Philip Nothard, Insight and Strategy Director

The used vehicle market landscape continues to experience significant and enduring transformation. Recent market reports indicate that Europe's pandemic-related supply chain disruptions and the ongoing conflict in Ukraine have led to nearly 42 million vehicles being lost over the last three years.

Moreover, consumers' changing attitudes towards vehicle ownership have substantially impacted financing and leasing, affecting both new and used vehicle markets. We must also consider the potential impact of some OEMs shifting towards the premium segment to boost profitability during the supply shortage. This shift could have significant implications on used vehicle market dynamics for the next five to ten years, with fewer cheaper yet still popular models entering the market.

It is clear the used vehicle market is in a state of flux, with numerous factors shaping its future trajectory. But above all the factors just mentioned, the single biggest change to the used car market is the rise of battery electric vehicles (BEVs).

Undoubtedly, the supply of BEVs in the used vehicle wholesale market is increasing, and this growth has led to unprecedented levels of volatility and uncertainty, catching many off-guard. While it is true that changes in the used vehicle market historically take time to stabilise, the emergence of the BEV sector adds an extra layer of complexity, especially around managing residual values.

Unlike the development of an Internal Combustion Engine (ICE) vehicle or the facelift of an existing model, the evolution of the BEV sector presents unique challenges for market participants. As a result, effectively navigating this rapidly changing landscape requires a comprehensive understanding of the factors driving demand and supply and the broader trends shaping the used vehicle market.

Incentives are needed to support the used BEV market

The regulations mandating net-zero emissions are the main driving force behind the shift towards Battery Electric Vehicles (BEVs) in the new vehicle market. This shift is accompanied by the potential of significant financial costs for OEMs and the need for infrastructure improvements, which are being supported by local governments. However, in the UK, there is a great deal of caution around pre-owned BEVs, and it’s clear more needs to be done to support consumer and business appetite towards the purchase one.

While some European countries provide generous incentives to encourage the adoption of pre-owned BEVs - such as subsidies of up to €2,000 in the Netherlands, a one-time grant of €1,000 for private individuals in France, and incentives of up to €6,000 in Germany for both BEVs and PHEVs - the UK currently offers limited support for pre-owned BEVs. Even in the US, the Biden administration has introduced a $4,000 tax credit for the purchase of used BEVs under $25,000, which has led to a significant increase in their adoption.

It is essential that similar initiatives are implemented here to encourage the adoption of used BEVs and support the growth of this market. Until then, there will only be more instability and volatility.

Currently, there is a disparity within the UK, as Scotland supports the transition and pre-owned BEV market by offering 0% finance. Still, it’s clear that England and Wales need more incentives to encourage used buyers to consider BEVs.

Used BEV pricing

As the BEV sector continues to evolve with new entrants and innovations, the increasing volume of used electric vehicles entering the market creates uncertainty and volatility around pricing. Although pricing dynamics depend largely on the specific make, model, and derivative, cautionary buying behaviour by retailers and consumers is common. In addition, the lack of government incentives to support the transition to electric vehicles in the used car market adds further pricing pressure.

As we look ahead, the number of used BEVs entering the market is growing at a faster pace than the development of supporting infrastructure and the 2030 Net Zero deadline. Furthermore, the pricing strategies of Chinese brands entering the UK and Europe still need to be determined, as they prioritise volume market share and disrupt existing brands. Therefore, it's essential to closely monitor these developments to understand their impact on pre-owned battery electric valuations and prepare for any future pricing disruptions. In contrast, ICE vehicles will remain in demand for years due to infrastructure challenges, range anxiety, or simply user preference and a reluctance towards the shift to electrification. This will create a valuation imbalance between BEVs and ICE vehicles.

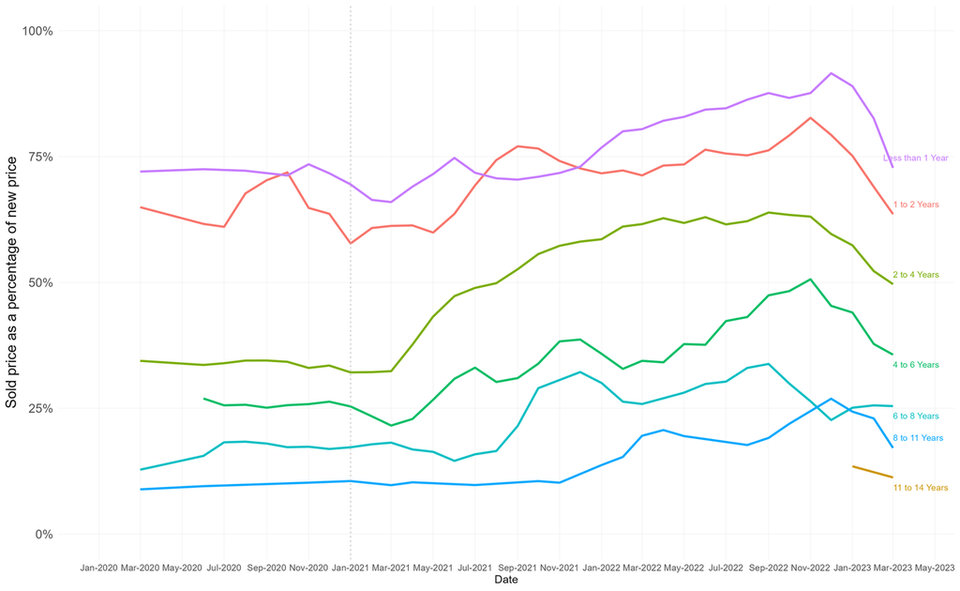

Sold price as a percentage of original new price - BEVs only

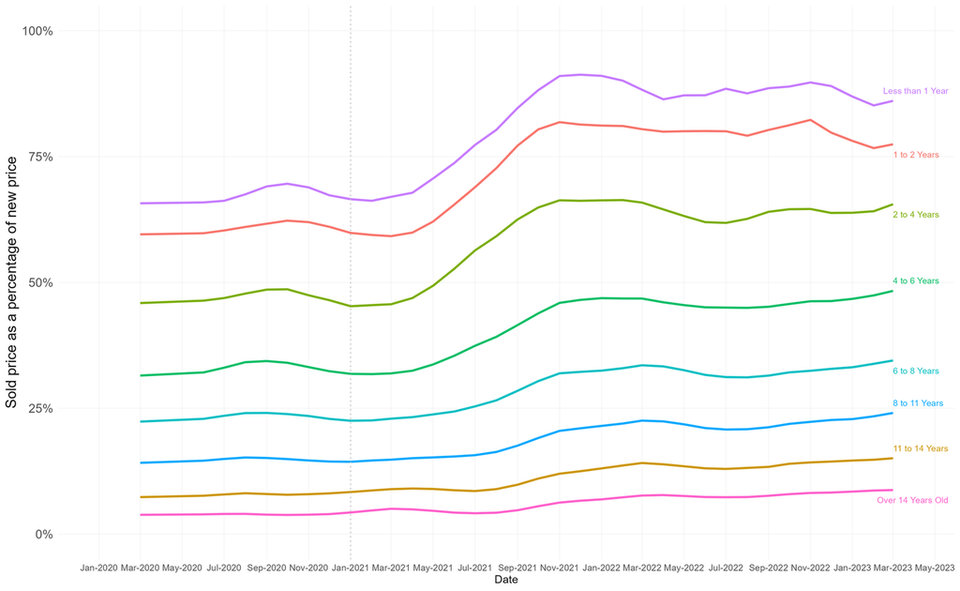

Sold price as a percentage of original new price - all fuel types

The current state of the electric vehicle market poses a potential risk for the used car sector. Despite the increasing prevalence of BEVs in the UK parc, only 64% of franchise dealers stocked BEVs as part of their used vehicle inventory in 2022, whilst 89% of independent dealers refrained from doing so. This creates uncertainty around the pricing and availability of pre-owned electric vehicles, which could lead to cautionary buying behaviour from both retailers and consumers.

By the end of 2023, more than a fifth of 0-1-year-old vehicles in the UK parc is expected to be a BEV, and this figure is projected to increase to 41% for 1-3-year-old cars by 2027. To keep pace with this rapid market shift, the sector must prioritise education, knowledge-sharing, and legislative measures to support the ownership and stocking of pre-owned electric vehicles.

Without collaborative efforts to improve awareness and infrastructure, the used car sector risks falling into a ‘valley of death’ where the new market moves faster than the appetite for pre-owned BEVs.

Used Car Forecast

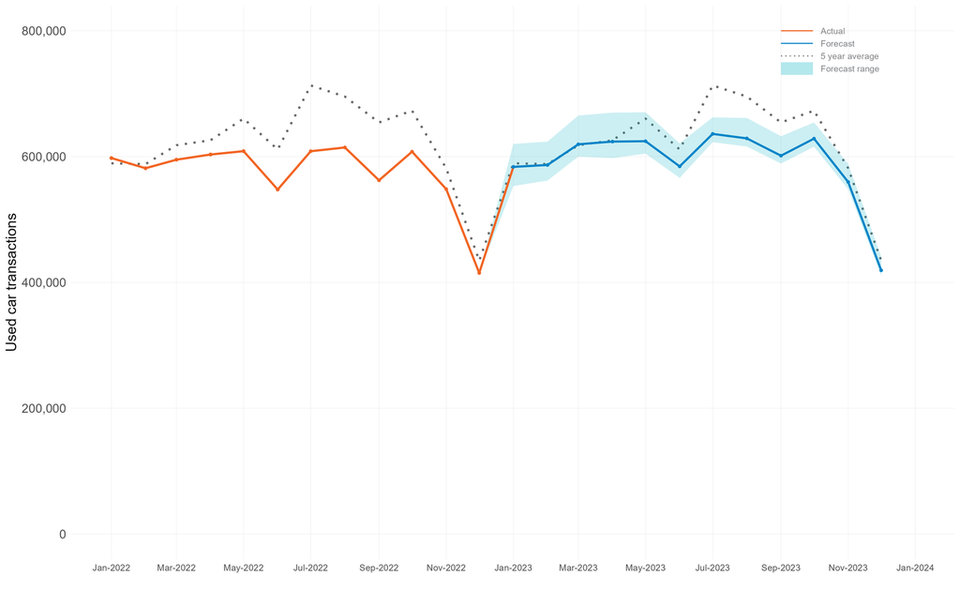

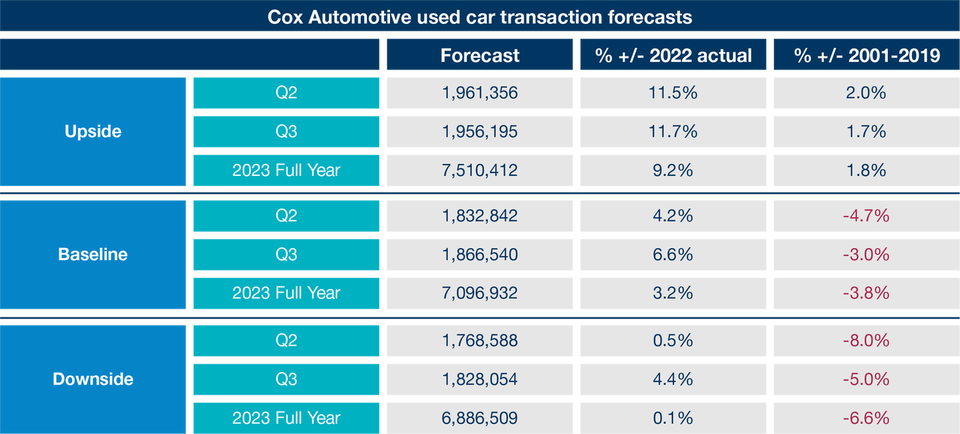

Building on recent used car figures, the market factors described in this article, and in line with previous Cox Automotive forecasts, we have adjusted our used car registration forecasts. Our forecasts are broken up into three scenarios – upside, baseline, and downside – each with its justification below. The baseline is, we believe, the most likely scenario to materialise.

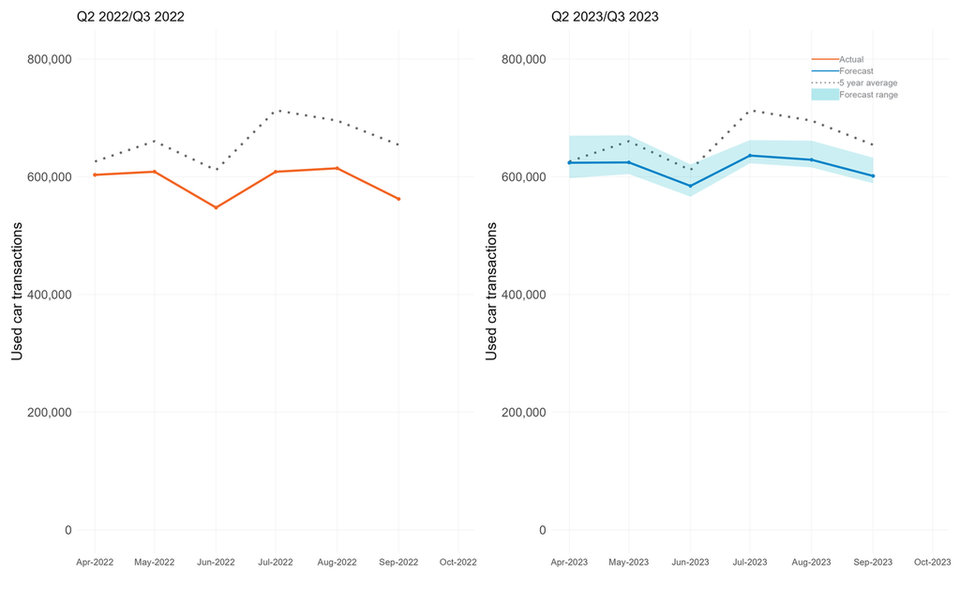

Used car transactions forecast - Q2 and Q3 focus

Source: Cox Automotive

Used car transactions forecast - 2023

Source: Cox Automotive

Source: Cox Automotive

Upside scenario

- The increased new vehicle productivity immediately impacts used vehicle supply and the consumer and business confidence recovery.

- Agency model shift creates a positive ecosystem for the relevant OEMs' used vehicle retailers.

- As with new, the recent government and Bank of England measures have an immediate influence on stabilising and reducing inflation and the cost of living.

Baseline scenario

The market experiences a stable but slow consumer and business confidence recovery, with little significant shift.

Economic headwinds remain consistent throughout the remainder of 2023, and any notable recovery is not seen until early or mid-2024.

Consolidation and acquisition positively impact the transactional used vehicle market, while retail pricing remains unaffected by the rise in interest rates and household expenditure.

Downside scenario

The headwinds of the broader economy, cost of living pressures, and the energy crisis continue to intensify, creating a challenging business environment for the automotive industry.

The shift away from used vehicles and back to new ones becomes even more pronounced as the oversupply of new vehicles leads to heavy discounting, further eroding the value of used cars.

Despite an increase in vehicle production and registration activity, the used vehicle wholesale sector remains stagnant due to the oversupply of older models and a lack of demand, exacerbating the supply and demand imbalance and making it difficult for dealerships to move stock.

Matthew Davock, Director of Commercial Vehicles, Manheim Auction Services

The used LCV market

"Quarter one concluded with a bang at the UK’s number 1 CV auction house, with demand remaining very positive as the quarter concluded in a strong position for used LCV values. Overall volume levels increased further throughout the quarter representing a 19% increase vs year-on-year in the auction lanes. This increased positivity around vehicle supply is undoubtedly bringing challenges as stock profile changes affect many dynamics, such as buyers needing to change vehicle profile buying habits and stocking much older and higher mileage vans. This is matched with increased time and cost getting these vehicles to retail standard.

“During quarter one, Manheim recorded its highest-ever age of vans (81 months old on average). This demonstrated a 24-month increase vs pre pandemic average. This was matched with mileage increases also, with average mileage being recorded at 84,379, an increase of 15,600 on average again vs pre-pandemic averages.

“Overall, market appetite has been extremely buoyant, with 84% selling first time, which matched with average days to sell of just nine days representing a four-day reduction versus 2022 averages for sellers.

“Even with the vast changes in age and mileage profiles seen today, the average selling prices have remained positive for the quarter at £9,064, demonstrating a significant increase of 46% versus pre-pandemic averages. As we move into the second quarter of 2023, we expect some seasonality to play a bigger role as retail activity becomes more challenging around holidays and bank holiday weekends. However, with the overall wholesale levels still being generally short, we expect the average selling prices and other KPIs to have remain positive.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc.

The US perspective

“The used market started the year strong in January but then saw fading momentum, resulting in used sales decreasing year-on-yearyear in March and for the first quarter. Rising retail prices negatively impacted the used market in March following wholesale prices that increased monthly in the quarter. In addition, with yield spreads widening substantially in March, payment affordability worsened, with the average used loan rate reaching 14% in March, an increase of 379 BPs year over year. Improving inventory and sales of new vehicles also shrank the buying pool for used retail vehicles in March, and tax refund season, which is critical for used vehicle demand in the spring, also contributed to lacklustre sales. Tax refunds for 2023 are tracking behind 2022 on all key metrics. With statistics through the week ending March 31, more than $183 billion in refunds were issued. The number of refunds issued was down 1% from last year, 10% less had been disbursed than the previous year, and the average refund at $2,910 was down 10% year over year. Used retail sales were down 3.5% year over year in March, causing used retail sales for the quarter to be down 2% year-on-year. Even with the disappointing tax refund season, used supply remains very tight. Total used vehicle inventory was just under 2.1 million units at the end of March and was down 19% year-on-year as dealers keep supply limited in uncertain demand. The wholesale market has a very tight supply, contributing to the quarter's wholesale price gains. We expected the used vehicle market to be challenging in 2023, and we are on pace to see a year that will likely show little to no improvement from a year that declined 10% in 2022.”