How external pressures are influencing UK automotive

In this section, we discuss the primary factors driving the current new car market and share our latest new car forecasts.

Continue reading

Philip Nothard, Insight and Strategy Director

How do you effectively sell a big-ticket item that continues to rise in price due to low supply when the consumer market’s willingness to purchase such items is decreasing, and your costs are growing and impacting margins? That’s the enormously difficult situation automotive retailers are facing today. One that doesn’t have a single cause but rather is the result of a perfect storm of extraordinary global events.

While there is a myriad of macro issues specific to the UK economy that is affecting the automotive market, these are generally being influenced by three broader global pressures:

1. The hangover and recovery from Covid-19

2. The war in Ukraine

3. New and aggressive manufacturers entering the market

Let’s explore each in more detail.

The continued effects of the pandemic

The potential of the automotive industry continues to be held back by the Covid-19 hangover. Production line shutdowns, parts shortages and global supply chain disruption led to the mother of all headaches and no amount of rehydration can make up for all that was lost. It’s reported the semiconductor issue has impacted more than 400 vehicle manufacturing plants to date, and raw material supply shortages and rising prices continue to affect the number of vehicles that can be produced and the margin manufacturers can make.

As I discussed in the last issue of AutoFocus, 31 million fewer cars were produced in the two year period following the global lockdown than in the same period before. Considering the challenges that still exist today around global production in the manufacturing space, this is set to rise to closer to 40 million over three years, if not more.

It was previously predicted - or hoped - that the production of new vehicles would return to normality by the end of 2022. Now, many manufacturers indicate this won’t be the case until at least the second or third quarter of 2023. This a worrying thought, but I should caveat that supply has improved marginally this year, particularly for specific makes and models, and that manufacturers continue to find new ways to source the vital materials they need to drive supply up.

We can see how this global supply shortage has played out in the UK market. The 2022 UK registration forecast is currently at around 1.5 million, much lower than pre-pandemic levels. The UK will end the year with a deficit of over 2 million registrations since the pandemic began. We have already observed the impact this has had in the zero to 12 and 12 to 24-month used market, and we will soon start to see the same impact in the three-year old market too.

The war in Ukraine

Not only is the sector facing challenges around vehicle supply, but it now also needs to navigate through both the political and economic turbulence that is helping to drive inflation and soaring costs.

The war in Ukraine shocked the world when it began in February this year, and its effect on the automotive industry and the entire global economy has been immense. Fuel and energy prices have seen a steep incline, particularly in Europe, which relies heavily on the gas and oil that Russia controls.

Supply chains have too been impacted. Several major manufacturers sourced raw materials and components from business in both Russia and Ukraine; the conflict and resulting sanctions has had an obvious impact. All of this has had an inevitable influence on manufacturing costs and most brands are passing at least a proportion of that cost onto the consumer – contributing to global inflation.

Although not dissimilar to the UK new vehicle market, which has seen a marginal recovery in 2022, the other four big European automotive markets (Germany, Italy, Spain, and France) are downgrading their 2023 forecasts as the rising energy costs, inflationary pressures and rising interest rises curtail consumer purchasing power.

Governments in the UK and across Europe continue to look at ways to ease the pressure for both the consumer and businesses, but any stimulus, or initiatives to slow inflation and interest rate rises, will inevitably take time. Therefore, any recovery to the new vehicle demand will be weighted towards the second half of 2023.

New players in Europe

It’s impossible to ignore China's growing influence in most areas of the West’s economy in the last 20 years. Still, to this day, its influence in the automotive market has been relatively small, perhaps due to the abundance of recognised brands that already exist here. However, as Chinese brands continue to grow in reputation in the UK, Europe and indeed globally, it’s not a matter of if but when they will have a significant presence in terms of sales.

China today is the world’s largest electric vehicle market, with over 1.3 million units sold a year, representing more than 40% of sales worldwide. As Europe moves towards a greener future, we will need more electric vehicle-centric manufacturers providing the clean cars legislation and consumer demand necessitates. Of course, most Western brands now have robust EV plans in place, but perhaps Chinese brands present an additional solution.

This could come sooner than previously thought. As Chinese brands reveal their strategies for entrance into Europe and the UK, we will see a significant shake-up of import and export market dynamics. It remains to be seen how established European and US manufacturers will react.

The new LCV market

“September's new LCV registrations boost positivity in the new LCV market, with volume driven by the medium and large panel sector, and mainly BEV products. However, the improved positivity seen during September is artificially inflected in comparison to the Q3 and year-on-year position, as the period in 2021 was the lowest registration period since the 2009 recession. With the year-to-date registrations down 20.1%, the overall year-end outlook looks challenging at c.302,000 vehicles estimated. However, this number will be c.290,000 as the overall manufacturing challenges and headwinds are clear.2023 however, will be a healthier and more stable market for LCVs in the UK, as more manufacturers are prioritising van registrations and the fleet and rental order banks continue to be at record-breaking levels with a further 375,000 vans destined for the UK market that are not yet built.”

Matthew Davock, Director of Commercial Vehicles, Manheim Auction Services

The challenges the automotive industry needs to navigate range from the immediate through to the near future, but all will have very real effects on the UK automotive market, both positive and negative.

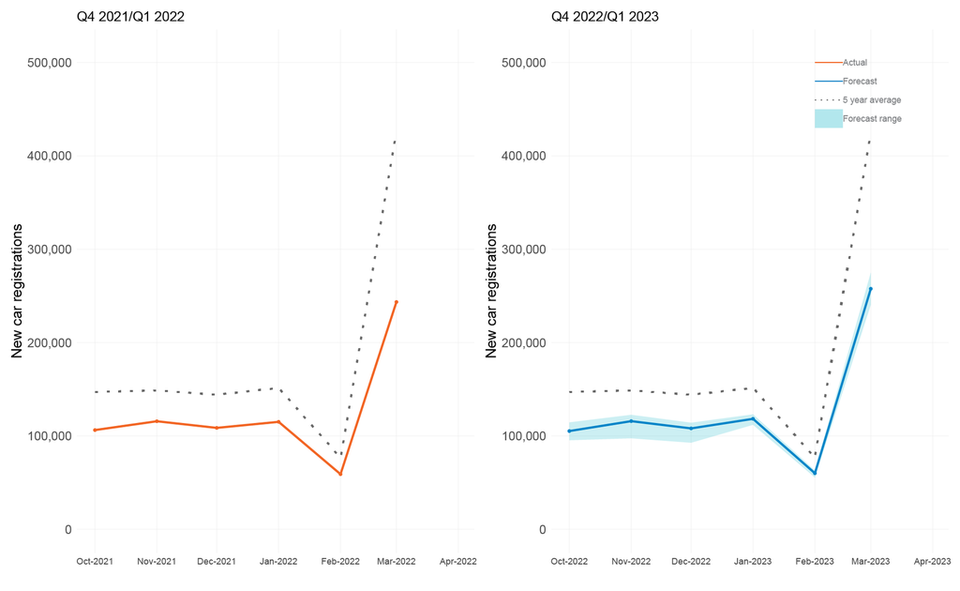

Building on recent new car figures, the market factors mentioned above, and in line with previous Cox Automotive forecasts, we have adjusted our new car registration forecasts.

New car forecasts – Q3 and Q4 focus

Source: Cox Automotive

Upside scenario

In our upside scenario, we predict Q4 2022 will end on 351,171 registrations, a +6.2% increase year-on-year, -23.5% down compared to the 2000-2019 average, and -21.8% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q1 2023 to end on 460,929 registrations, a +10.4% increase year-on-year, but -30.6% down compared to the 2000-2019 average and -34.3% compared to the most recent pre-pandemic 2019 performance.

Baseline scenario

In our baseline scenario, we predict Q4 2022 will end on 329,055 registrations, a -0.5% decrease year-on-year, -28.3% down compared to the 2000-2019 average, and -26.7% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q1 2023 to end on 435,956 registrations, a +4.4% increase year-on-year, but -34.4% down compared to the 2000-2019 average and -37.8% compared to the most recent pre-pandemic 2019 performance.

Downside scenario

In our downside scenario, we predict Q4 2022 will end on 285,550 registrations, a -13.6% decrease year-on-year, -37.8% down compared to the 2000-2019 average, and -36.4% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q1 2023 to end on 407,885 registrations, -2.3% down year-on-year, but -38.6% down compared to the 2000-2019 average and -41.8% compared to the most recent pre-pandemic 2019 performance.

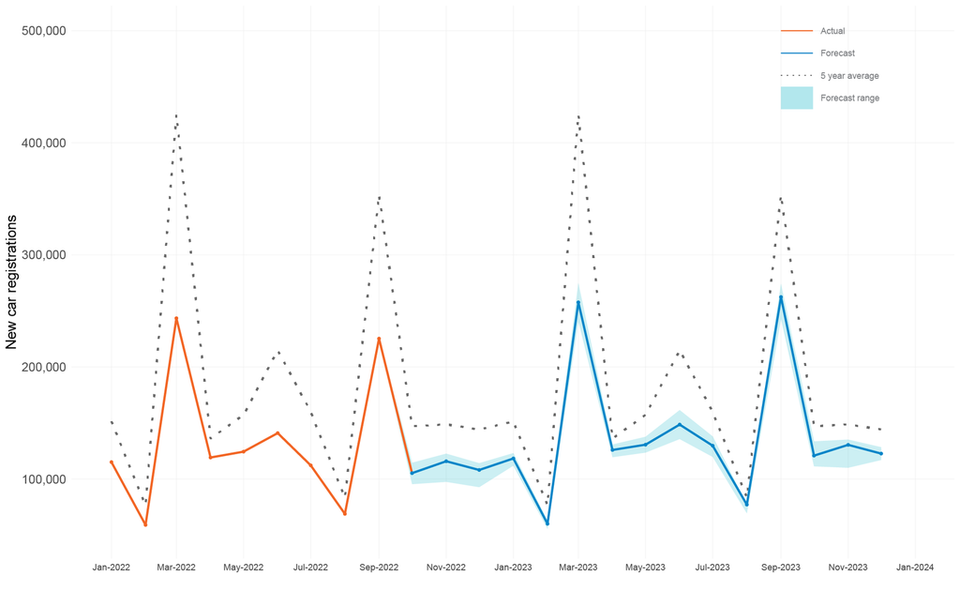

New car forecast - 2023 full year

Source: Cox Automotive

Upside scenario

Our revised upside scenario for 2023 sees the year end on 1.77 million registrations, a +15.6% increase year-on-year, -23.1% down compared to the 2000-2019 average, and -23.1% down compared with the most recent pre-pandemic 2019 performance. Resulting in a -15% downgrade on our previous forecast due to the market factors described previously.

Baseline scenario

Our revised baseline scenario for 2023 sees the year end on 1.68 million registrations, +9.5% up year-on-year, -27.1% down compared to the 2000-2019 average, and -27.1% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -10% downgrade on our previous forecast due to the market factors described previously.

Downside scenario

Our revised downside scenario for 2023 sees the year end on 1.55 million registrations, a +1.3% increase year-on-year, -32.6% down compared to the 2000-2019 average, and -32.6% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -7% downgrade on our previous forecast due to the market factors described previously.

The US perspective

“The new vehicle market saw modestly improving momentum at the end of the third quarter as improvement in deliveries from North American production produced sales gains in September. With improving production, inventory levels also increased slightly, but supply remained very tight and down 62% from 2019. Supply varies dramatically across brands, with US brands generally with more supply and with Asian, UK, and European brands with much lower supply. Production is only expected to improve slightly by year end. As a result, sales forecasts were again downgraded with expectations that new light vehicle sales in the US will fall 8.3% for the year to 13.7 million, which will be the lowest volume year in a decade. Manufacturers and dealers continue to enjoy strong pricing power that is producing a record low incentive as a share of transaction price and a record high average transaction price relative to invoice and suggested retail prices. The average new vehicle sells for more than $48,000, with the average price paid exceeding the manufacturer's suggested retail price for 16 straight months. Interest rates moved higher in the third quarter, with the average interest rate on new vehicle loans having increased two percentage points since the beginning of the year. These trends lead to declining affordability and growing concern that demand may not keep up when supply improves further without some corresponding change in pricing or program support. The Federal Reserve raised expectations for rates that could lead to auto loan rates rising by another two full percentage points by year end. The prospect for monetary tightening leading to a recession in 2023 increased after the last Fed meeting and is now above 50 per cent.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc.