Philip Nothard

INSIGHT DIRECTOR

7 min read

The phrase 'cautious optimism' summed up our analysis of the new car market in the last issue of IQ. Double-digit year-on-year growth in Q1 marked a healthy start to the year and led us to revise our baseline forecast upwards. Three months on, this sentiment holds true.

I'll start with the reasons to be optimistic. The second quarter followed a similar trajectory, leading to just over a million registrations recorded by the half-year mark. July's figures brought further positive news in the guise of 24 consecutive months of growth. We've also seen major OEMs, including BMW, Mercedes, Renault and Peugeot, returning to form from a volume perspective.

From the lows experienced by the sector since 2020, this is a genuine cause for celebration, and it gives us renewed confidence in our prediction of just over 2 million registrations for the full year. We've updated our forecast to reflect Q1 and Q2's performance: read it here.

But it's right we remain cautious. Growth is good, and the half-year position was the best since 2021, but the new car market remains 20.7% behind the figure recorded for H1 in 2019. The registration figures for January to June also clearly show the pressure on retail volumes and EV uptake. As of the end of June, fewer than one in five BEVs went to private buyers, and private EV registrations had declined by over 10% since the start of the year. EV volume, as a proportion of all registrations, was – and remains – considerably behind the requirements of the ZEV mandate.

Will ZEV targets be met?

The ZEV mandate has dominated the new market conversation this year. Whether you think it's the right strategy to drive EV adoption or not, it's the instrument by which manufacturers have been instructed to act, and for better or worse, they have geared their outputs accordingly.

Despite options being available to them, such is the punitive nature of the cost of non-compliance, several OEMs, including Stellantis and Ford, have been clear that they will hit the target by any means necessary. This suggests that as we move closer to Q4, we will almost certainly see dramatic – drastic even - manoeuvres by OEMs to adhere to this assertion. These will range from pre-registration tactics and aggressive fleet and retail price strategies to restricting ICE volume to ensure EV sales meet the prescribed proportion.

The concern is that this creates an unrealistic and unnatural market with potentially far-reaching consequences over the long term. It could compromise profitability, restrict consumer choice, and hit residual values as these heavily discounted EVs flood the used market in 12-36 months. Time is running out, and with no government concession on the ZEV timetable or any support mechanisms in sight, the risk of facing significant challenges in Q4 is genuine, unlike anything seen in over a decade.

On the subject of legislation, readers should note the new government's decision to reverse the previous administration's decision to push the 'ICE ban' deadline back to 2035. We were critical of this then and welcome the decision to reinstate the 2030 timeframe for no reason other than aligning with the ZEV mandate and giving consumers clarity on what's expected of them. We remain of the view manufacturers need greater support in the form of consumer incentives and infrastructure investment. The legislative stick is a harsh and unsustainable pressure on a sector already reeling from profound change.

Record growth for Chinese brands

Change in the new market has also continued to come thick and fast from new entrants. Chinese manufacturers have the UK and Europe firmly in sight and are aggressively targeting volume sales.

Seven new brands entered the UK market last year, joining the 23 brands already active here in 2022. Overall, Chinese brands registered 321,918 units in 2023, a year-on-year increase of 79%, taking them to a record market share of 2.6% in 2023, up from 1.7% in 2022. Chinese-branded EVs alone are set to account for 11% of the EU's electric car market this year, rising to 20 per cent by 2027. Whether the tariffs now imposed by the EU will temper this growth remains to be seen (read Grant Thornton’s assessment of this here.)

Chinese OEMs are stealing an advantage from their legacy targets with credible products and a disregard for short-term profitability. They are fast establishing retail partnerships and leaning into fleet sales to achieve volume and familiarity. A twist in the tail few predicted is many are also coming to market with ICE derivatives. One school of thought is they've identified the gap left wide open by the culling of popular and affordable models by the legacy manufacturers, recognised that consumers aren't moving as fast on EV adoption as anticipated, and so have moved quickly to offer an alternative. How these marques, models and derivatives perform on tomorrow's used market is yet to be seen, but that is of secondary concern to these aggressive new entrants.

PHEVs outpace EV growth

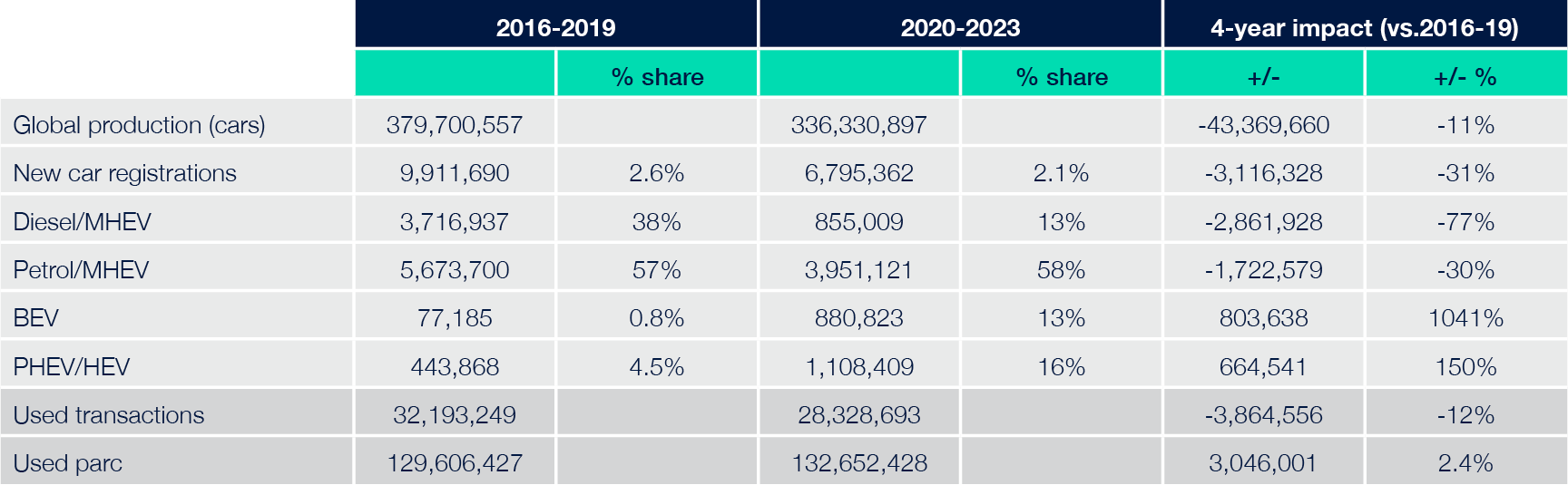

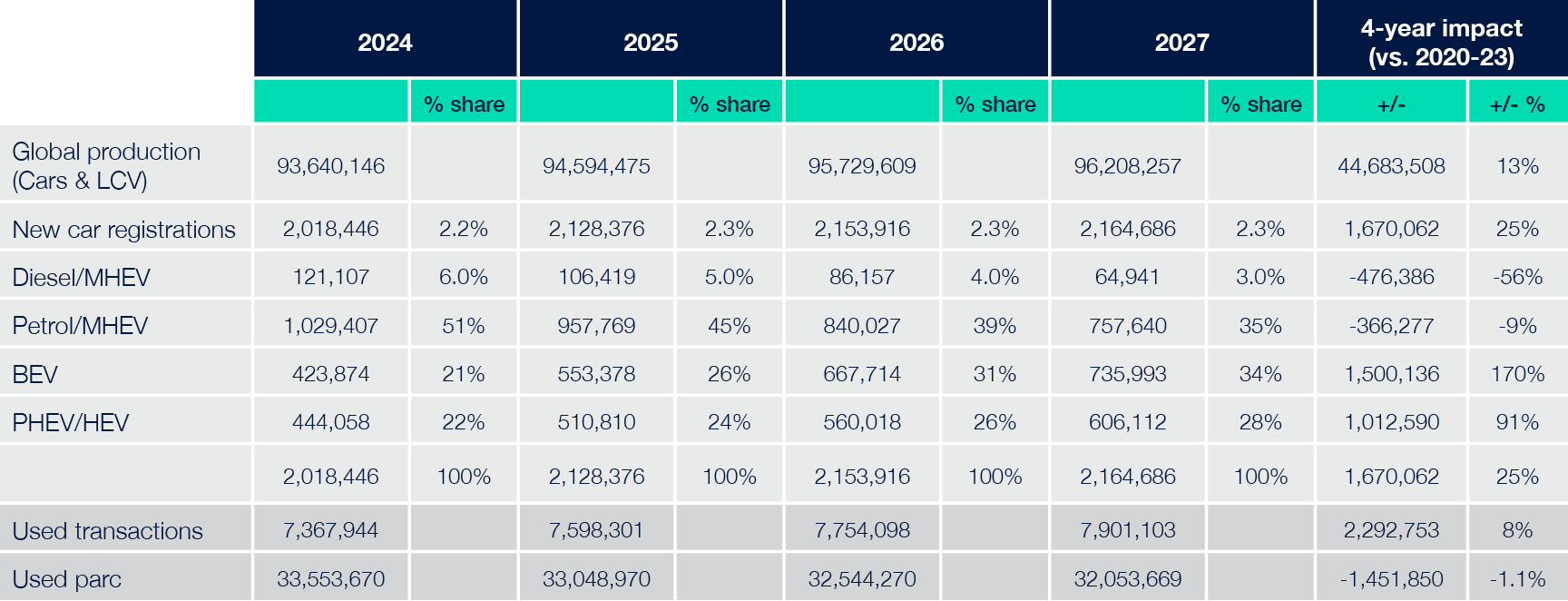

A topic identified in the four-year fuel-type forecast we published in March was the projected rise in fortune for PHEV derivatives. The SMMT's registration data for H1 shows how this is playing out. It reported a 30.0% year-to-date growth in PHEV registrations over the first six months of this year versus just 7.4% growth in the EV segment.

For many, PHEV is now widely seen as the natural stepping stone to cleaner motoring. The jump from pure ICE variants to hybrid is easier to comprehend and bypasses charging infrastructure and range anxiety concerns. They are also generally more affordable. Hybrid is a viable alternative for buyers wanting an ICE vehicle but finding their choice limited.

Our forecast predicts that in 2024-27, PHEV share of registrations will grow 84% vs 2020-23 volumes, rising from 444,411 units sold in 2024 to 578,030 in 2027. This contrasts sharply with the fate of diesel derivatives: their market share has declined from 38% in 2016-19 to 13% in 2020-23. In fact, by 2023, diesel vehicles represented just 8% of new registrations. We project that this will have declined to 3% by 2028.

We note with interest the number of legacy and new entrant manufacturers that have extended their hybrid lineups in recent months. The term' new energy vehicles', coined by Chinese manufacturers including GWM, has started to gain traction and offer a new take on the hybrid format. Is this a sign that PHEVs' share will grow beyond our forecast?

Price rise

A bone of contention for consumers is the rising cost of new cars. This chart illustrates the change since 2009.

RRP (Recommended Retail Price £) New Cars - UK 2009 - 2024

Source: DVLA / Cox Automotive

The average cost of a new car has risen 129% over the last 15 years, from £22,868 to £52,342. This is almost 50% above inflation across the same period. The average diesel is now 149% more than its 2009 equivalent. Petrol cars today command 93% more.

In that time, the makeup of the new car parc has changed dramatically. There are 88% fewer diesel models to choose from today and 63% fewer petrol models. EV growth is understandably off the chart. But of specific note is the average price of an EV today vs its ICE counterpart: £62k vs £ 45k for petrol and £58k for diesel.

For many car buyers, this cost of change and change in product lineup will come as a shock when they come to upgrade their current car. Retailers who are empathetic and able to help them navigate this new world will win favour.

Consolidation and industrial strategy

Two other themes that continue to influence the new car sector as we move through the year are consolidation within the dealer landscape and the need for the government's industrial strategy to embrace the automotive sector.

The European franchised dealer sector has seen significant consolidation over the last five years. Between 2019 and 2023, the number of outlets declined 16% to 59,000, a loss of some 11,000 rooftops.

This trend is driven by international investment - North American businesses now own five of the top ten UK dealer groups - and strategic moves by manufacturers that aim to stem network brand leakage. Legacy OEMs are realigning their partnerships and territory representation, while Chinese new entrants are actively partnering and replacing existing market players. The pace of change is significant and is contributing to the sector's sense of turmoil.

Meanwhile, those with a UK manufacturing presence are retooling factories for electrified model production, turning substantial investments into reality despite economic and consumer demand headwinds.

Industrial competitiveness is critical, with government commitments to gigafactories, green energy, expedited planning, and skills reform strengthening the UK's position as a leading advanced manufacturing hub. A comprehensive industrial strategy is essential for sustained growth, potentially enabling the production of over nine million zero-emission vehicles by 2035.

With a new government focused on stimulating growth, we should see a rise in confidence and stability within the automotive sector. While tangible results of policy changes favouring automotive may take some time, the growth potential is significant and should be looked upon optimistically.

In the meantime, all eyes are on Q4 and observing how the race to meet the ZEV mandate plays out. Use of the word unprecedented may be too frequent these days, but has our sector ever faced so much? These are fascinating times.

New car registrations - 2016-19 vs. 2020-23

Source: SMMT / DVLA / Cox Automotive

New car registration forecast 2024 - 2027

Source: Cox Automotive