Philip Nothard

INSIGHT DIRECTOR

6 min read

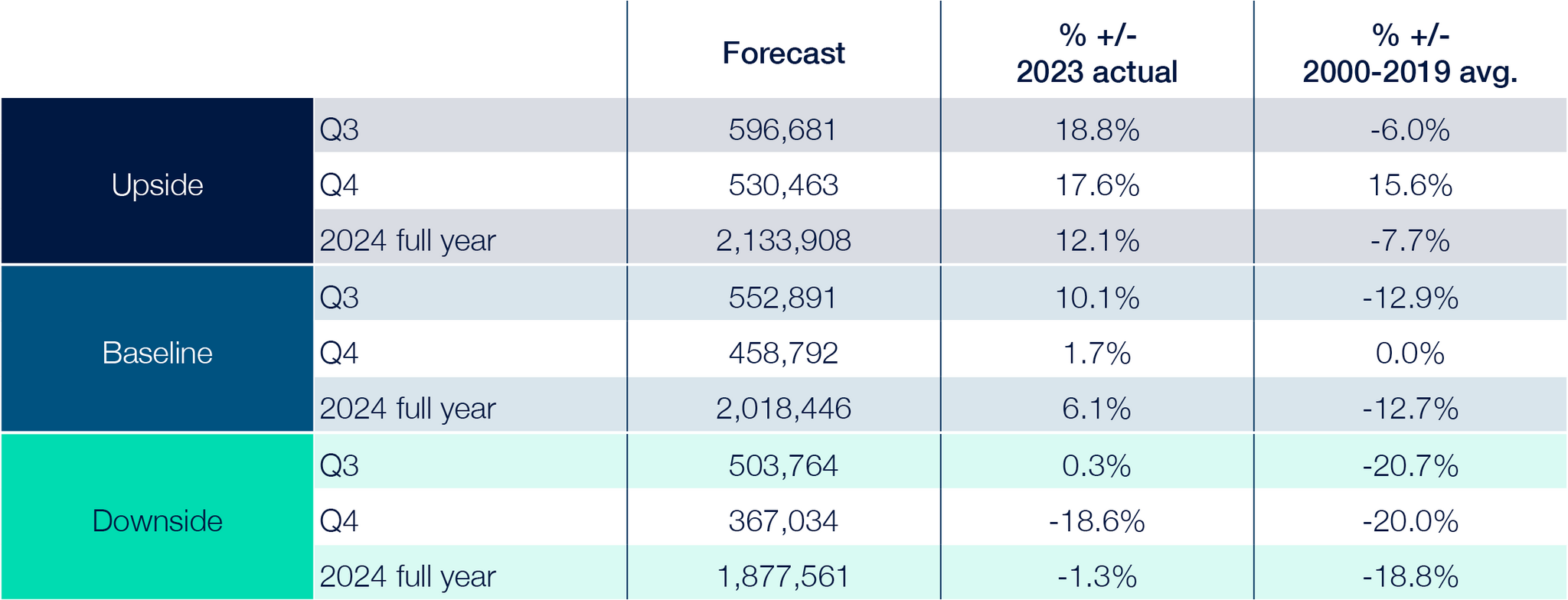

We've updated our new car forecast for Q3 and beyond using the latest new car registration data alongside our own data insights and market intelligence. As usual, we offer three scenarios—upside, baseline, and downside. The rationale behind each can be found below. The baseline is, we believe, the most likely scenario to materialise.

Our baseline forecast predicts 2,018,446 registrations will be achieved by the end of the year. This is a marginal 2.07% decrease on our previous forecast and reflects the performance recorded by the SMMT in the first two quarters and the volatility expected in Q4 as the ZEV mandate influences strategic and tactical activity on the part of many manufacturers.

Our baseline forecast anticipates 552,891 registrations in Q3 and 458,792 in Q4. The year will end 6.1% up on 2023’s full-year volume. This is 12.7% down on the 2000-2019 average.

Source: SMMT / Cox Automotive

Upside scenario

In this scenario, a strong economic recovery later in the year boosts consumer confidence, and we witness successful market entries, a smooth adoption of the agency model, and progress in sustainable transportation policies.

- An economic resurgence spurs a swift nationwide economic recovery, surpassing GDP growth projections set by the UK government and the Bank of England. This rapid upswing triggers a notable decrease in inflation, leading to a corresponding drop in interest rates. As a result, personal disposable income per capita sees a significant upturn, igniting a notable growth in consumer confidence. Heightened consumer confidence correlates positively with increased spending on new and used vehicles.

- New entrants quickly establish robust consumer and business brand recognition backed by substantial product volumes. Their presence catalyses market expansion and gradually reduces established manufacturers' market share. Of note are the significant contributions made by Chinese manufacturers to this upward trajectory.

- Manufacturers and retailers, in the main, achieve the targets specified by the ZEV mandate without significant financial impact or disruption to distribution.

- The adoption of the agency sales model meets with minimal disruption to established manufacturers' market share and distribution channels. Transition achieves a delicate equilibrium between ICE vehicles and EVs, ensuring customer acceptance.

Baseline scenario

In this scenario, economic pressures persist alongside agency model transition challenges and issues posed by legislative change in the UK and Europe:

- Consumer spending remains subdued as the economy grapples with ongoing challenges. Inflation and interest rates are expected to ease slower than initially forecasted, adding uncertainty surrounding living costs and energy prices. Consequently, caution over expenditure remains low. Despite these hurdles, a gradual improvement in consumer confidence is anticipated, with sustained demand in the fleet market for new vehicles.

- The postponement of agency model adoption by many OEMs in 2024 highlights the need for clarity regarding its financial viability. More OEMs are expected to gradually move toward the agency model in its purest form or via hybrid variants. This shift represents a departure from the traditional "push" model of the financial environment to a consumer "pull" model. However, implementing new agency models reduces the number of vehicles in the market.

- Global production levels surpass forecasts, raising sustainability concerns. The UK's emphasis on implementing the ZEV mandate impacts OEM market performance significantly. However, the disconnect between high global production and potentially unattainable targets for the 2024 ZEV mandate raises doubts about OEM commitments to the UK automotive sector. Additionally, the challenges associated with reducing ICE vehicle production to meet the mandated share for EVs further complicate the situation.

Downside scenario

In the downside scenario, persistent low consumer confidence, subdued business activity, challenges arising from new legislation, and notable difficulties transitioning to the agency model are prominent.

- The economy experiences further deterioration as unchecked inflation persists despite government measures. This places significant strain on consumer spending and the cost of living. The looming possibility of interest rate hikes or minimal prospects for reductions threatens to escalate costs for consumers and businesses. Consequently, consumer confidence declines, potentially pushing the Business PMI (Purchasing Managers' Index) below the critical threshold of 50, indicating a contraction in business activity.

- Despite the continuation of the ZEV mandate, consumer enthusiasm for BEVs diminishes due to prolonged government inaction on support and incentives. Moreover, the widening gap in the cost of entry between new and used vehicles further strains the financial viability of retailers.

- Legacy OEMs encounter significant complexities in transitioning to the agency model. Adoption rates fall short of initial projections, and the new model disrupts established consumer purchasing processes, leading to uncertainty and reluctance among buyers. Furthermore, issues emerge in the fleet sector as OEMs starve supply to the UK, exacerbating the already challenging market conditions.

Source: Cox Automotive