Lee Swinerd

DIRECTOR AND HEAD OF AUTOMOTIVE

6 min read

The high cost of Battery Electric Vehicles (BEV), coupled with range anxiety sparked by a lack of charging infrastructure, have softened demand for BEVs across Western Europe and North America. As the initial surge from early adopters subsides, it had been expected that internal combustion engine (ICE) powered vehicles would perform well. However, the UK market paints a much more complex picture and a rapidly evolving future.

When we examine the automotive sector more closely, we can see a range of factors influencing what we see today. First and foremost, it starts with the vehicle manufacturers (OEMs), which have medium- and long-term strategies built around BEV adoption, which is increasing at a faster rate than currently being experienced.

This has built a leaning towards the BEV market, which is also supported by the new political landscape. The Zero Emission Vehicle (“ZEV”) mandate will impose punitive penalties of £15,000 per vehicle if OEMs do not meet increasingly challenging BEV sales levels, starting at 22% in 2024 and increasing to 80% by 2030. To hit this target OEMs can both push BEVs through their sales channels but also restrict the availability of ICE vehicles. Ford’s Martin Sander, for example, recently stated that Ford was “not going to pay penalties” if demand for BEVs was not there.

This market uncertainty has a detrimental impact on the ICE supply chain. Production schedules become less predictable as the OEMs grapple with the supply/demand dynamic. Movements in production schedules cause short-term stresses within suppliers, often impacting working capital and liquidity. This is in addition to a period since COVID-19 of unpredictable new vehicle production.

In the longer term, a pertinent question prevails: Will OEMs look to extend the life and the volumes of existing ICE products to help fill the gap where BEV demand was supposed to be?

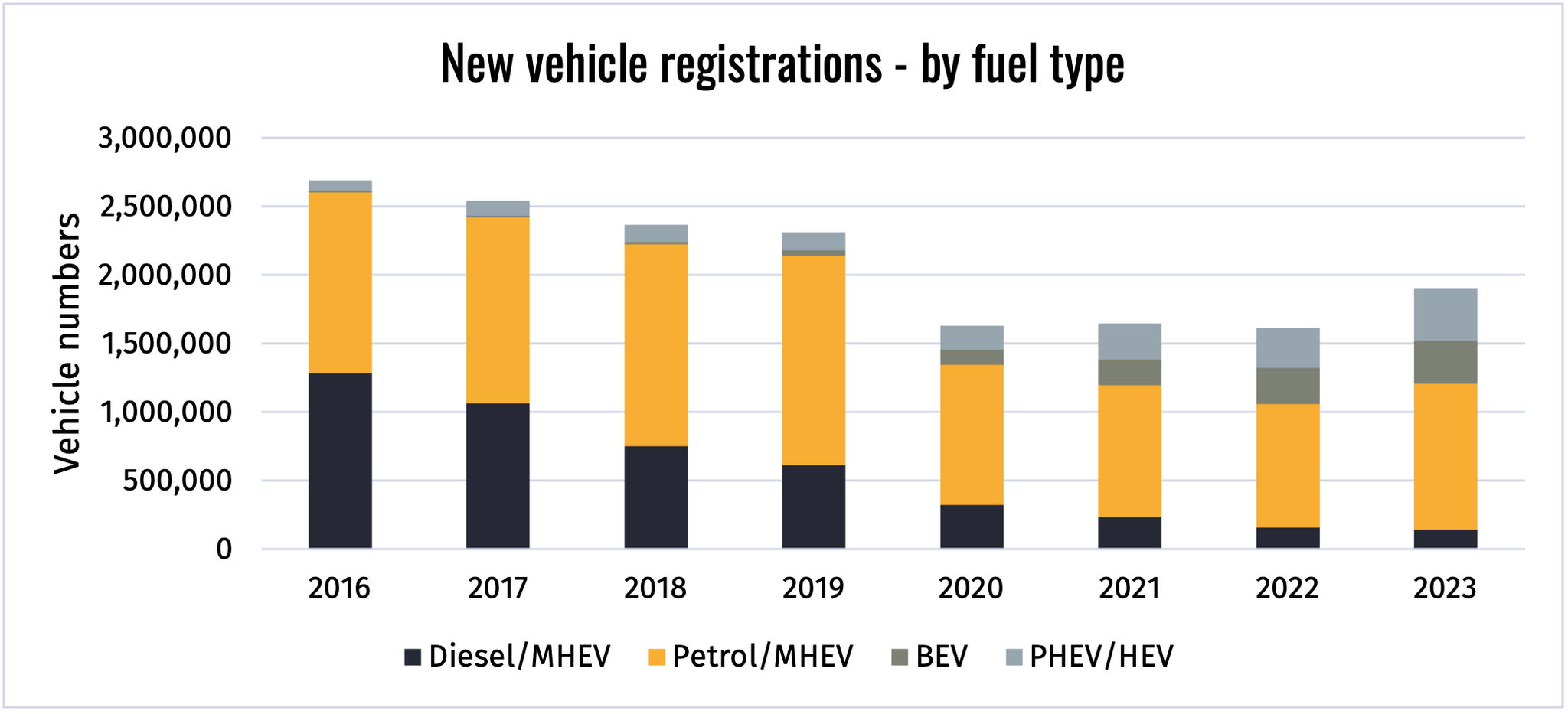

Source: SMMT / Cox Automotive

Many ICE suppliers have already set their medium- and long-term strategies to match those of their OEM customers, and this has, over the past few years, already sparked a shift from diesel to petrol, even within the ICE powertrain sector. These changes in strategic direction have meant investment has been curtailed or ceased entirely, and capacity has started to be reduced across manufacturing footprints. A lack of alternative suppliers has made matters challenging for OEMs to source ICE components. It has resulted in little alternative for the OEMs but to support those suppliers with financial challenges, thereby increasing the overall cost per part being produced.

Many existing ICE vehicle and engine programmes are starting to reach the end of their anticipated lifecycles. The lack of investment means the capital equipment is becoming increasingly difficult to maintain as it ages, with spare parts often difficult for the supplier to source. This leads to production downtime if equipment breaks down, adversely impacting the number of ICE vehicles the OEMs can manufacture. Suppliers can potentially catch up on production volumes using overtime and extra shifts, but that comes at a cost. Who is paying for that?

Suppliers will often look to pass these additional costs on to their customers. If the increases are accepted, the OEMs must either swallow the margin impact or raise the prices of their ICE vehicles. If the extra costs are not passed on, then this creates further pressure on the suppliers, sometimes being enough to force the supplier into financial difficulties.

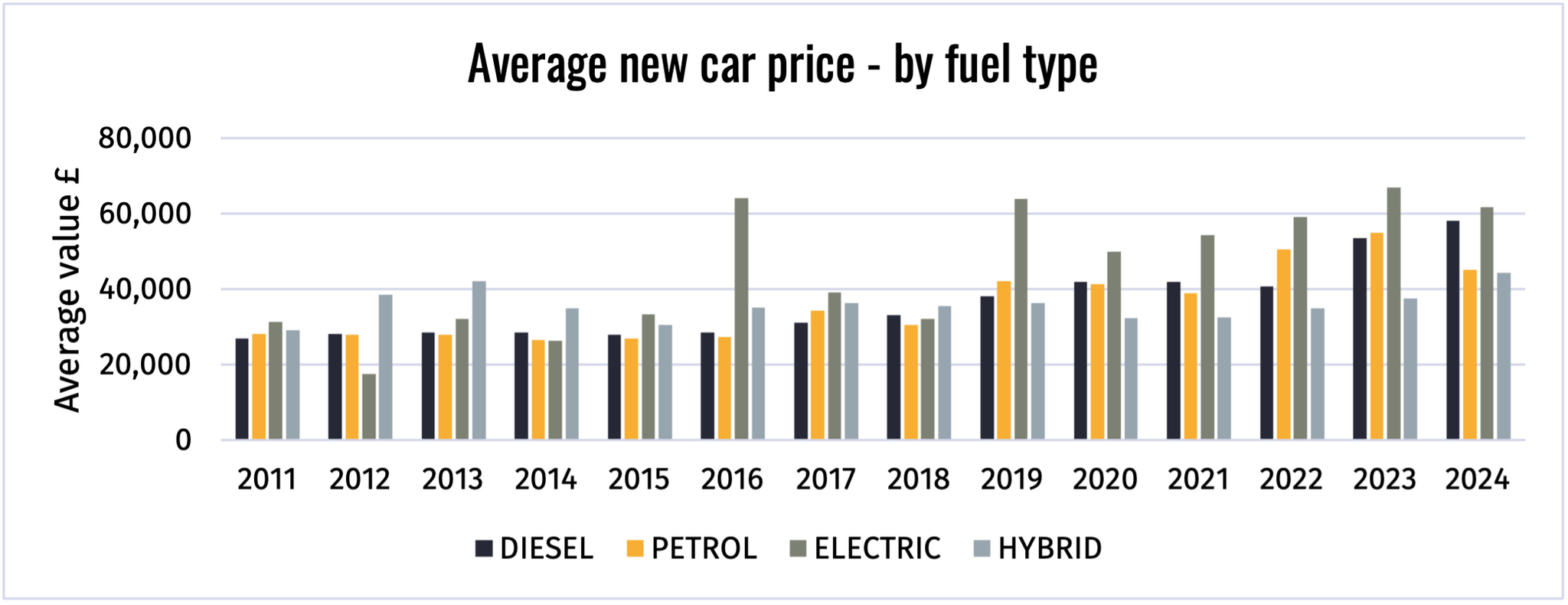

Source: Cox Automotive

Yet, with new car prices continuing to increase, it remains to be seen whether any additional costs passed onto the buyers of ICE vehicles will make them prohibitively expensive. OEMs are unlikely to want to further increase the price of BEVs to cross-subsidise any ICE sales, and equally, in the UK, adding a further £15,000 per ICE vehicle is going to make ICE vehicles increasingly unaffordable.

The lack of certainty around future ICE volumes, predicated on weaker than anticipated consumer uptake of BEVs, does and will continue to create stresses and strains throughout the ICE component supply chains.

Such volatility will keep analysts on their toes. What is certain is that these dynamics are likely to mean an increased level of intervention being required from OEM customers to shore up their supply chains. It will also entail a reduction in consumer choice as OEMs drive an even greater push of EVs into the marketplace.