Philip Nothard

INSIGHT DIRECTOR

6 min read

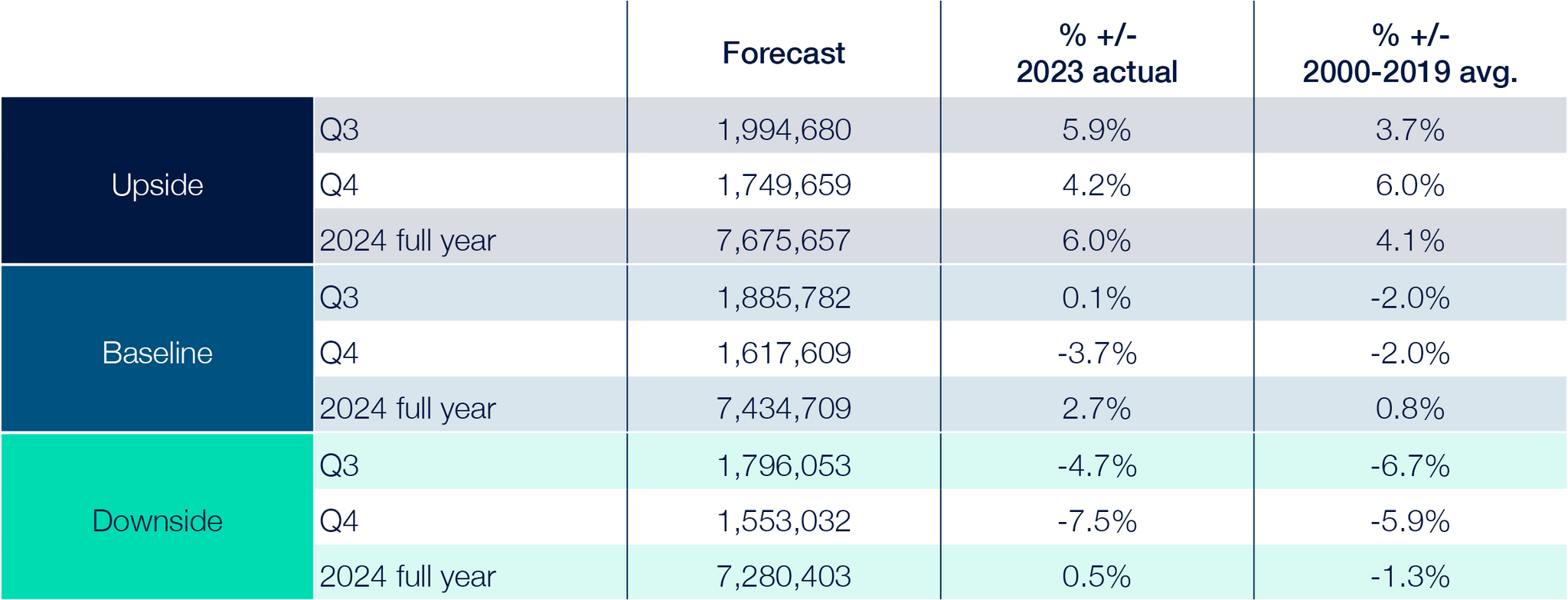

Using the latest used car data alongside our own data insights and market intelligence, we've updated our used car registration predictions for Q3 and beyond. As usual, we offer three scenarios – upside, baseline, and downside. The rationale behind each can be found below. The baseline is, we believe, the most likely scenario to materialise.

Our baseline forecast predicts 7,434,709 used car transactions will be achieved by the end of the year. This is a marginal 1.2% increase on our previous forecast and reflects the performance recorded by the SMMT in the first two quarters and the conditions we anticipate playing out in Q3 and Q4.

Our baseline forecast anticipates 1,885,782 transactions in Q3 falling to 1,617,609 in Q4. The year will end 2.7% up on 2023’s total transactions figure. This is 0.8% up on the 2001-2019 average.

Source: SMMT / Cox Automotive

Upside scenario

In our upside scenario, a balanced recovery continues to unfold, driven by increased choice, heightened consumer confidence, and a notable surge in Battery Electric Vehicle (BEV) ownership.

- New vehicle registrations follow a steady recovery trajectory, alleviating the strain on the cost of owning used vehicles compared to new ones.

- Recent production shortages, which previously limited choice in the used market, gradually ease as fleet and rental sector inventory enters the market. This influx and a notable upturn in consumer confidence support increased supply volumes.

- Economic measures, such as lower inflation and declining interest rates, implemented sufficiently in 2024, stimulate consumer confidence and enhance overall spending. Consequently, this alleviates pressure on both the leading and broader automotive sectors.

- The used EV market experiences significant expansion as consumer interest in ownership rockets. This heightened interest could stem from increased confidence in residual values, enhanced battery health, or government-driven initiatives to bolster demand.

Baseline scenario

In our baseline scenario, a slow resurgence unfolds as economic factors maintain inflation at higher-than-ideal levels. At the same time, new vehicle production gradually recovers amid growing EV adoption.

- The broader economy remains stable, characterised by ongoing challenges but no significant deterioration. Long-term recovery plans and forecasts remain viable, although only a gradual reduction in inflation tempers them. While the UK interest rates are easing, they remain higher than previously experienced, showing only modest yearly declines.

- The recovery in new vehicle production stabilises and potentially gains momentum. As EV adoption grows, particularly in the new vehicle market, the return of fleet, rental, and business sector commercial discounts helps ease pressures on the supply of used vehicles.

- The shift to EVs in the used car market continues slowly. Similar to the trend observed in 2023, the adoption of used EVs shows incremental progress but without significant acceleration.

Downside scenario

In our downside scenario, weakened consumer confidence and economic struggles contribute to a challenging landscape where financing a used vehicle proves prohibitively expensive for many.

- The economy undergoes a substantial and prolonged downturn, with implemented measures failing to make a significant impact. Persistent high inflation rates persist, with limited prospects for reduction. The Bank of England maintains elevated base rates to counter inflation, further exacerbating economic woes.

- Fragile consumer sentiment decreases demand for used vehicles, leading to a contraction in the used car market. Economic uncertainties prompt consumers to postpone or reconsider purchasing used vehicles, dampening market activity.

- Financing rates for used vehicles remain markedly higher than anticipated, rendering used vehicle ownership financially out of reach for many consumers. This disparity in affordability is particularly pronounced amid a cost-of-living crisis and within an economic landscape characterised by persistent inflation.

Source: Cox Automotive