We have discussed how external pressures are mapping out a new future for dealers and manufacturers. Looming legislative changes are set to have an immediate and profound effect too. These changes will compel manufacturers, fleet managers, retailers and other automotive industry stakeholders to quickly re-evaluate their strategies.

Technology, political realities and the climate change fight are compounding a new kind of industrial revolution. Players in all sectors must adapt to the raft of changes while ensuring their business can keep pace with consumer expectations.

The long and winding legislative road ahead

The clock is ticking on a new deadline that looms for automotive across the continent. The Rules of Origin (RoO), part of the Trade Cooperation Agreement (TCA), are regulations that determine the country of origin of a good. Signed in December 2020 as part of Brexit negotiations, they cover a variety of products, including vehicles.

RoO means that a certain percentage of an Internal Combustion Engine (ICE) vehicle’s value must be made from locally sourced components. If the vehicle is built in the UK, 55% of parts must come from the UK and vice versa for EU vehicles. If the figure is less than 55% of the total, a 10% import tariff per vehicle will be applied. This section of the regulations is particularly significant following Brexit, as EU parts in a British-built car do not count.

RoO has applied to ICE vehicles since 2021 and manufacturers in the UK and EU have complied quite well thanks to their well-established, localised supply chains.

EVs are a different matter altogether. As a technology and associated supply chain that’s still developing, manufacturers source components wherever they can be found. Local supply sources for the materials and components required to build an EV are generally thin on the ground.

The new phase of RoO is due to come into force on 1 January 2024. It will mean that 45% (versus 40% as it is currently with this number increasing to 55% in 2027) of an EV needs to originate in the country of origin to remain tariff-free for export, while 60% of the battery pack will also need to come from the UK or EU. Those who will be most affected are firms exporting to Europe and those importing to the UK. The fact is EV batteries are expensive to make and so represent a high parts-value percentage. For example, it’s estimated that the 62kWh pack fitted to the UK-built Nissan Leaf costs more than £7500 to build1. In summary, the RoO changes will add, potentially, an additional 10% to the cost of manufacture, in an industry already facing numerous challenges.

These rules have caused much disquiet among manufacturers and their associations, several of whom, including the Society of Motor Manufacturers and Traders (SMMT) and the European Automobile Manufacturers’ Association (ACEA), are lobbying alongside EU bodies and OEMs to keep aligned and push the legislation back to 20272.

Localised supply chains needed to meet the legislation do not yet exist. Many of the raw materials come from outside the UK and EU. Battery manufacturing in the UK is still in its infancy in both areas. It’s thought that up to five years is needed to construct the gigafactories needed, as well as a fully functioning distribution and supply chain to meet the RoO.

The RoO changes run the risk of adjusting both the distribution and cost of new vehicles, as the rules will influence tariff costs, and therefore, distribution decisions. Some manufacturers may be forced to exclude certain models from specific markets. The tariff issue was not as problematic before the UK left the EU. However, with large manufacturers currently seeking to stall the costly implications of RoO, their changes will have weighty implications for automotive.

Staying compliant will be costly but the scale of the penalties means it will be less financially damaging in the long run.

The ZEV mandate and CAFE culture

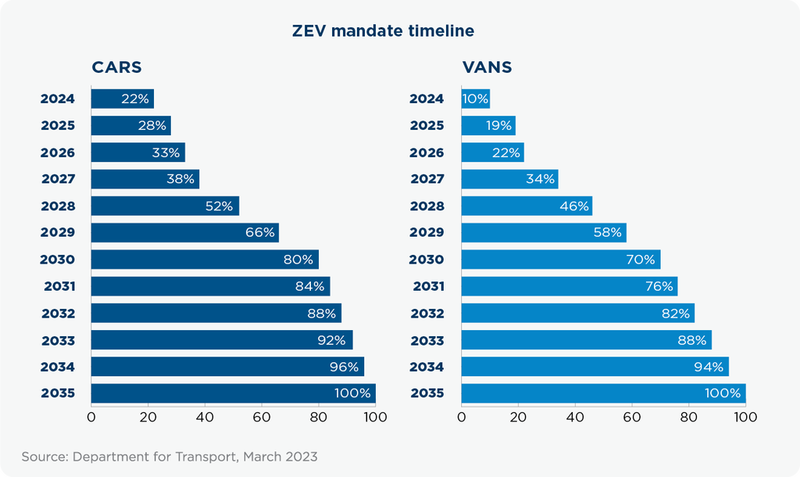

Government statistics say cars and vans were responsible for 18% of the UK’s total domestic greenhouse gas (GHGs) emissions in 20213. By way of comparison, the EU figure in 2020 was around 15%4 and in the US, it was 29%5. For those in power, Zero-Emission Vehicles (ZEVs) are the most foolproof way to decarbonise road transport in line with net-zero legislation. Therefore, the UK’s ZEV mandate, a new mandatory framework coming into force in 2024, requires manufacturers to ensure a certain percentage of their overall annual sales (22% for cars and 10% for LCVs) are BEVs. It is designed to accelerate the transition to electric motoring while cutting greenhouse gases.

In terms of EVs built, getting the percentage right may mean that some manufacturers hold back sales of ICE vehicles. But what choice do they have?

While European manufacturers contend with ZEV, US counterparts continue to adhere to Corporate Average Fuel Economy (CAFE) regulations which have, in recent years, become a key part of the current US administration's plans to meet its net-zero targets. There are numerous pieces of legislation regarding net zero throughout the world, but as yet there is no global standardisation. Going forward, surely there’s room for a universal set of guiding principles?

All of this suggests that manufacturers and car owners alike are battling on numerous fronts, at great cost, to meet stringent regulations.

As we edge closer to the ZEV mandate’s introduction next year, more needs to be done for EVs to truly become the dominant mode of transport. Significant investment is still needed in charging infrastructure to support a growing EV parc. The cost of EVs remains a barrier to entry for many people despite the price of both new and used vehicles softening.

Is the government going to roll back on the collective legislation? As of the time of writing, it appears not. Will there be some give or take around specific deadlines? Possibly.

Putting the politics to one side, the fact is that everyone needs to do something on the environmental front. Despite being beaten with a bigger stick than it deserves, road transport nonetheless has to see change. The path has been set and manufacturers have built their own roads to net zero accordingly.

The bigger issue may be around the fact that manufacturers must sell the EVs they are so proudly marketing. They’ve simply no choice. They’ve made the investment and shareholders will expect them to show that they are getting a return on that investment.

Fleet impact

New vehicle shortage has significantly impacted the fleet sector, forcing many fleet managers to change both how they operate and the age and mileage profile of their vehicles. EV momentum has also played a huge role for fleets. They play a significant part in helping meet corporate sustainability goals, plus employees gain from the various taxation incentives (benefit in kind). It’s for this reason that fleets are responsible for the majority of EV registrations. Buoyed by government incentives, many manufacturers, in partnership with fleets, have vowed to electrify their vehicles to meet the ZEV mandate and new 2035 deadline.

One thing is certain and that is that the ICE in its current form clearly does not have a long-term future in many markets. It’s notable that some manufacturers are investing heavily in e-fuel development, a move that could one day lead to wider usage and offer ICE vehicles something of a reprieve. It also offers a lifeline to low-volume, niche-interest manufacturers, especially if high manufacturing costs can be tempered. Additionally, it’s worth considering that manufacturers may decide to serve certain established new and used markets with ICE and hybrid vehicles.

Retail tactics

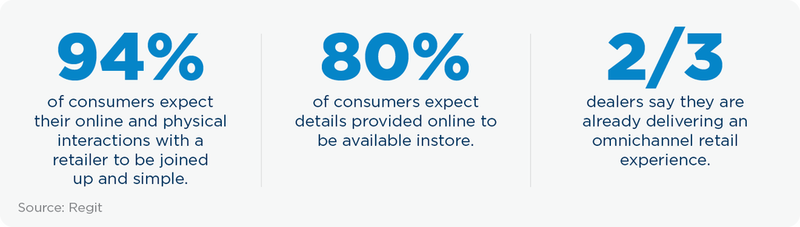

Manufacturers may have strategies in place to absorb the numerous hits they are taking in the modern world economy, but franchised and independent dealers also need to prepare. For those in the automotive retail sector, the most ubiquitous buzzword is currently ‘omnichannel’, but what does it mean in practice and, more importantly, what should it mean?

We know that it refers to an overarching business strategy that integrates all customer routes to the retailer. These could be dealerships, websites, social media channels and apps. The most significant benefit of omnichannel, for customers, is them being able to interact with a retailer with ease, whatever the mix of channels they use along their journey. For the retailer, in the long term, it should mean lower costs and the opportunity to use customer data to reinforce customer retention.

Recent research suggests that the majority of consumers, more than 80%, want to combine online steps in the buying journey with those taken at a physical outlet. The same study suggests that not all buyers share the same view as to which stages should be online and which face-to-face. So, flexibility, when it comes to implementing omnichannel, is particularly important.

A quality website, including video walkarounds, quality photography and part-exchange functionality are necessary in order to do omnichannel properly. But the customer must also have the tools to conduct almost every part of their buying journey from the comfort of their sofa. These could include a personalised section of the site where progress can be saved or semi-regular updates about the latest stock.

Omnichannel and EVs

With brand and customer loyalty at a historic low and cars increasingly being regarded by many as “white goods”, there’s never been a better time to exploit the full potential of omnichannel, especially where EVs are concerned.

Cox Automotive has often spoken of the need for greater education when it comes to electric vehicles – and with good reason. We think there’s an opportunity to do more than simply improve the look and feel of a dealership’s website or offer a part-exchange online as well as arrange the finance with a mouse click.

What is less evident in the omnichannel approach is content and tools that are focused on the customer of tomorrow, as opposed to today. Many opinions on omnichannel appear to be weighed heavily in favour of mere selling. But with all the negative media attention faced by EVs, whether it’s coverage that’s likely to fuel range anxiety or stoke fears about charging infrastructure inadequacy, surely there’s a case for greater nurturing of the potential EV customer. Omnichannel should gently guide customers along the path of EV enlightenment by hosting content that carefully demystifies perceived jargon about twin motors and Level 3 charging. The content should be coupled with advice about whether an EV is even the right move, maybe a hybrid would be more suitable?

Upping the amount of information available could be supported by dealership events designed to entertain and entice potential buyers.

Let's consider the dizzying choice that will soon be on offer when new entrants get a firm footing in the EV-selling arena, and bear in mind the fact that brand loyalty, for increasing numbers, is an anachronism. The case for nurturing makes a lot of economic sense. The time for dealers to become an authoritative voice in the EV space – experts essentially – is right now.

Better technology

In the past year, the unstoppable rise of large language (AI) models, including ChatGPT and Google’s Bard, has demonstrated the sheer power of emerging AI technologies – tools that will certainly shape the future of car retail. Advancements in AI, machine learning, Virtual Reality and Augmented Reality are already being used by dealers to enhance customer experiences, optimise operations and drive innovation.

Consider too the amount of information being generated by dealerships and how data analytics presents greater opportunities to further personalise targeted marketing or make their business run more smoothly, whether through better inventory management or data-based decision-making.

Successful dealerships of the future that embrace these technologies and adapt to changing customer expectations will be better placed to offer attractive and engaging experiences at every touchpoint.

Other tactics

The changing retail landscape is making new ways of selling cars obligatory; however, many dealers have dealt with the challenging circumstances by venturing into new areas.

Some have moved into ancillary areas such as online parts sales and distribution as well as subscription – with varying degrees of success. The shift to agency, the unavoidable rise of EVs and the growing importance of building and maintaining a digital presence could force even more dealers try something new.

Throughout this transformational era, the automotive sector has faced various challenges. The changing landscape has seen casualties and with further consolidation, we will likely see more. Technology is fundamentally altering how business is done and it will continue to reshape consumer behaviour too. Savvy retailers, those who see what’s already here, whether that’s agency, the era-defining shift to zero emissions, or greater opportunities in the digital space, are best positioned to adapt, survive and thrive.

PERSPECTIVES

References

- Rules of origin regulation ‘to be pushed back to 2027’. Autocar

www.autocar.co.uk/car-news/business-government-and-legislation/rules-origin-regulation-be-pushed-back-2027 - Consultation on a zero-emission vehicle (ZEV) mandate… Gov.uk

assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/1154610/zev-mandate-co2-emissions-regulation-consultation-document.pdf - CO2 emissions from heavy-duty vehicles

www.acea.auto/files/ACEA_preliminary_CO2_baseline_heavy-duty_vehicles.pdf - Fast facts on transportation greenhouse gas emissions

www.epa.gov/greenvehicles/fast-facts-transportation-greenhouse-gas-emissions#:~:text=According%20to%20the%20Inventory%20of,U.S.%20GHG%20emissions%20in%202021

Jonathan Smoke

chief economist, cox automotive INC.

Making the most of new technology…

Our research indicates that the consumer wants an omnichannel experience. They want to understand monthly payments as they narrow down their search, but they eventually want to physically touch, drive, and learn about the vehicle in person. They want a seamless, efficient process, but they also desire the transaction to receive an appropriate investment of time worthy of its size.

With the shift to electrification, education plays an important role in overcoming obstacles to adoption including complex issues like understanding vehicle range and navigating charging options, which vary dramatically by state and county.

Jürgen Stackmann

Director Future Mobility Lab @Uni St.Gallen, Lecturer @HfWU Geislingen

Making the most of new technology…

Of the many advancements, I believe that consumer and B2B platforms have shaped and will continue to shape new and used car retailing and distribution most significantly. Whilst especially prevalent in the consumer market, these platforms have reached a high level of concentration and new attempts to attack the top 2 or 3 have so far not succeeded. Each new used retailer must understand the power and potential of platforms for their business, both in the buying/purchasing process of vehicles and their distribution.

The increasing presence of fully integrated online sales platforms, offered as white-label solutions, has the potential to expand the market, making it more affordable and less complex even for smaller dealer groups.

In addition, independent B2B trading platforms can secure independence from?? the retail sector and will provide continued access to affordable and attractively priced used cars.

Mathew McAuley

Director of Strategy & Marketing, Cox Automotive Australia

Making the most of new technology…

Digital technologies have revolutionised how cars are sold, whether that’s as online adverts with quality imagery and video, or embedded conversational AI such as chatbots or e-commerce.

Particularly during COVID lockdowns, but still to this day, some OEMs have commenced full online retailing, particularly on EVs aimed at progressive, ‘risk-averse' buyers.

On the wholesale side, at Manheim, we’ve moved to online simulcast auctions that run concurrently with in-lane, making our service more accessible to more people.

Again, the key to making use of technology-led advancements is ensuring new and used vendors have a smooth combination of physical and digital channels to switch between seamlessly: slick sales websites and modern backends for chasing and qualifying leads.

We also should not forget technological advancements such as EVs, which at this stage are favoured by people more likely to engage and even transact digitally.

Matthew Davock

Director of Manheim Commercial Vehicles, Cox Automotive

Making the most of new technology…

It is crucial that we continue to embrace change and build on the significant acceleration of the pandemic for dealers operating in the LCV retail sector. Many dealers in the UK have excelled in this area over the past 24 months.

LCV retailers were one of the first early adopters to “click and collect” retail models during the pandemic in the UK, and many van dealers have further supercharged this model with seamless end-to-end retail portals and advanced website self-serve capabilities. This proactive activity has been revolutionary and further accelerated the LCV retail market by eight-to-10 years.

If you are retailing new or used LCV assets today, vehicle knowledge, customer excellence and vehicle presentation will continue to be the three most important areas to master.