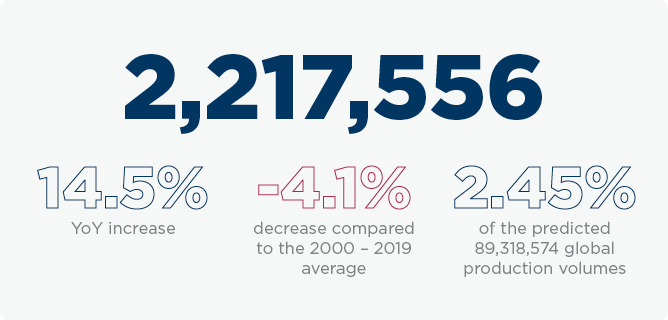

Assessing the historical landscape of new car registrations in the UK involves consideration of their overall percentage share of global production. Between 2002 and 2019, the UK averaged just over 3% in this regard. And even during the peak years of global production from 2016 to 2018, that figure remained, on average, 2.61%.

The UK's post-financial crash recovery extended over seven years. During this period, we witnessed notable spikes in new car registrations that aligned with global production peaks. Those significant increases were fuelled by accessible and affordable finance as well as government and manufacturer incentives.

Much like discussions surrounding global production peaks, the UK's new car registration market has a benchmark of 2.6 million. However, the reality is different. Between 2002 and 2019, the average number of new car registrations in the UK stood at 2,351,5781. Only twice did we reach 2.6 million - in 2015 and 2016 - with registrations decreasing annually from then on, until the pandemic struck.

These patterns and figures are not unique to the UK; the relationship between local and global impacts and their influence on production and registrations varies based on severity and localised factors.

Considering future forecasts for new vehicle registrations requires a thorough examination of legislation and regulations at a global and local level. This includes factors like the Zero Emission Vehicle (ZEV) mandate, which significantly affects OEM decisions regarding the timing and location of vehicle registrations, mainly for Internal Combustion Engine (ICE) versus Battery Electric Vehicles (BEV). For instance, in the UK, OEMs plan to prioritise ICE vehicles in 2023 and then focus on BEVs in 2024.

Additionally, 2024 will witness a surge in OEMs transitioning to new agency or hybrid dealer networks across the UK and Europe. This shift may present volume and market share fluctuations, as adapting to new systems, processes and strategies takes time.

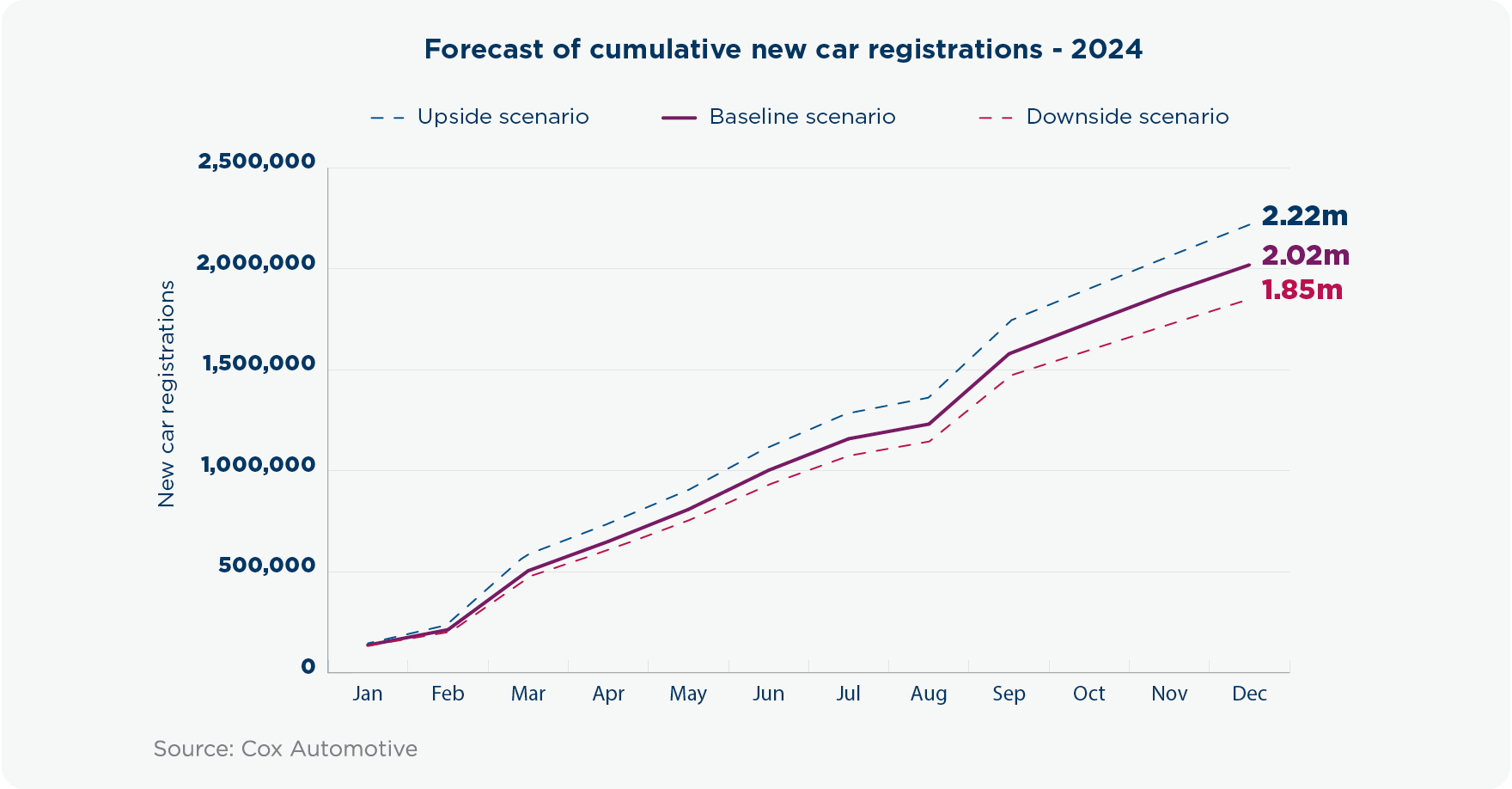

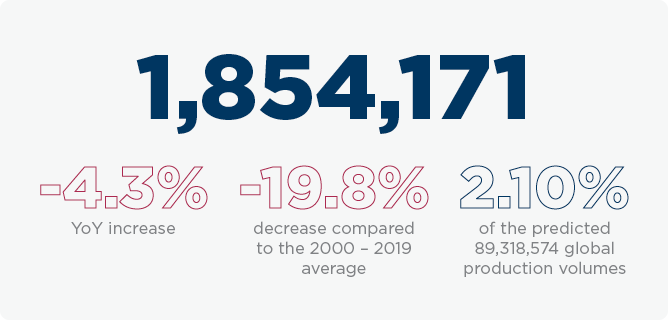

Following the 2023 pandemic recovery in the UK, most manufacturers aimed to regain lost market share and volume. However, this occurred in a landscape characterised by ongoing local and global economic challenges which shackled consumer and business activities. In 2023, new car registrations reached 1.9 million, a 20% year-on-year increase. Nonetheless, that total remained well below (16.2%) the 2000-2019 UK average.

While many anticipate continued recovery into 2024, we must be prepared for the obstacles that manufacturers will face in the UK. These include the transition to agency model, a growing electrified market and seemingly unshakeable economic headwinds.

2024 new car forecasts

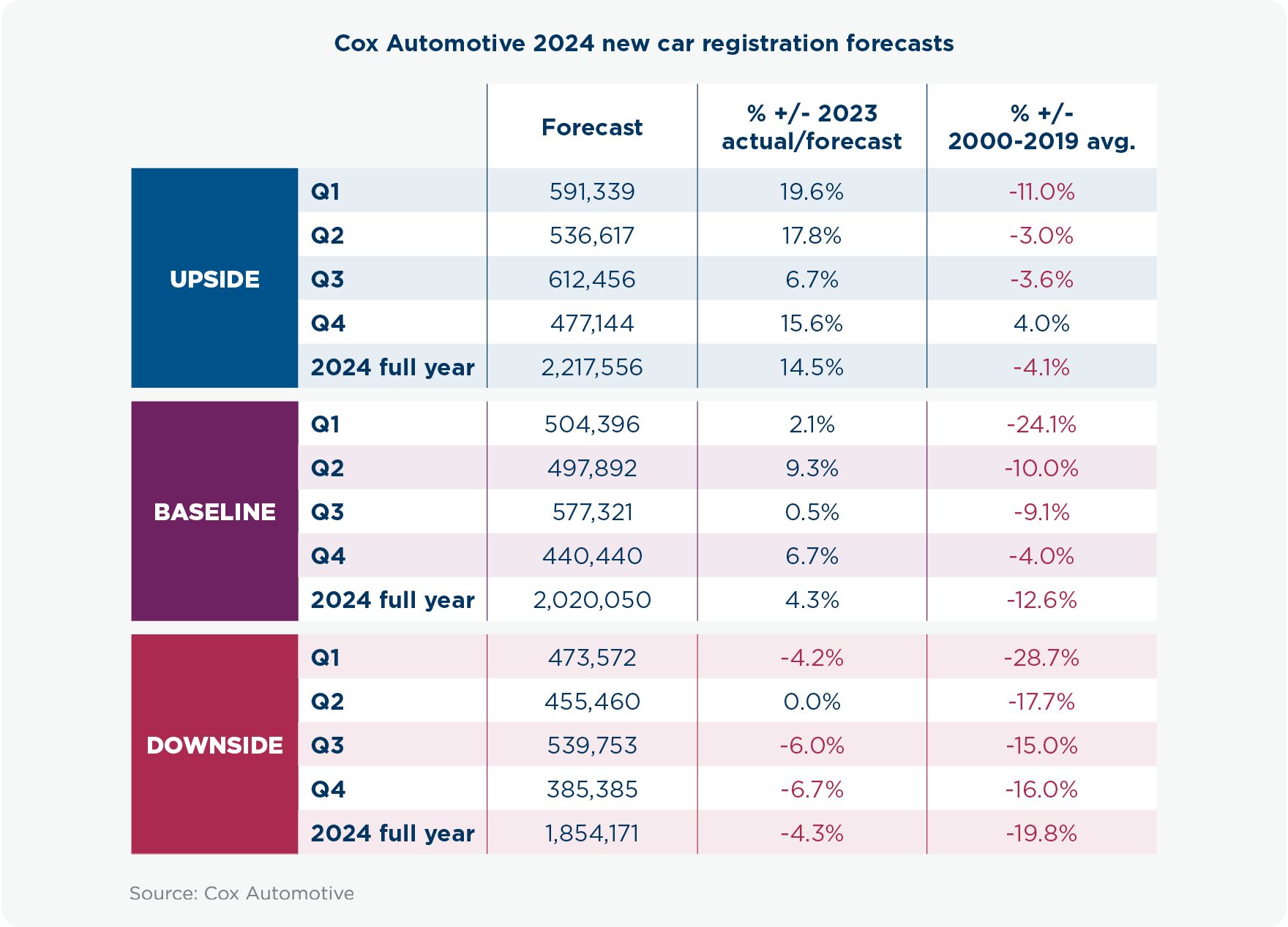

UPSIDE SCENARIO

In the upside scenario, we see a robust economic recovery driving higher consumer confidence, encouraging new entrants, enabling a smooth agency model transition, and facilitating sustainable transportation policies.

Confidence abounds: In this scenario, circumstances will usher in afaster-than-anticipated economic recovery nationwide characterised by higher GDP growth rates above those projected by the UK government and Bank of England (BoE). This rapid rebound will cause a swift lowering of inflation, prompting a fall in interest rates. As a result, personal disposable income per capita would improve and consumer confidence would soar. We know well the positive correlation between consumer confidence and the inclination to invest in new and used vehicles.

New entrant successes: Market entrants quickly establish strong consumer and business brand recognition, supported by substantial product volumes. They stimulate market growth and start chipping away at established manufacturers’ market share. Chinese and Vietnamese manufacturers make up a significant portion of this growth.

Smooth transition to agency model: The transition to agency model minimally impacts OEM market share and their routes to market. This transition balances Internal combustion-engine and EVs, ensuring broad acceptability.

Government policies: While the automotive market thrives, government policies such as the Zero Emission Vehicle (ZEV) mandate are implemented with minimal market disruption. These policies align with industry trends and facilitate a smoother transition to cleaner, more sustainable transportation.

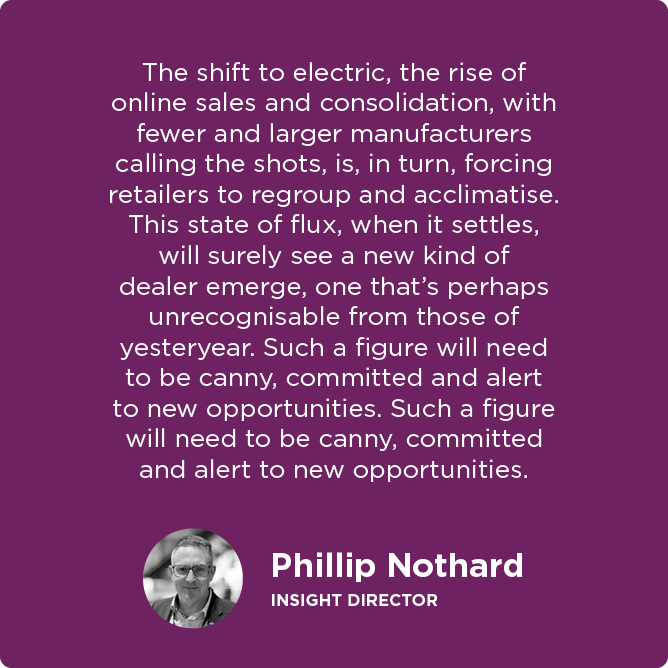

Phillip Northard

INSIGHT DIRECTOR

BASELINE SCENARIO

The baseline scenario is characterised by economic pressure, the effect of the agency model transition and the effect of new UK and European legislation.

Economic pressure persists: The economy continues to damp down consumer spending. There will be a slower-than-anticipated easing of inflation and interest rates. Uncertainty will loom over the cost of living and energy prices, keeping consumer confidence in the negative zone. However, we expect a gradual improvement in consumer confidence from its current low levels and the fleet market will continue to display healthy demand for new vehicles.

Agency model transition: By 2024, there will be a clearer understanding of the impact of the agency model. More OEMs will embark on the journey towards agency, whether in its purest form or any hybrid variant. This transition represents a shift from the franchised model's traditional 'push model' to a 'consumer pull' model. Historically, the implementation of true agency models has reduced the number of vehicles in the market. We anticipate minimal disruption from new entrants in the UK market.

Stable global production: We expect a stable supply of vehicles on the global production front. The UK's focus on implementing the ZEV mandate for OEMs and adherence to the Rules of Origin (RoO) is unlikely to significantly impact market performance. Most vehicles imported into the UK will meet RoO requirements, and the supply will be maintained at, or above, 2023 levels.

DOWNSIDE SCENARIO

The downside scenario suggests a period of low consumer confidence, restrained business activity and challenges posed by both new legislation and significant issues with the shift to agency.

Economic downturn: The economy deteriorates further as the government struggles to contain inflation. This places immense pressure on consumer spending and escalates the cost of living. There's a looming possibility of interest rate hikes or little prospect of any fall, which would introduce substantial cost increases for consumers and businesses. This scenario results in reduced consumer confidence, and the Business PMI (Purchasing Managers' Index) may dip below the critical threshold of 50, indicating a contraction in business activity.

ZEV mandate and consumer attitudes: The ZEV mandate coincides with declining consumer enthusiasm for BEVs. This is due to the prolonged absence of government support and incentives. Additionally, adherence to the RoO imposes unnecessary costs on vehicle prices in the UK, further dampening market sentiment.

Challenges with the agency model: The transition to the agency model proves to be complicated for legacy OEMs. Adoption rates are slower than expected, and the new model disrupts established consumer buying processes, causing confusion and hesitation.

Beyond 2025: A glimpse into the future

Navigating the automotive landscape beyond 2025 is akin to forecasting the weather – challenging and subject to many interacting elements. However, gazing into the metaphorical crystal ball can nonetheless provide useful insights.

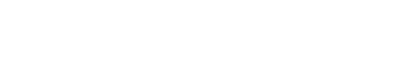

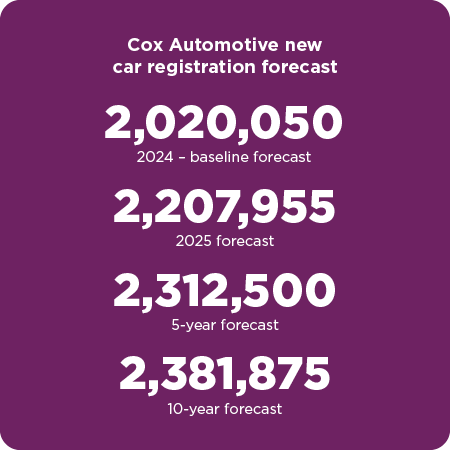

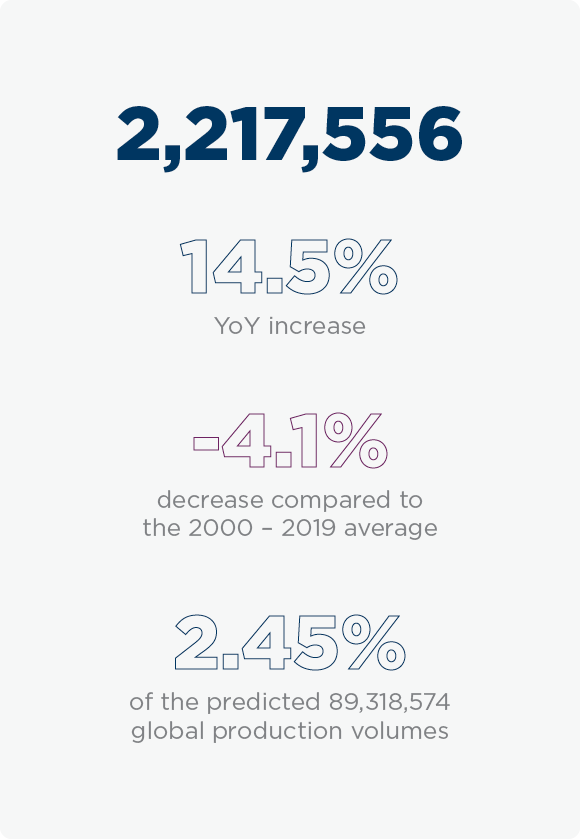

2025: Following a relatively flat 2024, we anticipate a modest recovery as economic, legislative and structural changes settle in. The UK's new car registrations are expected to return to a more standard figure of around 2.2 million. This accounts for roughly 2.4% of the global production volume, forecasted to be just under 92 million.

2028: Fast forward three years and we envisage further stability with approximately 2.3 million new car registrations in the UK. This again represents a small proportion of the 92 million production total. Beyond this, looking to 2033, we predict substantial global production growth, potentially reaching 95 million.

However, it's worth noting that the ever-evolving automotive industry is susceptible to myriad shifts and changes, as exemplified by the developments witnessed over the past three years.

PERSPECTIVE

Phillip Northard

INSIGHT DIRECTOR

TITLE

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis ut finibus metus. Fusce vestibulum ex neque, sit amet rutrum ipsum congue sit amet. Nullam nisl tellus, faucibus et mi at, tempor pharetra lorem. Integer luctus velit nec sem pellentesque, nec dapibus nisl euismod. Nulla sed augue ac sem faucibus iaculis. Integer fringilla ultricies enim, et vestibulum urna. Vivamus ante justo, dictum aliquet quam quis, interdum blandit libero. In feugiat mi sit amet posuere venenatis. Sed luctus magna eros, id malesuada nisi malesuada sit amet. Morbi ante erat, imperdiet nec enim quis, euismod feugiat leo. Fusce at sapien non massa volutpat fermentum. Donec accumsan urna in ex vestibulum varius.

Sed eget eros rhoncus, aliquet diam ac, efficitur dolor. Nullam convallis diam id magna congue condimentum. Cras vestibulum ut quam ut hendrerit. Morbi vulputate rhoncus dui blandit lacinia. Ut ac iaculis mi. Pellentesque ultrices molestie tortor ac fringilla. Vivamus finibus massa quam, sit amet pharetra sem laoreet quis. Ut ornare volutpat ipsum quis hendrerit. Pellentesque a ornare ipsum. Aliquam sed tincidunt urna, nec mattis tellus.

Interdum et malesuada fames ac ante ipsum primis in faucibus. Nam ultrices nulla metus, vitae euismod massa mollis sit amet. Maecenas mollis, lectus in vulputate egestas, dui ipsum tincidunt purus, et vehicula est eros non nunc. Morbi nec volutpat nisi. Praesent et augue erat. Etiam aliquam lacus non semper vestibulum. Etiam pellentesque molestie leo.

Quisque et purus vehicula, interdum orci non, maximus orci. Mauris a imperdiet arcu, nec sagittis erat. Vestibulum eget ligula et ligula accumsan accumsan ut semper massa. Maecenas varius interdum dui, a interdum lectus commodo a. Donec nec ornare orci. Pellentesque at condimentum nulla. Vestibulum faucibus, nunc sit amet luctus elementum, lorem dui vulputate mauris, eu porttitor mi est ac urna. Praesent iaculis fermentum ex vel ultricies. In ut sem in neque imperdiet rhoncus. Integer aliquam erat eget sollicitudin fermentum. Maecenas at nulla facilisis, congue erat vel, euismod nunc. Nunc tempus ac elit vel efficitur. Suspendisse non pellentesque ante. Nam pretium et mi sodales mollis. Sed dignissim urna eu quam auctor fermentum.

Quisque quis suscipit neque. Pellentesque suscipit leo eu tellus efficitur, id rhoncus sapien iaculis. Maecenas porta augue ac scelerisque luctus. Proin in aliquet diam. Morbi ultrices ante eget nunc finibus, sit amet molestie mi eleifend. Integer lorem lorem, elementum id turpis vel, lobortis eleifend ex. Proin suscipit, leo nec rhoncus dapibus, purus lacus faucibus risus, a suscipit purus lorem sit amet metus.

Vestibulum vulputate magna lacus, sed aliquet nulla porta ut. Morbi vel metus felis. Maecenas vehicula augue id mauris dignissim, sed suscipit dui commodo. Mauris euismod ipsum vitae facilisis pharetra. Phasellus sodales finibus nisi, in facilisis eros hendrerit eget. Duis at urna feugiat, blandit lorem ac, ornare nulla. Aliquam dictum nisl sit amet auctor dapibus.

Donec condimentum suscipit dapibus. Sed cursus suscipit odio, sed bibendum arcu ullamcorper at. Integer vulputate sollicitudin ex, non euismod diam sodales ut. Cras magna nibh, vestibulum nec eleifend sed, accumsan et metus. Quisque magna neque, vulputate ac ante quis, hendrerit vulputate lectus. Quisque eleifend lacus at.