The key to survival in the automotive industry? Creating scale

Continue reading

Owen Edwards, Head of Downstream Automotive

at Grant Thornton UK LLP

The automotive manufacturing market continues to evolve with new drivetrain technologies, batteries, hydrogen e-fuels and continued improvement in the ICE to meet new Global, European and UK legislation. Investment in connected autonomous vehicles and new mobility services (Mobility as a Service – MaaS) has increased, compounding the total capital investment OEMs must make in their supply, distribution and retail chains. Therefore, increasing scale in the upstream and downstream automotive sectors has become even more important.

The scaling up of the supply chain cannot be isolated to new drivetrain technology as traditional OEMs still aim to make profits from ICE vehicles and legacy parts. These are slowly losing market share to new drivetrain technology, fuel tanks, combustion engines and exhaust pipes etc.

The ability to generate scale and profits from traditional ICE vehicles is becoming more important than before and OEMs are struggling to make profits from BEVs. To create scale, ICE vehicle partnerships are increasing. Geely and Renault have agreed to form a new ICE power plant company. Both automotive makers will hold equal stakes in the new venture, which will manufacture ICE and hybrid powertrains.

"The ability to generate scale and profits from traditional ICE vehicles is becoming more important than before and OEMs are struggling to make profits from BEVs. To create scale, ICE vehicle partnerships are increasing."

Owen Edwards, Head of Downstream Automotive at Grant Thornton UK LLP

Partnerships mean benefits

Such partnerships create benefits, not only in the scale of manufacturing but also by scaling up R&D into ICE engines – research that will be required for many years to come, due to increasingly stringent regulation on ICE emissions, e.g., the new Euro 7 measures expected in July 2025. The Geely/Renault partnership will include Dacia, Volvo Cars, Lynk & Co, Proton, and Nissan Motors and Mitsubishi Motors through the Nissan/Renault and Mitsubishi Alliance. The new company is looking to operate 17 power plants on three continents, employing around 19,000 people, with capacity to produce 5 million ICEs, hybrid and hybrid plug-in engines and transmissions per annum. Renault has predicted that the partnership could produce up to 80% of ICE-vehicle global requirements, although no timescale has been outlined for that ambitious target.

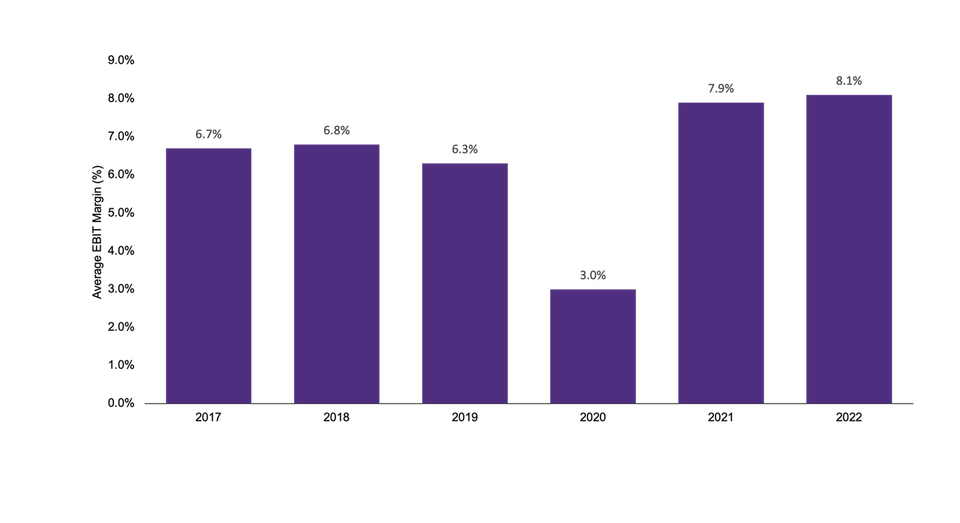

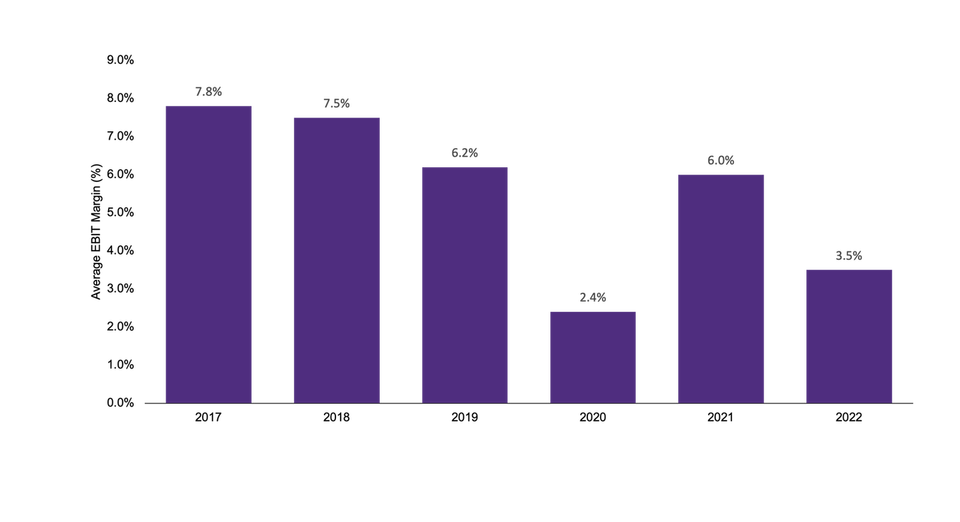

Historically, OEMs have applied pressure on their supply chain – Tier 1-4 parts suppliers – and the impact of this pressure can be seen in the share price of Tier 1 suppliers between 2017 and 2022: the index of auto parts suppliers fell by 40% below the S&P 500 fortune Automotive Index. The average EBIT margin for the top auto OEMs in 2022 was 8.1%, while the average EBIT margin for top auto suppliers was 3.5% (see chart). This indicates pressure on the supplier chain parts businesses from several areas, leading to unpredictability and constraints exacerbated by the lack of clarity over demand from the OEMs, who have suffered large swings in their production targets and volumes. There have also been bottlenecks to sourcing raw materials and labour shortages as employee expectations have shifted from manufacturing and production jobs to other roles or industries.

Average EBIT margins for top auto OEMs1

Source Capital IQ, BCG

1Notes: Average EBIT margins (%) of sample OEMs (VW, Renault, Nissan, Ford, GM, Stellantis, Honda, Hyundai, Suzuki, Toyota) – 2022 estimates

Average EBIT margin for top auto suppliers2

Source Capital IQ, BCG

2Notes: Average EBIT margins (%) of 46 public auto suppliers from 2021 top 100 ranking by Automobil Produktion (2022 estimates)

To achieve the scale required to provide a return on the capital investment in these capital-intensive businesses, strategic changes will be required to develop a sizeable scale:

- Focus on new markets, such as BEV and ADAS products; companies such as Bosch and Schaeffler have gone down this route. This area of the market should generate high-profit margins and scale. Still, we expect further partnerships or consolidation in this market to achieve the scale required to maintain or generate growth in these companies profit margins. This consolidation and partnering process will take place over the medium-to-long term.

- Continue to manufacture the parts that have not been impacted by the changes in drivetrain technology – seats, exterior parts, lighting etc. These suppliers will consolidate or partner to generate scale for these suppliers, and this strategic shift will likely take place in the short-to-medium term.

- Partnering and consolidation amongst legacy parts providers are already taking place. They are expected to gather pace as the market share of ICE vehicles sold into the global market continues to decline.

Some companies must have two or more strategies in their growth portfolio.

However, OEMs are also partnering in legacy technology and new drivetrain technology – for example, VW, which has developed its MEB BEV platform. The MEB platform has cost the automotive maker $16bn, which will be used for all BEVs across the VAG brands (Audi, VW, SEAT, Skoda). The VW brand alone is expected to launch ten new BEVs by 2026 underpinned by this architecture. VAG is expected to produce 10m vehicles with this architecture. To meet this target of 10m vehicles, the VAG brands will use this “skateboard” BEV architecture alongside Ford and potentially other brands. The first Ford model to use the MEB platform will be the Ford all-electric Explorer.

Economies of scale options

Automotive OEMs are not simply partnering with each other in the supply chain to support the manufacturing of vehicles but also gain the benefits of partnering in other customer services. In the US, Ford and Tesla recently indicated that Ford customers can use Tesla chargers. Ford’s new generation of vehicles (US only at the moment) will be made with Tesla-style charging ports to allow them to use Tesla chargers. Tesla will benefit from Ford customers using their network as the utilisation of Tesla chargers will increase; furthermore, Ford will not require the implementation of a large charging network across the USA, instead they will ‘piggyback’ Tesla’s 12,000 US superchargers. It is unclear whether Tesla’s customers will be happy with Ford customers using their network as the charging network may become overcrowded, potentially increasing charging anxiety for Tesla drivers.

Whether in the supply chain or distribution of vehicles, continued technological evolution, and the significant investment required, are forcing the automotive industry to consider many different options to gain economies of scale and achieve the return on investment necessary to satisfy shareholder demands.