Owen Edwards

HEAD OF DOWNSTREAM AUTOMOTIVE

6 min read

Recent press commentary has focused on Chinese brands looking to expand into the UK and Europe. Over 30 million new and 350 million used vehicles are sold yearly in China, representing a new car market 13x larger than the UK. Chinese OEMs see the UK and Europe as potential markets for expansion; the European market sells, on average, 15 million used vehicles a year, and the UK is the second-largest market in Europe, with an average of about 2.3 million new vehicles sold (2019).

Historically, Chinese brands regarded Europe as a market with the potential to sell a large number of new vehicles, and there was the added advantage of historically lower import tariffs of 10%. The increase in import tariffs for Chinese BEV brands now means that all Chinese brands selling BEV in Europe will succumb to higher import tariffs.

The big question is: how will this impact the demand for Chinese vehicles imported into the UK? Of course, the first thing to remember is that the new tariffs only concern BEV vehicles – ICE vehicles will still only be exposed to the current 10% import tariff.

Why were these tariffs proposed for Chinese BEVs?

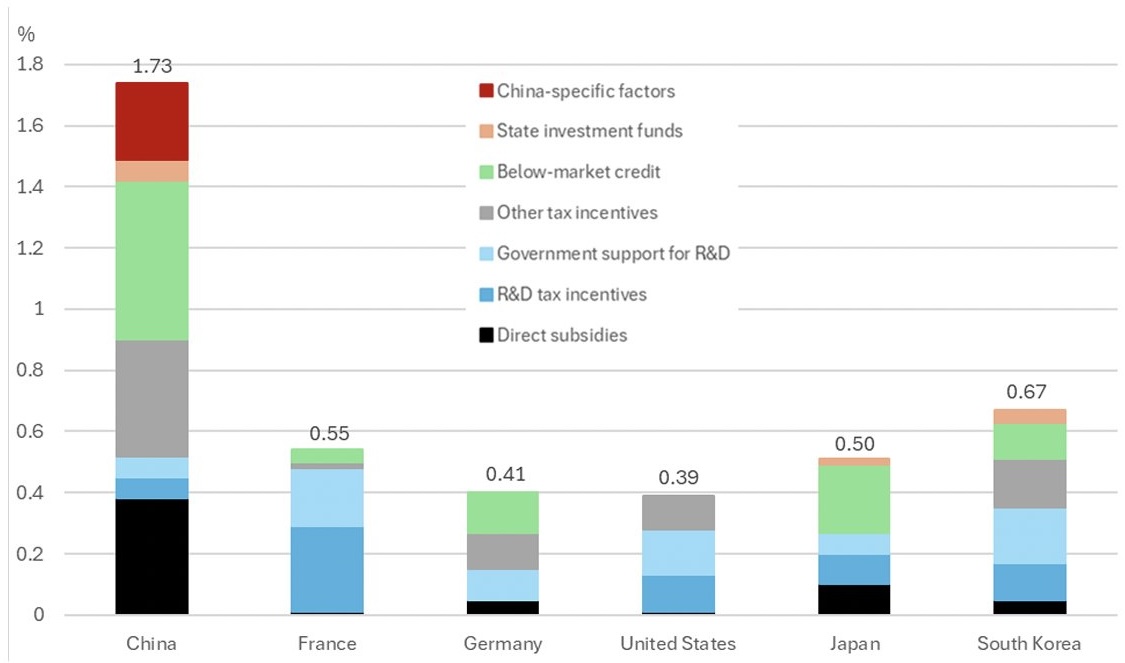

The rationale behind the new import tariffs relates to the Chinese government's support for the R&D, design, and manufacturing of vehicles and the support it has provided to encourage consumers to purchase new electric vehicles. Chart 1 depicts the level of support the Chinese government provides versus the support provided by other countries. It shows the substantial difference between China and the US, the country receiving the next-largest level of government support. The EU considered this level of support significant and likely to impact the EU's local automotive manufacturing industry.

Chart 1: Industrial support spend in China and key OCED countries in 2019

Source: Kiel Institute for the World Economy

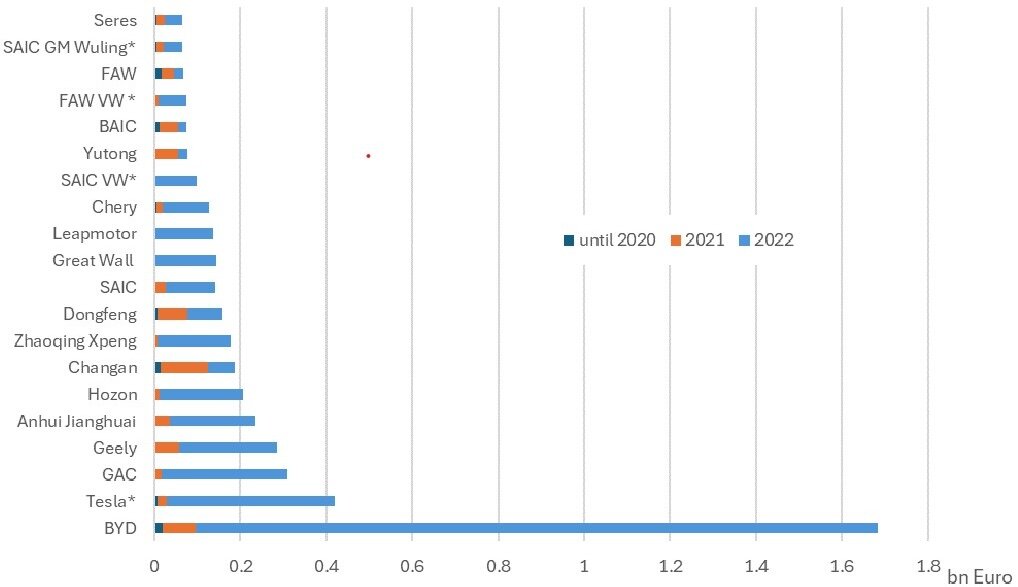

Chart 2 illustrates financial consumer support for the purchase of BEVs.

Chart 2: Approved New electric vehicle purchase subsidies in the Chinese market

Source: Kiel Institute for the World Economy

What are the BEV tariffs for Chinese brands importing vehicles into Europe?

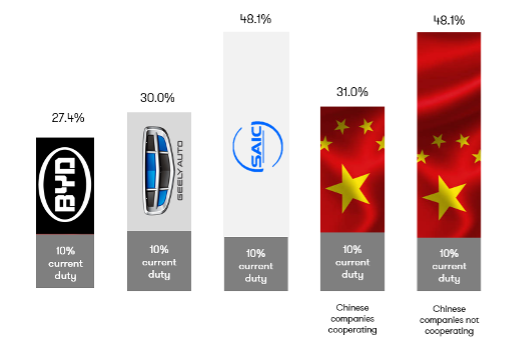

With this evidence, the EU decided to impose the following tariffs on selected Chinese brands selling BEVs in Europe. The EU reviewed several companies. Those that assisted in the research to determine the level of support provided by the Chinese government were treated with greater leniency than those that did not.

Duty/import tariff proposed on Chinese-made BEV by the EU

Source: EU

The EU determined that three specific companies – BYD, Geely, and Saic – plus all other Chinese companies that import BEVs into Europe will have import tariffs imposed. These will be 19% or 46.3%, depending on whether they cooperated with the EU's research.

Discussions between Beijing and the EU are ongoing. However, any investigations will conclude within a maximum of 13 months from 4 October 2023, when the EU initiated its research.

A number of other points to highlight:

- Tesla's import tariff for its Chinese vehicles is under review, and Tesla may receive an individual calculated duty rate

- At present the UK has not publicly indicated the level of tariffs that it will implement. We await further news from the new UK government concerning the potential ramifications

Some quoted Chinese BEV companies have indicated that they will absorb the cost of the increased import tariffs (e.g. BYD); however, other Chinese brands have suggested that some of the costs from the import tariffs will likely be passed fully or partly on to the end consumer. This could well slow the growth of certain Chinese BEV brands in Europe.

In the short term, a slowdown in sales of some Chinese BEVs may be expected, although the impact is likely to be more limited for those willing to accept the total cost of the increase in import tariffs. Nevertheless, consideration should be given to those Chinese OEMs looking to manufacture vehicles in the EU. BYD is in the process of building a battery manufacturing plant, and vehicle plants will follow soon in Hungary and Turkey. Meanwhile, recent news from Chery has indicated that Spain will support the manufacturing of Chery vehicles. If this is the case, import tariffs may not apply to some components. Automotive industry specialist UBS Equities estimate that 75% of all components in a BYD vehicle are manufactured in-house; this would mean that production in Hungary would be cheaper than other European competitors. Such a competitive advantage would allow BYD to reduce the retail price of its vehicles, take market share quickly, maintain prices below its local competitors, and thus retain more profits from each BEV produced. Either strategy would provide BYD with a positive position in the EU.

The EU's imposition of tariffs on Chinese BEVs may slow the growth of some Chinese brands but will not stop a number of Chinese brands from entering Europe. We estimate over 10-15 brands could enter UK and European markets. If tariffs are unlikely to stop the Chinese brands from quickly taking market share in Europe, what will?

We believe that some of the following issues will impact demand for Chinese brands:

- Brand acceptance – the willingness of UK and European consumers to try new brands without local brand awareness. Recent research by JudgeService Limited suggests that of UK consumers shopping for a premium-brand vehicle, 41% would consider a Chinese brand if priced £3,000 more cheaply, while 27% of customers shopping for volume brands would consider a Chinese brand if the vehicle was £3,000 cheaper. Furthermore, brand awareness has increased significantly following the likes of BYD sponsoring the UEFA European Football Championship

- Dealer network – consumers will still need access to test drive a vehicle and to have their vehicle serviced and repaired

- The supply of vehicle parts for repairs and servicing – we understand that some Chinese brands are struggling to provide parts to service and repair vehicles, causing frustration to both their dealer networks and consumers

- Used vehicles and residual values – creating a used vehicle market for used Chinese BEVs and ensuring that residual values are maintained over time and that consumers, leasing, fleet and rental companies have confidence that they will not be negatively impacted by potential falls in residual values

It is undeniable that a number of Chinese brands are coming to the UK and Europe. However, the big question is the speed at which those Chinese brands arrive. Clearly, all Chinese brands are looking to take market share in both the UK and Europe and make the sale of vehicles profitable, but how much market share will they achieve?