Unlocking EV momentum

Continue reading

Ian Richardson, Co-Founder,

360 Media Group

We have seen impressive uptake in electric vehicle sales during the last three years; however, concerns about affordability and charging show no signs of abating.

We look at what factors will influence the growth of electric vehicles before the 2030 deadline to ban the sales of new petrol and diesel cars and vans.

The Fleet Outlook Report from 360 Media Group informs fleet strategies. 400 UK fleet interviews were conducted during Q1 2023, measuring buyer opinions on their plans, goals, and future requirements.

We have analysed the results to reveal key findings requiring education and collaboration to accelerate EV adoption.

Electric vans

Electric LCVs now make up 7% of all new registrations. The SMMT's latest estimation is that 7.4% of all new registrations will be electric by the end of 2023.

Green shoots of recovery

Confidence in the vehicle supply chain is returning, with 48% of fleets expecting to see an improvement in the next 12 months.

The market is set to grow

With a UK van market exceeding 4 million vehicles, 49% of businesses are confident that the number of LCVs they operate will increase in the next 12 months.

EVs represent the biggest opportunity

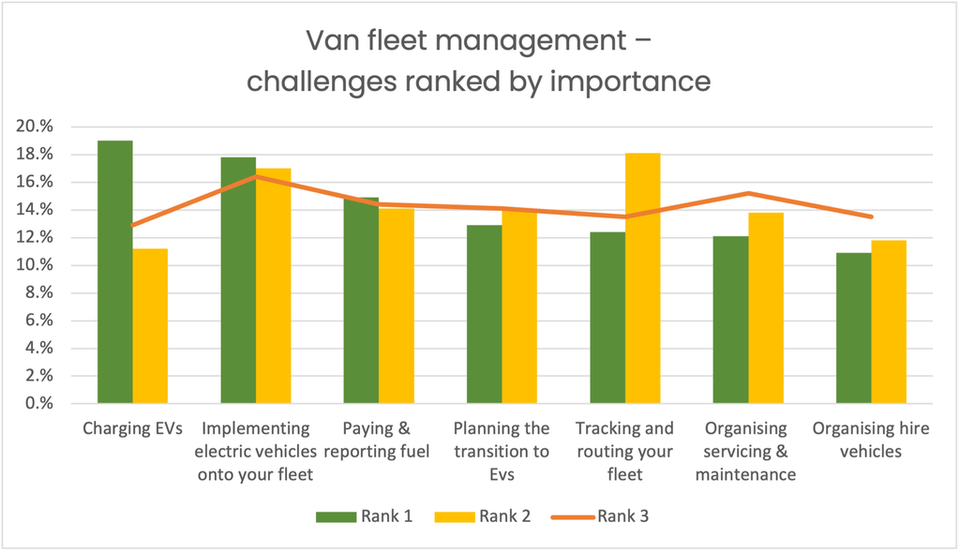

The biggest issues for van fleet decision-makers are planning, implementing and charging EVs.

Fleets predict a departure from diesel as they explore alternatives, with 22% planning to order electric vans in the next 12 months.

The two primary concerns remain price and charging

It is recognised that charging strategies start at the workplace, and 71% of van fleets plan to invest in depot charge points in the next 12 months. This number has remained consistent for three years, with ownership of premises, cost and driver resistance cited as investment barriers.

The two primary concerns remain price and charging

It is recognised that charging strategies start at the workplace, and 71% of van fleets plan to invest in depot charge points in the next 12 months. This number has remained consistent for three years, with ownership of premises, cost and driver resistance cited as investment barriers.

EVs will continue to dominate the conversation

With 26% of fleets expected to have at least half of their van fleet powered by electricity by 2025, these next 12-18 months will prove critical for fleets to turn plans into actions, with driver engagement and access to energy sources top of the to-do list.

Support for the EV transition is business critical

Over half of the fleets concede that there are gaps in their electric vehicle knowledge, creating an opportunity for the supply chain to step up.

Just 23% have a CO2 cap of under 100 g /km, and 40% of fleets would consider switching suppliers based on their capabilities to support the transition to electric vans.

Winning hearts and minds

Fleets concede that they must do more to engage with van drivers and find adequate charging options. With 30% of fleets not intending to invest in workplace charging, the driver requires a local charging solution. 40% of drivers cannot or will not charge at home, which makes working with local authorities to access reliably safe charging paramount.

SMEs remain underserved

SMEs lack support on Fleet Policy, EV Knowledge, and TCO; this translates to using a broader repertoire of suppliers.

With just 51% of fleets adopting the TCO model for vehicle purchasing, the hard yards for EV adoption are ahead of us as fleets need help to justify higher list prices.

The agency model is coming

With fleets indicating the need for education, just one-third are fully aware of and understand the agency sales model. OEMs have a job to communicate the changes and how this positively supports fleets on their journey to electrification.

A flexible future

Economic uncertainty impacts fleet plans for acquiring vehicles, with 65% of fleets admitting to delaying their plans to transition to electric vans due to the energy crisis. We see 52% of fleets expecting to extend their van replacement cycles, whilst 42% expect to increase their sourcing of flexi-rental vans.

Company car fleets

1 in 3 company cars is allocated to perk drivers; these are the heartland for EV adoption as their mileage profile equates to between 1 to 2 charges per week.

The HMRC has reported a three-year decline in company car drivers; however, fleets are reported cash allowance takers returning to the scheme to access electric cars.

EVs are not yet on all car choice lists

Fleets predict that 23% of their new car orders will be electric. The trajectory indicates that demand will overtake petrol by 2024.

However, 59% of fleets offer electric cars on their fleet choice list. The option to trade up is available from half of all fleets. With BIK tax certainty through to 2028, there is a risk of losing talent for businesses that fail to make electric cars available.

Alternative car funding

Electric vehicles are extremely popular as a talent retention tool, with 48% of fleets being ‘very likely’ to introduce Salary Sacrifice Schemes in the future. This is good news for employees interested in a new car; the challenge now is to scale buy-in.

We have seen the introduction of EV car subscriptions, and fleets are interested in this option, with 47% being ‘very likely’ to introduce them in the future.

New entrants

A number of exciting new brands are coming to the UK, with NIO, Byd, and GWM upscaling their European operations to unlock aggressive sales growth; this should be good news for fleets and their drivers, making electric cars more accessible for many.

Most car brands now have credible electric cars on sale in the UK, with the top five car brands ranked on brand consideration:

1

2

3

4

5

Audi

BMW

Mercedes-Benz

Ford

Toyota

Summary

As the fleet manager job role evolves, stakeholder engagement will be cruciate to gain buy-in for investment in electric vehicles and related infrastructure. The challenge for van drivers is to start the day on a full charge, and if this cannot be achieved from home, then access to local public and depot charging is key.

The challenge for company car fleets is simple, update your purchasing model to TCO and make electric cars available on the choice list.

About

360 Media Group is the authority on the UK fleet market; our focus on delivering insights, education, and thought leadership helps brands translate their marketing and sales strategies into results.

Ian Richardson – Co-Founder of 360 Media Group

Ian has been advising automotive brands on fleet data and researching fleet audiences for two decades. Previously serving as the publisher of Fleet News, Ian helps brands gain clarity on fleet market growth opportunities.