How will the agency model impact dealer financials?

In this section, Zeus Capital dives into the latest dealer profit reports and explains what this means for the market and investors.

Continue reading

Mike Allen, Head of Research, Zeus Capital

As we pass through the first quarter of the calendar year, it’s worth reflecting on the changes we see in the industry, assessing any impact on the trading landscape and determining whether any of these factors have filtered through to PLC dealer valuations.

Regarding industry change in automotive retail, the most pertinent theme at present is the agency model and whether this has had a material impact on trading. In short, we believe the answer is not yet.

It’s important to distinguish between the worlds of theory and reality, particularly in a complex world in, which the automotive retail environment almost certainly existsis. Starting out as a theoretical strategy for OEMs to reduce network costs, likely spawned by management consultants during the dark days of COVID-19, the agency model has now been implemented in the real world by major OEMs. Mercedes launched their agency model in January this year, and it appears to have gone well, without any major technical hitches. It is clear that the agency model is here to stay, with more brands likely to adopt this over the coming months. As equity analysts, we do not receive granular detail of how this will be executed on a per brand basis. However, we anticipate execution will vary across brands , and we fully anticipate any original agency plans will evolve with time, responding to market/retail network conditions. SupposeIf we have been taught anything over the past couple of years. In that case,, it’s been that the most successful businesses (whether a PLC, private group, or a start-up) thrive when the customer journey is entirely flexible around individual needs.

"Regarding industry change in automotive retail, the most pertinent theme at present is the agency model and whether this has had a material impact on trading. In short, we believe the answer is not yet."

Mike Allen, Head of Research, Zeus Capital

In a world of low, albeit improving, supply, discounts have been few and far between in recent months. So, it’s an interesting time to establish what the OEMs would argue is a fixed price model. Do some customers like going to a dealership to haggle and receive a discount? Possibly, but as we have said, it is impossible to have a “fixed” model that will meet every customer need because, in today’s environment, most consumers want to feel they are getting a bespoke service. Can the agency model fulfil this? Will the OEMs not choosing the agency route get a competitive advantage? Only time will tell.

There are advantages to the agency model for the dealer, particularly from quality of earnings perspective. In theory (we keep coming back to this), the dealer does not have to invest in stock. Suppose the unit economics are pitched fairly, with dealers gaining from cost savings. In that case, the theoretical margins and ROCE (Return on Capital Employed) should be enhanced vs the traditional model. If this plays out and impacts Group financials, it should eventually lead to higher valuations. However, this is some way off as this will take time to develop.

We have been pleasantly surprised by the performance of the UK economy. We had previously anticipated a shallow recession in the UK economy during 2023, which will likely be avoided. All eyes will remain on inflation and interest rates. According to Oxford Economics, the market expects another 25bps hike in the Bank of England base rate in May. Still, the voting by Monetary Policy Committee members will likely be more split than recent decisions.

From a trading perspective, the PLC dealer groups have all made a solid start to the year, with trading in March looking robust as demand has remained resilient. Following a bruising 2022, we suspect many companies had cautious budgets for 2023, and as analysts, we made conservative assumptions around this, causing a “double discount” effect. While we are all mindful that the UK economy is “not out of the woods”, as ever, the dealer model and performance are more resilient than they are given credit for.

From a PLC valuation perspective, we have not seen any real improvements since our last article. Indeed, while the economic fundamentals are better than first feared, concerns of a banking crisis and contagion following the collapse of Silicon Valley Bank have made stock markets jittery in March following a solid start to the year.

In our latest sector note, we have looked at PLC valuations in several ways. Confirmation that Jardine Motors was acquired for £300-400m by US listed Group Lithia looks out of kilter with how larger and more profitable PLC groups are valued. According to the latest accounts filed at Companies House for the year to 31 December 2021, the Group earned revenue of £1.6bn and underlying PBT of £24.5m (adjusting for £4.4m exceptional profit on asset disposals). At the FY21 year-end, it had freehold and long-leasehold property assets of £103m and net debt (cashless bank loans) of £79.5m. Jardine’s FY21 underlying PBT of £24.5m was much lower than £84.4m for Pendragon, £80.7m for Vertu (year to 28 Feb 2022), and £90.7m for Lookers.

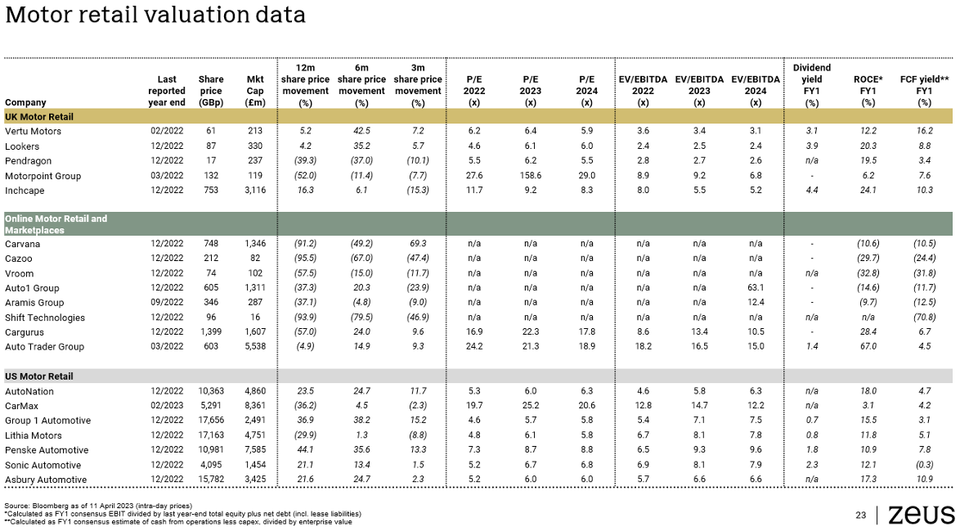

Looking at the latest valuation multiples, UK PLC dealer groups remain close to trough levels despite delivering a resilient earnings performance. It’s clear that most of the disrupters have been disrupted and outperformed by omnichannel, with public online car retailers’ share prices falling >90% over the last twelve months in some cases. Independent used car group Motorpoint has also struggled relative to the franchised dealers, albeit they are investing for growth. US retailers also remain at trough levels, with CarMax still in recovery mode as it has suffered from rising interest rates via its lending business.

Source: Bloomberg, as of 11th April 2023

Finally, we have previously referred to the resilience of the franchised dealer model and how investors often overlook this. The perceived cyclicality of the sector no doubt contributes to the low valuations that are seen across the sector. However, looking at the last 23 years, there has been clear aggregate growth in revenues, profit, and earnings. Looking at the next decade, would we bet against the existing companies to continue to these long-term trend lines (albeit with the odd bump)? Absolutely not.

Source: Bloomberg