Philip Nothard

INSIGHT DIRECTOR

6 min read

VUCA has been our acronym of choice since the pandemic. It remains as relevant now as back then. Four years on, despite the progress made, the used market remains volatile, uncertain, complex and ambiguous.

We reflected on our original 2024 used car market forecast in May to reflect Q1’s actuals. The SMMT had reported a strong start to the year: the used market grew 6.5% to almost two million units, a fifth successive quarter of growth and a five-year high. The actual number of transactions was within a whisker of our upside forecast of 1.96 million (equivalent to 99.5% accuracy). As we said then, this was good news and a cause for celebration. You can read this forecast here.

Some commentators suggested this signalled a change in fortunes for the used sector, and such growth would be the pattern for the rest of the year. We exercised a more pragmatic view, stating that we expected Q1’s upbeat performance to repeat in Q2. But we cautioned that the second half of the year will likely see volume cool due to tightening supply into the market, heightening price competition in the new car space, and low consumer confidence.

With the SMMT publishing its Q2 used market figures just as we were finalising this issue of IQ, we can now see that this prediction, so far, holds true. The actual year-on-year growth figure for Q2 was just 0.2% of our upside forecast (7.4% vs 7.2%) and our volume number was 96.5% accurate. But our baseline forecast for the full year, remains the likely scenario, not our upside projection of 7.7m, despite the volume growth witnessed so far. Our forecast (read it here) has been adjusted to reflect H1’s actuals – a 1.1% increase (84,504 vehicles) – but our rounded full-year number remains at 7.4m.

New influences

When looking at the used market, we must always have one eye on the new, which is experiencing significant volatility right now. The headlines – 2.5% growth in July and two straight years of consecutive growth - suggest a market on the up, but the detail tells another story. Fleet sales are propping up registration volumes, EV share is declining at the point it should be climbing, and the number of ICE vehicles on offer is in freefall.

The BoE’s base rate drop on 1st August was welcome. Still, retail demand is hampered by the availability of in-demand derivatives, the high entry price of most EVs, the comparably high cost of finance, the ongoing cost of living challenges and a generally light consumer appetite for big-ticket items. The new government has announced decisive plans to address the nation’s economic woes, but their impact will not be realised for some time.

So, what does this mean for the used market?

Demand is subdued for many of the same reasons. However, supply remains the most frequent topic of conversation among dealers of every type and size. Despite fleet owners and operators’ fervent activity, securing a reliable and sustainable flow of the vehicles most in demand remains hugely challenging.

Used dealers continue to feel the effect of the 3.1 million ‘lost’ registrations from 2020-23. These are the vehicles that ordinarily would now be replenishing forecourts up and down the country. Their absence is palpable.

ICE melt

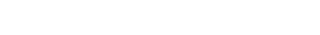

We’re also starting to see the effect of a changing vehicle parc in terms of fuel type. Our four-year by fuel-type forecast, published in March, showed how manufacturers are diverting their efforts away from ICE and towards EV and hybrid. The acceleration of that change is now taking effect. As discussed in our new market analysis elsewhere in IQ, the number of ICE models entering the new market is diminishing rapidly. Model names and derivatives that formed the backbone of Britain’s best-selling league tables for years have disappeared and are not being replaced like-for-like. These nevertheless remain the very cars used buyers want.

Source: Cox Automotive

The standalone used supermarkets are suffering the brunt of this shift. Evidence of this can be found in the widely reported consolidation and financial challenge in this segment. The vehicle supply on which they built their business models has waned, exacerbated by fierce competition from franchised dealers and greater control exerted by manufacturers on de-fleet supply.

The competition for young used ICE vehicles will only intensify from here. With two in every five new cars joining the UK car parc this year forecast to be EV or hybrid, and with that proportion set to grow rapidly in future years, dynamics in the used market over the next four years will arguably rival the complexity and impact of those experienced during the pandemic.

In 2016, EV claimed just 0.4% share and hybrid took 3%. By 2019, this had risen to 1.6% and 6%, respectively, and by the end of 2023, their share had each shot up to 17% and 20%.

The opposite can be said for petrol and diesel. In 2016-19, ICE cars made up 95% of new car registrations. That number fell to 71% in 2020-23, a loss of 4.6 million cars. The ICE decline accelerated throughout this period, dropping from an 83% market share in 2020 to 64% in 2023. Cox Automotive forecasts a further drop of 35% between now and the end of 2027, meaning just 784,000 new ICE vehicles will hit the road in 2027 versus the 1.2 million recorded in 2023.

New ICE vehicle prices are increasing, too, as economies of scale reduce in line with production numbers, and manufacturers seek to offset the margins they can realise from EV models. So, while current used vehicle values are stable, this, together with the tightening supply of ICE vehicles under four years old, will almost certainly increase values and put further pressure on margins.

EVolution

The picture with EV is no less challenging, albeit from a different angle. The rate of decline has slowed significantly, but used EV values remain volatile and are unlikely to settle until at least 2027.

We are starting to see EVs enter the used market in reasonable volumes. The first wave of mass adoption via company car and salary sacrifice schemes is maturing, so the supply of three-year-old EVs will increase dramatically over the next 12-24 months. Fleet owners and operators, whether they be lease companies, rental outfits, finance houses or owner-operators, are, however, managing their de-fleet strategies very carefully to minimise their exposure to their fluctuating residual value (just as there are, conversely, managing their ICE assets for the opposite reason).

Residual values are also being influenced by retail price competition. The heat is on to get EVs registered and on the road, and will create some astounding deals for consumers, making the high price of a used EV equivalent hard to justify. The market will settle, as it always does. Still, the harsh reality is many original asset owners are having a tough time with their residual values, dealers are mindful of the risk they take having EV stock that might not move quickly enough, and consumers aren’t sure what to do for the best.

The next challenge—and opportunity—for the used sector will be the influx of nearly new EV cars we’re likely to see later this year and throughout 2025 as the push to hit ZEV targets intensifies. This oversupply will exert downward pressure on sale prices, complicate pricing strategies and put margins under pressure as trade valuations hold stronger than retail market values. This will be the primary influence on the Q4 and Q1 numbers; expect it to be central to our market commentary in the third issue of IQ.

Dealer resilience tested

Wholesale values as % OCN (Original Cost New) by fuel type (2-4 year old cars)

Source: Manheim Auction Services

The chart shows the average wholesale prices for cars aged 2 to 4 years (sold through Manheim Auction Services) as a percentage of their original cost new (OCN) by fuel type. It illustrates that after a prolonged period of volatility, the market is now stabilising, particularly in the ICE and PHEV segments. EV prices in this age bracket are also settling, although this has come at a high financial cost to their original owners, especially since October 2022. Monitoring and managing this ebb and flow has become a business-critical job for dealers.

Margin is also under pressure from increased vehicle preparation costs and lead times. Many used dealers have diversified their stock profile to include older vehicles to offset the supply challenges already highlighted, putting this into sharp focus.

All of this combines to test even the best used car operator, as evidenced by the changes we see across the sector. The first quarter of 2024 was the busiest yet for the number of dealerships changing hands. Activity at the top of the market has been widely reported but is happening throughout the sector. There’s likely to be further consolidation as higher volumes of smaller independent dealers look to exit or consolidate to benefit from scale.

Despite these challenges, the automotive sector is renowned for its resilience, and the used sector is no different. Significant hurdles are anticipated in the second half of 2024 and into 2025. Still, the volume of transactions we see should be taken as a positive sign that demand and profit opportunities exist. We’re seeing retailers adapt, innovate, and double down on their cost management to good effect.

With the right strategic adaptations, we will see growth. The sector’s ability to innovate, embrace regulatory change, and respond to evolving consumer demands will determine its success in the coming years. The focus should be on sustainable growth, leveraging technology, and enhancing customer engagement.