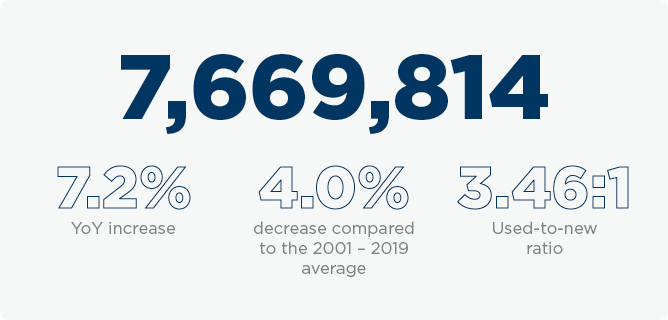

UPSIDE SCENARIO

This scenario envisions a balanced recovery, where registration numbers are bolstered by greater choice, increased consumer confidence and a brisk rise in battery electric vehicle (BEV) ownership.

Recovery in new vehicle registrations: New vehicle registrations follow a balanced recovery trajectory that does not exert excessive pressure on the unrealistic cost of owning used vehicles compared to new.

Easing of used vehicle choice limitations: Recent production shortages that have restricted choice in the used market begin to ease as fleet and rental sectors release inventory into the used car market.

Economic initiatives boost consumer confidence: Economic initiatives (much lower inflation, falling interest rates) are implemented to stimulate consumer confidence and enhance consumer spending. In turn, this eases pressure on the leading and broader automotive sectors.

Rapid growth in pre-owned BEVs: The used BEV market experiences substantial growth as consumer interest in ownership surges. This heightened interest may result from greater confidence in residual values, improved battery health, or government initiatives to drive demand.

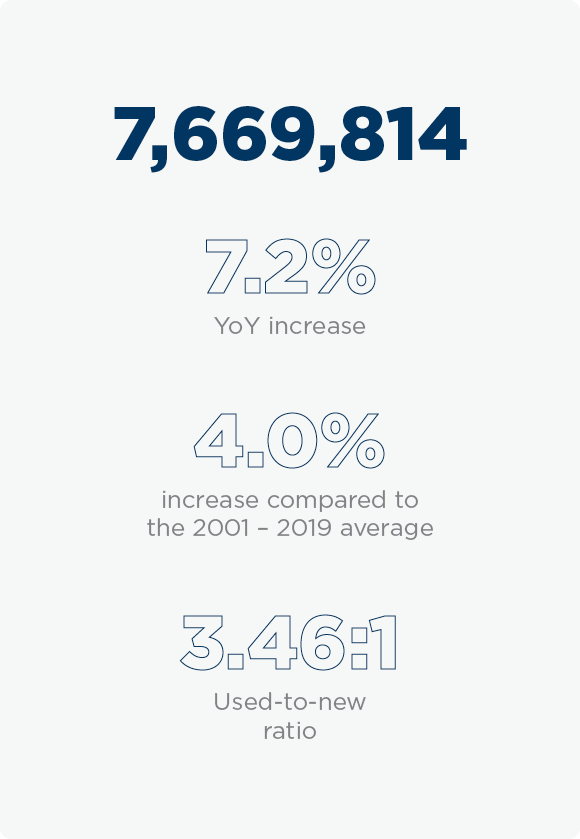

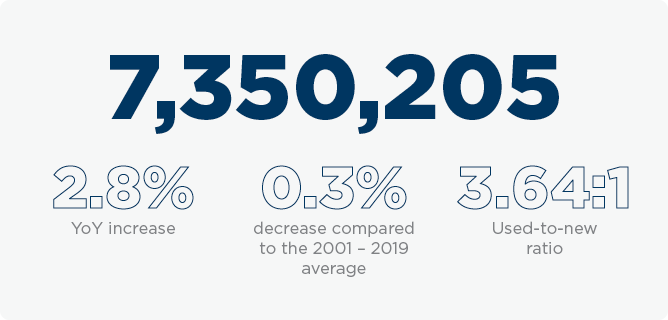

BASELINE SCENARIO

In this scenario, a sluggish resurgence as economic factors keep inflation high while new vehicle production sees a steady production recovery as EV adoption continues to grow, albeit at a slow pace.

Economic stability with moderate recovery: The wider economy maintains a state of unresolved conditions with no significant deterioration. Long-term recovery plans and forecasts remain achievable. Gradual reduction in inflation levels, and interest rates remain high with only minor falls in the year.

Steady new vehicle production recovery: The recovery in new vehicle production continues steadily. There is a return to the fleet, rental, and business sector commercial discounts, resulting in a consistent increase in the supply of used vehicles. This growth is carefully managed to avoid a significant oversupply that could lead to an unnecessary crash in vehicle values.

Gradual adoption of used electric vehicles: The adoption of and shift toward using electric vehicles in the used car market continues at a gradual pace. Trends observed in 2023 regarding the adoption of used electric vehicles remain similar, without significant acceleration.

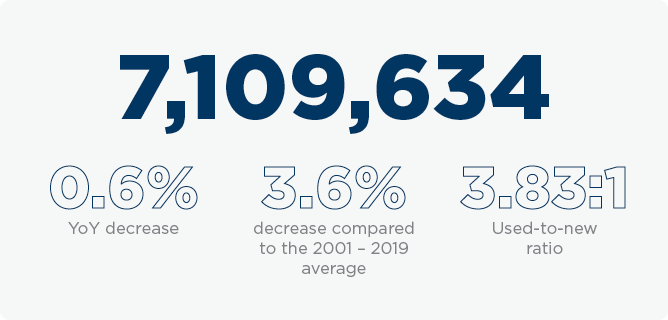

DOWNSIDE SCENARIO

In this scenario,as the economy struggles, consumer confidence is weak and the cost of financing a used vehicle remains too high for many.

Severe economic deterioration: The economy experiences a significant and prolonged downturn, with measures implemented having minimal impact. Inflation remains persistently high, and the prospects for its reduction are limited. To combat inflation, the Bank of England's base rate remains at an elevated level.

Weaker consumer confidence: Shaky consumer assuredness leads to a decline in the demand for used vehicles, causing the used car market to contract. Consumers may postpone or reconsider purchasing used vehicles due to economic uncertainties, resulting in reduced market activity.

High financing rates: Financing rates for used vehicles remain significantly higher than forecasted. This makes used vehicle affordability unattainable for the majority of consumers, especially amid a cost-of-living crisis and in the context of an economy denoted by persistent inflation.

Navigating the future of used vehicle transactions beyond 2024

A more complex picture emerges as we peer into the potential post-2024 automotive landscape. The anticipated resurgence of GDP growth, aligned with the gradual alleviation of inflation and interest rates inching closer to the Bank of England's target of around 2%, is shaping what's to come.

One significant future transformation will involve a glut of part-exchange vehicles transitioning from the new car market into the used. While this influx will undoubtedly bolster the used car market, it's important to emphasise that even more inventory will be needed to satiate the growing demand. This underlines the persistent supply shortage compared to pre-pandemic levels.

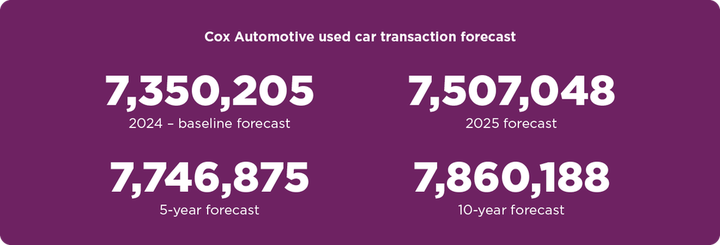

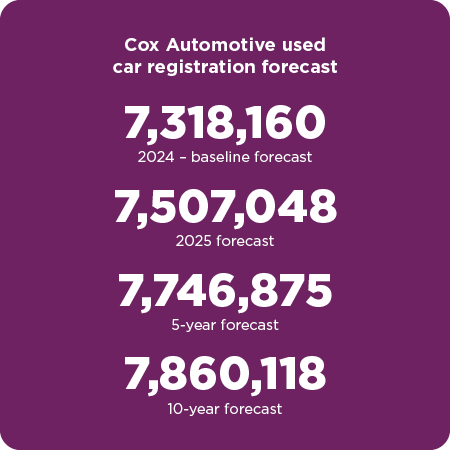

Much like the outlook for new car registrations in 2024, we anticipate a gradual recovery for used car transactions.

As we set our sights on 2025, the numbers look more promising. We expect that used car transactions will surpass 7.5 million, bettering the 2018-2022 average and edging closer to the much-expected figure of 8 million.

While it's a challenge to gaze even further ahead, 2028 will see a used vehicle transactional market of around 7.74 million, a number set to evolve alongside new car registrations and production recovery. In a best-case scenario, this market could grow from between 7.8 and 8 million used car transactions a decade later.

However, the road ahead has obstacles, especially in the BEV sector. Consumer caution may persist until resolutions for lingering concerns are found, marking it a nuanced journey for used vehicle transactions in the long term.

Used values outlook

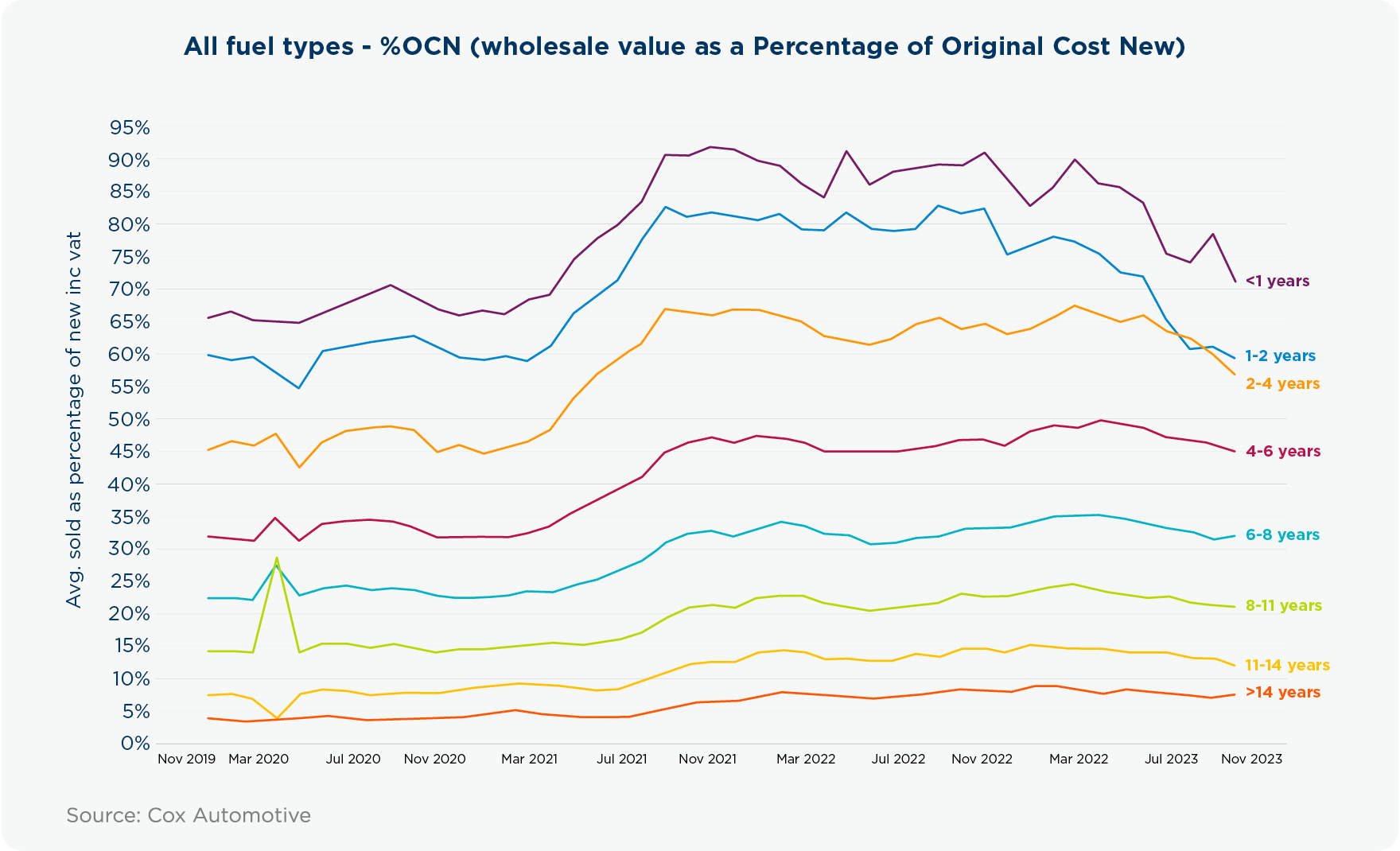

The current monetary value of used cars continues to cause alarm, indicating a situation that might not be sustainable in the long term. This is especially concerning when considering the economic backdrop, the overall cost of motoring and the increasing availability of new vehicles. The unprecedented rise in vehicle values over the past three years has halted. With supply and demand now more aligned, we believe that failure to improve the economic outlook will put additional pressure on used values. The threat of significant reductions in values should not be exaggerated but it should also not be ignored; the situation is delicate.

OEMs are expected to revert to a ‘push’ market strategy. They will reimplement incentives in response to declining sales and to navigate the challenges of Rules of Origin (RoO) and Zero Emission Vehicle (ZEV) regulations. We can expect to see more package deals and tactical initiatives aimed at aligning with these regulatory frameworks.

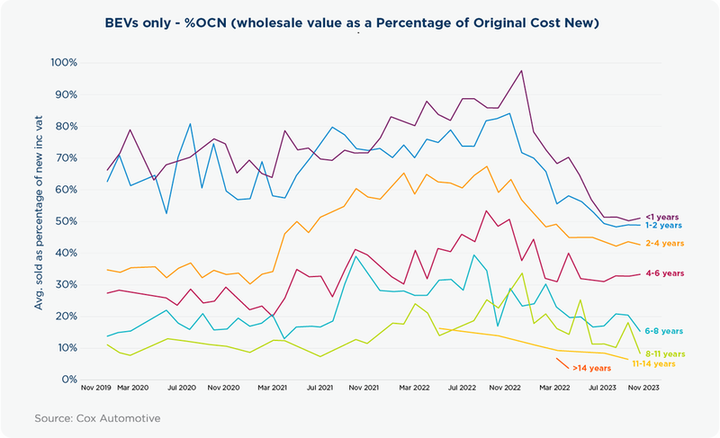

Following a necessary adjustment period, we’ll observe a gradual stabilisation of BEV used residual values. They are moving closer to parity with ICE vehicles. This shift is an encouraging sign for the future of the EV market.

However, the outlook for EV values is unclear. The wholesale market is seeing a growing number of EVs, and as battery technology improves, offering greater range and affordability in new vehicles, we can expect fluctuations in electric vehicle values.

While some seasonal improvement is expected in January 2024, it may not be a substantial ‘bounce’. The combined effect of reduced production and possible consumer response to the amended 2035 ICE vehicle ban could drive increased demand and boost the value of non-electric vehicles. These dynamics underscore the ever-changing nature of the automotive market.

PERSPECTIVE

Previous article

New car forecasts

Next article

Contributors

Phillip Northard

INSIGHT DIRECTOR

TITLE

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis ut finibus metus. Fusce vestibulum ex neque, sit amet rutrum ipsum congue sit amet. Nullam nisl tellus, faucibus et mi at, tempor pharetra lorem. Integer luctus velit nec sem pellentesque, nec dapibus nisl euismod. Nulla sed augue ac sem faucibus iaculis. Integer fringilla ultricies enim, et vestibulum urna. Vivamus ante justo, dictum aliquet quam quis, interdum blandit libero. In feugiat mi sit amet posuere venenatis. Sed luctus magna eros, id malesuada nisi malesuada sit amet. Morbi ante erat, imperdiet nec enim quis, euismod feugiat leo. Fusce at sapien non massa volutpat fermentum. Donec accumsan urna in ex vestibulum varius.

Sed eget eros rhoncus, aliquet diam ac, efficitur dolor. Nullam convallis diam id magna congue condimentum. Cras vestibulum ut quam ut hendrerit. Morbi vulputate rhoncus dui blandit lacinia. Ut ac iaculis mi. Pellentesque ultrices molestie tortor ac fringilla. Vivamus finibus massa quam, sit amet pharetra sem laoreet quis. Ut ornare volutpat ipsum quis hendrerit. Pellentesque a ornare ipsum. Aliquam sed tincidunt urna, nec mattis tellus.

Interdum et malesuada fames ac ante ipsum primis in faucibus. Nam ultrices nulla metus, vitae euismod massa mollis sit amet. Maecenas mollis, lectus in vulputate egestas, dui ipsum tincidunt purus, et vehicula est eros non nunc. Morbi nec volutpat nisi. Praesent et augue erat. Etiam aliquam lacus non semper vestibulum. Etiam pellentesque molestie leo.

Quisque et purus vehicula, interdum orci non, maximus orci. Mauris a imperdiet arcu, nec sagittis erat. Vestibulum eget ligula et ligula accumsan accumsan ut semper massa. Maecenas varius interdum dui, a interdum lectus commodo a. Donec nec ornare orci. Pellentesque at condimentum nulla. Vestibulum faucibus, nunc sit amet luctus elementum, lorem dui vulputate mauris, eu porttitor mi est ac urna. Praesent iaculis fermentum ex vel ultricies. In ut sem in neque imperdiet rhoncus. Integer aliquam erat eget sollicitudin fermentum. Maecenas at nulla facilisis, congue erat vel, euismod nunc. Nunc tempus ac elit vel efficitur. Suspendisse non pellentesque ante. Nam pretium et mi sodales mollis. Sed dignissim urna eu quam auctor fermentum.

Quisque quis suscipit neque. Pellentesque suscipit leo eu tellus efficitur, id rhoncus sapien iaculis. Maecenas porta augue ac scelerisque luctus. Proin in aliquet diam. Morbi ultrices ante eget nunc finibus, sit amet molestie mi eleifend. Integer lorem lorem, elementum id turpis vel, lobortis eleifend ex. Proin suscipit, leo nec rhoncus dapibus, purus lacus faucibus risus, a suscipit purus lorem sit amet metus.

Vestibulum vulputate magna lacus, sed aliquet nulla porta ut. Morbi vel metus felis. Maecenas vehicula augue id mauris dignissim, sed suscipit dui commodo. Mauris euismod ipsum vitae facilisis pharetra. Phasellus sodales finibus nisi, in facilisis eros hendrerit eget. Duis at urna feugiat, blandit lorem ac, ornare nulla. Aliquam dictum nisl sit amet auctor dapibus.

Donec condimentum suscipit dapibus. Sed cursus suscipit odio, sed bibendum arcu ullamcorper at. Integer vulputate sollicitudin ex, non euismod diam sodales ut. Cras magna nibh, vestibulum nec eleifend sed, accumsan et metus. Quisque magna neque, vulputate ac ante quis, hendrerit vulputate lectus. Quisque eleifend lacus at.