Strong dealer financials, so why are investors nervous?

In this section, Zeus Capital dives into the latest dealer profit reports and explains what this means for the market and investors.

Continue reading

Mike Allen, Head of Research, Zeus Capital

2022 was a year to forget for most investors as share price performances were typically poor due to the war in Ukraine, accelerating inflation, monetary policy tightening, continued COVID-19 locks in Asia, industrial action, the cost-of-living crisis unfolding – the list goes on. The MSCI All-World Index fell by a fifth, its worst year since 2008. The UK economy faced unprecedented volatility with three prime ministers, various economic plans, and disruption from ongoing industrial action in the public sector, which is likely to spill into H1 2023.

From a UK Automotive Retail perspective, most PLC Groups typically performed well operationally and look likely to hit our FY22 earnings projections, but this was not reflected in share price performance. There was plenty of takeover speculation and approaches for Lookers and Pendragon. At the same time, Vertu even completed a scaled transaction in Helston at the end of the year, perhaps showing some confidence in returning to the M&A market in this sector.

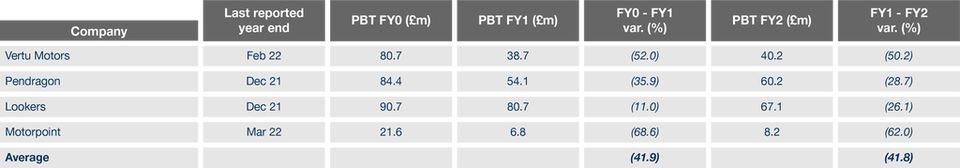

The financial performance across the sector, in general, was healthy coming out of various COVID lockdowns from 2020, and we all knew that the used car price performances of 2021 were never going to last. As a result, we had been careful not to extrapolate the super normal profits generated into 2021 into 2022 and, on average, assumed PLC dealer group adjusted PBT forecasts would be 42% below 2021 peak levels on average. Nevertheless, high super normal profits resulted in strong cash generation leaving most dealer groups with net cash positions (ex-leases) going into 2022.

"We anticipate that most of the PLC Groups will adapt, grow, consolidate, and continue to churn out a respectable financial performance. Perhaps one day, investors will recognise this, and they might get the credit they deserve."

Mike Allen, Head of Research, Zeus Capital

We anticipate global supply chains will remain disrupted throughout 2023, albeit there are some signs of improvements with certain brands that have been proven to have more nimble supply chains than others. That said, we believe it could take up to five years for the new vehicle chain to normalise back to pre-pandemic levels if it does at all. An interesting sub-theme within this is the impact new Chinese brands could have over the coming years as they target Europe, with the US becoming unattractive due to the high 25% import tariffs.

The demand dynamics are assumed to remain weak during Q1 2023 as the cost-of-living crisis bites. However, we note consumer confidence data did improve in the three months to December 2022 after hitting an all-time low in September. CPI inflation appears to have peaked at 11.1% in October 2022, although it is still likely to remain well above the BoE’s 2% target throughout 2023. Further increases in interest rates are likely to also hamper demand. Used car margins have started to normalise, and while new car margins remain above average, backed with long order banks, we expect these to reduce during 2023 as demand is likely to come under pressure.

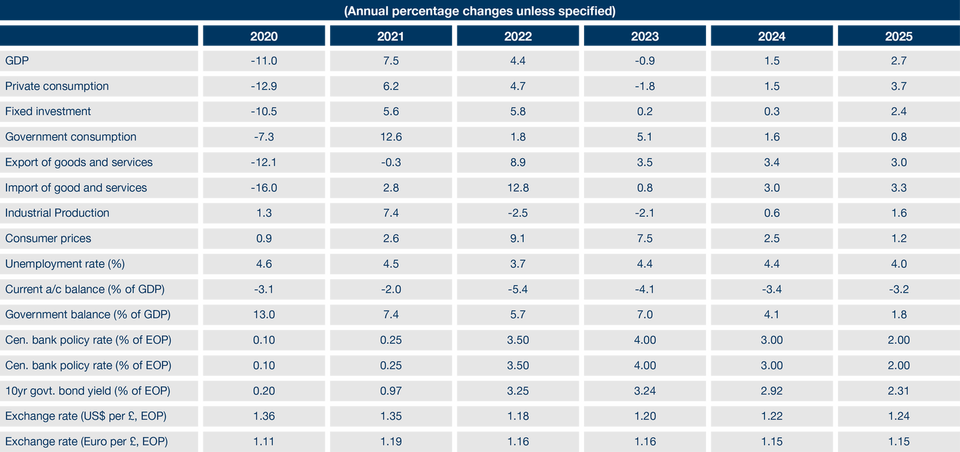

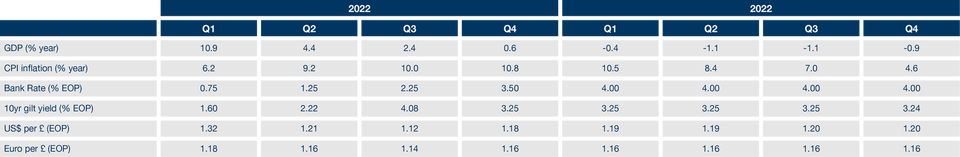

The question is, what we should expect from PLC groups in 2023? First, we should address the UK economy, which will largely dictate this outcome. We expect the UK economy to be in recession for most of 2023. Oxford Economics forecasts GDP to fall by 0.9% in 2023 and then recover to grow by 1.5% in 2024.

Source: Oxford Economics

The economy is expected to endure a relatively shallow recession as high inflation eats into household spending power and tighter monetary settings weigh on activity. With policy settings likely to remain much tighter than would typically be the case during a recession, the subsequent recovery is likely to be slow. Oxford Economics expects inflation to be above 4% by the end of 2023, and the MPC is unlikely to cut interest rates before inflation falls closer to the 2% target.

Source: Oxford Economics

The table below illustrates the most recent and forecast profit before tax of the four main UK dealer groups. FY0 represents 2021 for Lookers and Pendragon or the majority of the calendar year for Vertu (February year-end) and Motorpoint (March year-end). The data shows we are typically forecasting the FY22 financial performance (FY1) to be, on average, 42% below its FY21 peak, albeit there is a wide dispersion within this. This is because both Lookers and Pendragon benefited from restructuring gains made during COVID-19, with Motorpoint suffering several profit warnings during the year.

If we look to 2023 (i.e., FY2), we see a range of outcomes again, albeit for different reasons. Vertu will benefit from a small contribution from Helston, while Motorpoint is expected to benefit from organic expansion. As a result, our Lookers forecasts are at the conservative end of the consensus range.

Source: Bloomberg, as of 5th January

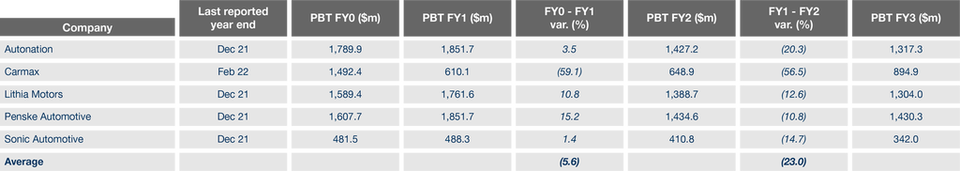

Looking across to the US, 2022 is expected to be an improvement in 2021 in many cases, except for CarMax. However, it is 2023 (FY3) when profitability is forecast to come under pressure.

Source: Bloomberg, as of 5th January

On a LFL basis, we believe it will be tough for PLC groups to exceed their financial performance of FY23 vs FY22. Not only are cost pressures ongoing, particularly on the labour side and with energy costs, but a big pressure for FY23 will be the impact of rising interest rates on debt levels. While balance sheets are generally strong, motor retailers having a balance of a number of debt levels from consignment stock, used car stocking loans and lease liabilities. Most dealers face several hundred million pounds of such financing in total; therefore, further 50bps of interest rate rises soon add up and create pressures on interest costs. This also causes demand-side pressure for the consumer, who also faces higher APR interest cost pressures when they purchase their next car, which can be a shock when comparing this to 2018/19 levels – quite a different world to what we are now living in.

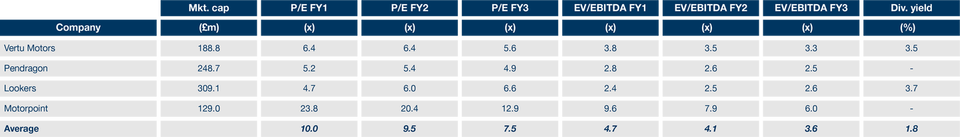

PLC valuations remain low by historical standards, as illustrated below. The PE ratios (the multiple of forecast earnings per share an investor pays for a share) are particularly low for franchised dealer groups such as Lookers, Pendragon and Vertu. Historically we have seen P/E ratings of a 9-12x mid-cycle (i.e. profits growing on an organic basis). One could argue with current levels of economic uncertainty coupled with rising interest rates (typically negative on a number of fronts for the sector previously discussed), we should be looking at the lower end of this range. Even if we do this, this should generate at least a 40% share price upside for Lookers, Pendragon and Vertu.

Source: Bloomberg, as of 5th January

Stock markets are typically discounting mechanisms looking at least six months into the future. We believe the markets are seeking assurance that inflation and interest rates have peaked, and once that is the case, we would expect markets to reopen and valuations to improve from here. Fund flows are another leading indicator that can predetermine a market recovery. 2022 was very much a year of investor funds flowing out of UK equity markets due to the high levels of uncertainty.

Looking ahead, it is clear that the industry in 2023 could face another perfect storm of ongoing supply pressures with deteriorating demand as the cost-of-living crisis and economic recession starts to bite. However, the PLC dealer groups have faced significant challenges and have robust balance sheets and strong management teams that can quickly adapt their businesses in a crisis. Of course, against a challenging backdrop, we will see significant change with the birth of agency and ongoing growth in EV vehicles.

2023 will not just be about risks and challenges in our view. We also see opportunity through change, and those most nimble dealers will spot opportunities throughout the supply chain in nearly new, used cars; finance and aftersales will typically triumph. We anticipate that most of the PLC Groups will be in this category and adapt, grow, consolidate, and continue to churn out a respectable financial performance. Perhaps one day, investors will recognise this, and they might get the credit they deserve.