There's only

one retail

In this section, ICDP provides an overview of what the future of retail looks like for dealers.

Continue reading

Steve Young

Managing Director of ICDP

Anyone working in the downstream end of the motor industry has been bombarded by their trading partners, software vendors, training companies – and me – by messages that the industry is changing. Because of this, they need to prepare for online channels, agency, consultative selling, digital, CRM, product geniuses, omni-channel – and many other approaches, concepts, and tools. So, it would not be surprising if you felt confused or overloaded, wondering where to focus and what to prioritise in terms of your investments and other resources.

The answer is that the focus should be where it should have always been – on the customer and that all these various approaches are just part of the overall picture that is modern retailing. If we genuinely put the customer first, then all the various building blocks can be put in context and become supportive of their buying experience rather than barriers, as is sometimes the case today. So, from the customer perspective, what are the considerations in creating a retail environment that is not only fit for purpose in terms of meeting their basic needs of having the right car, in the right place at the right time, at the right price, but also has the potential to over-deliver and delight the customer?

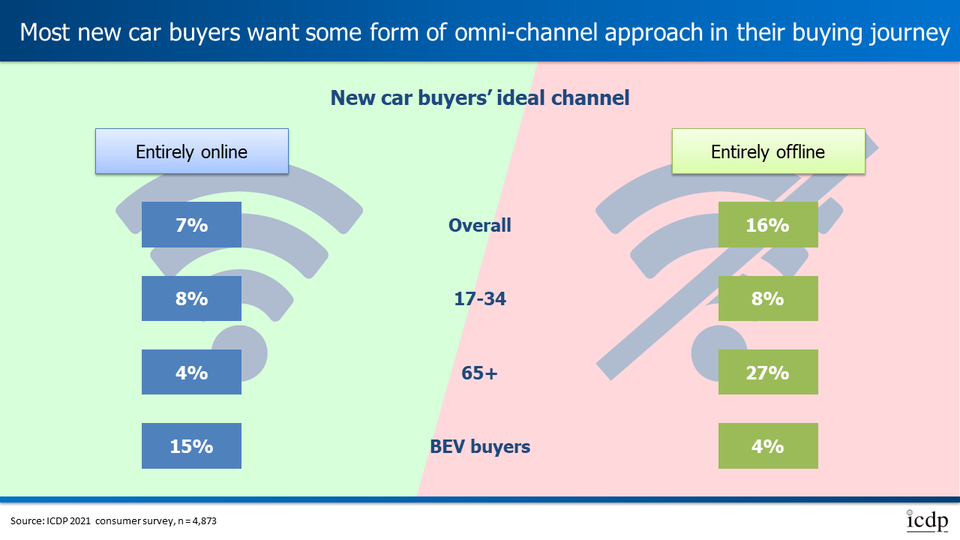

Over 80% of customers, according to ICDP’s proprietary consumer research, want to use both online and face-face channels during their new car buying journey. Whilst there has been some slight movement in this and factors that can affect it, like a highly simplified Tesla-style product offer, the reality is that we need to build our retail experience around both channel types, linked to give a seamless journey for the customer.

"Over 80% of customers, according to ICDP’s proprietary consumer research, want to use both online and face-face channels during their new car buying journey. Whilst there has been some slight movement in this and factors that can affect it, like a highly simplified Tesla-style product offer, the reality is that we need to build our retail experience around both channel types.”

Steve Young, Managing Director of ICDP

Most people involved in the industry would recognise that there are certain parts of the journey, such as product configuration, that should be provided by the manufacturer, whilst others like test drive that is best provided by the dealer. Other steps in the journey, such as valuing the part-exchange, preparing finance offers, and finalising the transaction, can be done by either party – and the trend with agency is that manufacturers will become more involved in these steps, but the bottom line is the same – we need one sales process and supporting IT infrastructure, accessible to manufacturer, dealer and customer, which has a single record for each customer and car in the system, but can be accessed flexibly. Due to the legacy drag on both manufacturers and dealers, progress to such an integrated system has been slow, but it is perhaps the single most important element of an effective retail environment.

If technology is number one, then people must be a close second. Great people can deliver a great customer experience, but if data is unavailable or fragmented and uncoordinated, then the best salesperson will not be able to give the customer clarity or pick up their physical journey at the point where they left it in the digital world. However, ICDP research dating back to 2008 (the year after the iPhone was launched and arguably brought in the digital age) has consistently shown that the most influential factor on a car buying journey is the quality of the people at the dealership and the interaction that the customer has with them. Many of the people initiatives in the industry either ignore this or are sticking plasters that try to work around deficiencies. We still have too many bonus systems from manufacturers and pay plans from dealers that encourage the wrong behaviours and influence the type of people employed at the customer interface. The best retailers have a clear hiring policy in terms of the profile of the staff they employ – best summarised by the maxim “hire for attitude, fire for attitude”.

After people, the most influential factors in the new car purchase decision, according to our consumer research, is the availability of cars on display and for test drive. This has become an increasing challenge due to the proliferation of models and variants within most manufacturers’ ranges. As a result, it is impossible for every dealer to have a truly representative selection on display or for test drive. This will become an even greater challenge both in terms of the inventory and operating costs and the implications of larger sites to accommodate more cars when the trend is in the opposite direction. A range of approaches have been adopted to address this, including manufacturer planning and ownership of display and demonstrator cars, having some models available only at regional hubs, the use of physically larger colour and trim samples, and digital tools, including virtual reality. These all help address the problem, but in the end, the manufacturer needs to question whether added range complexity generates correspondingly higher revenues that more than cover these and other costs of complexity. Tesla seems to be doing ‘just fine’ with a very different approach.

Beyond these three basic building blocks of effective retail that meets the customer's needs, I would argue that everything else is peripheral or simply tactical options on how to meet a specific need. Different standards of CI are unimportant to most customers as long as they meet a basic minimum ‘hygiene’ level. CRM is one internal process management and support tool within the overall digital retail environment, not an end in itself.

If, as an industry, we can get the basics of a unified retail platform, good quality people and an appropriate mix of display and demonstrator cars (which ties into broader questions of new vehicle supply chain management), then we have the foundations for fully meeting retail customer expectations. Moreover, anyone who achieves this will have the building blocks that allow them to differentiate themselves from competitors who keep trying to apply point solutions to a model that needs more fundamental reform.