Philip Nothard, Insight and Strategy Director

Used car retailers have become accustomed to the low supply, high demand market dynamics that have pummelled the used car market for close to three years now. But without a big influx of stock on the horizon, an oncoming wave of economic pressures impacting consumer purchasing power, and rising operational costs, retailers will need every trick at their disposal to navigate the coming months.

As ever, the used car market is constrained by a lack of new car supply, predominately impacting the zero to 12-month and 12 to 24-month sectors. But soon enough, we will see the same impact in the three-year-old sector too. Although there are patches of green shoots in new car supply, and the situation is undoubtedly improved compared to 2021, it remains some way off pre-pandemic levels. Moreover, any increases in supply are generally limited to specific models and derivatives.

The question remains about how much consumer demand will be weakened by the cost of living crisis, rising interest rates and inflation. It feels inevitable this will reduce consumer confidence and the willingness to purchase big-ticket items such as a car, but it’s impossible to predict the extent of this impact today.

Used values holding

We can however confidently predict how these factors will impact used car values. While consumer confidence and demand will dip, it’s unlikely to be at the level that will create an oversupply of used car stock. In addition, the shortage of end-of-contract and other used vehicles entering the market, alongside continued new vehicle shortages, leads us to anticipate many of the same supply and demand dynamics we’ve seen for more than two years continue to play out for most of 2023.

This means that values, while under increased pressure, will remain at their inflated levels for some time. We are no longer seeing the dramatic prices of last year; in fact, values in most cases have plateaued.

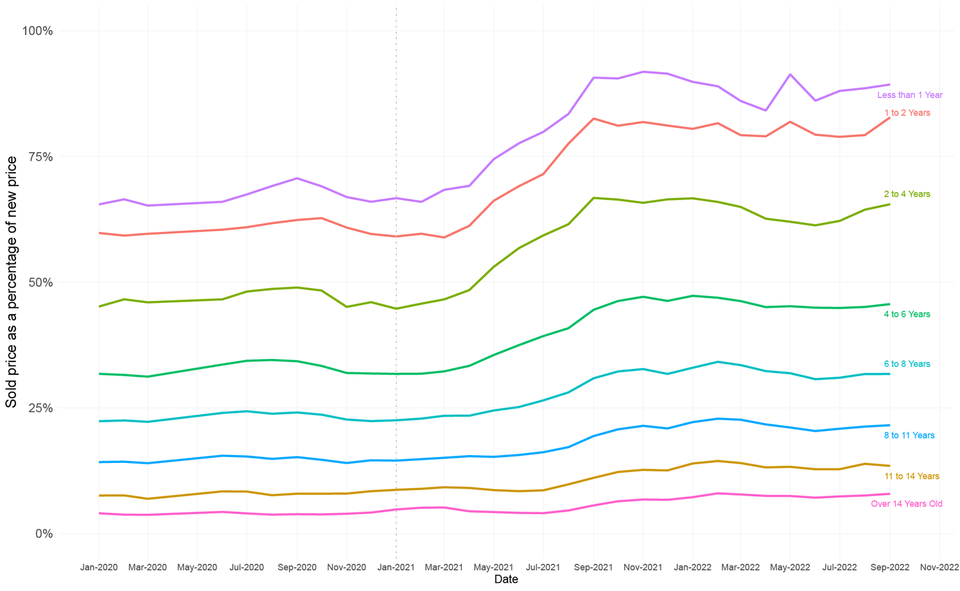

As observed since the heights of 2021, particularly in the sub-12 month and one to two-year market, there is extreme volatility as product becomes available and constraints return. As the chart above shows, used prices have plateaued as a percentage of cost new, but make no mistake, these values are still very high and unsustainable in the long term.

We must never forget used vehicles are depreciating assets. Although they have risen at an exceptional rate in recent years, and in some cases, to levels close to or above the original cost of purchasing new, they will have to come down at some point. The question is when we’ll once again see seasonal depreciation, and when that does return, to what extent?

At least for now, considering that new car supply is unlikely to materially improve until the end of next year and the ongoing economic situation, residual values will remain reasonably stable until at least 2024.

Other challenges for retailers to navigate

With the absence of supply, the uncertainty of when used vehicle values will decrease, and increasing pressure on retail prices, retailers are faced with a challenge to retain margins. As a result, many are focusing heavily on ready-to-retail product to maximise their return on investment and days to sell. However, this is not the case for all, as some retailers operating within specific brands are willing to buy vehicles requiring work as a way to obtain much needed stock. Refurbishment work can impact days to sell, but the evidence is it’s a risk worth taking.

Retailers must also consider their future strategies around the change in fuel types in the used vehicle parc and the effect this will have on choice. The new market is seeing a declining share of petrol and diesel vehicles with the push towards alternative fuels, meaning fewer volumes of these vehicles will enter the used market. While the direction of travel in the UK for cleaner motoring is needed, it presents a real challenge today as diesel remains the fuel of choice for many used vehicle buyers. Further supply and demand imbalances for these vehicles are therefore on the horizon, and both retailers and consumers will need to navigate this.

The used LCV market

"The market has found a level of health and stability during Q3, and the summer period has gone from strength to strength. It is a fair reflection that the used market has been under extreme pressure for the first six months of 2022, with overall buyer caution and retail softening being clear to see. Still, the LCV market has bounced back in the last three months and shown promising signs of stability and resilience. Strength in first-time conversion rates has returned with eight out of ten vans selling first time during September. We expect this performance to continue throughout Q4 as volumes continue to be challenged by a lack of new vehicle supply and overall fleet extensions. In addition, high mileage is starting to dominate catalogue auction entries, as 63% of the stock offered during the quarter had an average of 126k miles, and only 22% had under 65k on average. Could five years and 125k be the new norm for van lifecycle returns in the future?"

Matthew Davock, Director of Commercial Vehicles,

Manheim Auction Services

Used car forecasts

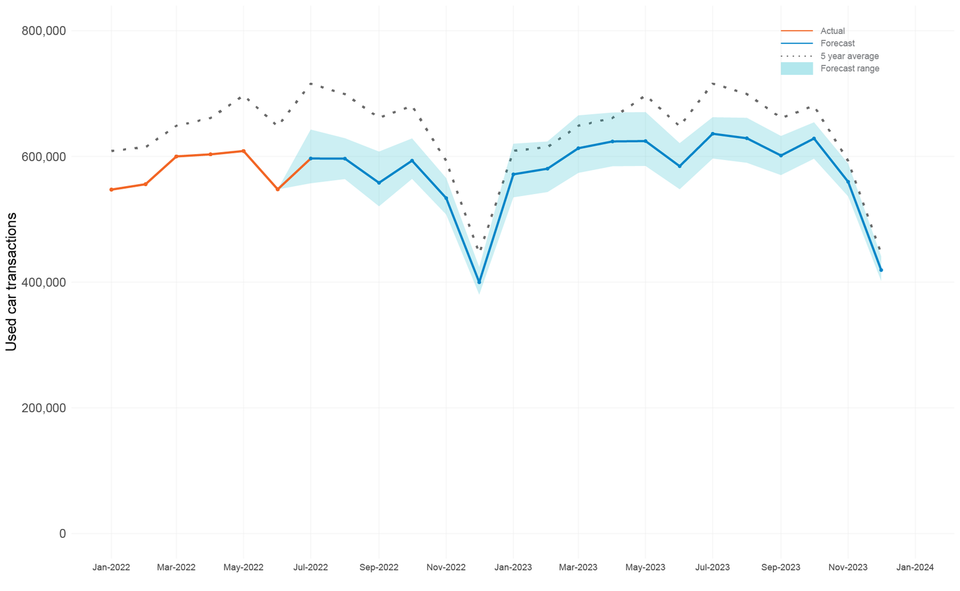

Building on recent used car sales, assumptions for the remainder of 2022, and considering the above factors, we have adjusted our forecast for used car sales in 2023.

Q4 2022 and Q1 2023 focus

Source: Cox Automotive

Upside scenario

Our upside scenario sees Q4 2022 end on 1.68 million transactions, a +2.6% increase year-on-year, +2.0% increase on the 2001-2019 average, but -6.7% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q1 2023 ends on 1.90 million transactions, a +7.6% increase year-on-year, +1.7% up compared to the 2001-2019 average, but -5.5% down compared to 2019.

Baseline scenario

Our baseline scenario sees Q4 2022 end on 1.59 million transactions, a -3.0% decrease year-on-year, -3.5% down on the 2001-2019 average, and -11.7% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q1 2023 ends on 1.76 million transactions, -0.5% down year-on-year, -6.0% down compared to the 2001-2019 average, and -12.6% down compared to 2019.

Downside scenario

Our downside scenario sees Q4 2022 end on 1.55 million transactions, a -5.5% decrease year-on-year, -6.0% down on the 2001-2019 average, and -14.0% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q1 2023 ends on 1.65 million transactions, -6.9% down year-on-year, -12% down compared to the 2001-2019 average, and -18.2% down compared to 2019.

2023 full year

Source: Cox Automotive

Upside scenario

Our revised upside scenario for 2023 sees the year end on 7.51 million used car transactions, a +9.2% increase year-on-year, +1.8% up on the 2001-2019 average, but -5.4% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -3.8% downgrade on our previous forecast due to the market factors previously mentioned.

Baseline scenario

Our revised baseline scenario for 2023 sees the year end on 7.07 million used car transactions, a +2.8% increase year-on-year, -4.1% down on the 2001-2019 average, and -10.9% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -5.8% downgrade from our previous forecast.

Downside scenario

Our revised downside scenario for 2023 sees the year end on 6.66 million used car transactions, a -3.1% decrease year-on-year, -9.7% down on the 2001-2019 average, and -16% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -6.2% downgrade from our previous forecast.

The US perspective

“The used market was little changed in the US as the sales pace in the third quarter declined at a slightly higher rate than is normal for the time of the year. The principal challenge to the market has become affordability as high vehicle prices combined with the highest interest rates on auto loans in 15 years produces average monthly payments that are increasingly out of reach for lower income and lower credit quality consumers. Retail and wholesale used supply was above normal relative to the pace of sales throughout the summer, which led to above normal wholesale used vehicle price declines. The used market benefits from more demand from consumers who would have traditionally bought in the new market. In part, franchise dealers have seen demand hold up better than independent dealers because the used market has been supported by consumers who would have bought new if supply was better and pricing was more advantageous. Retail prices have declined far less than wholesale prices as dealers attempt to keep gross margins healthy on inventory acquired at higher prices earlier in the year. Dealers are also carefully managing the level of used inventory to keep the days’ supply healthy. With interest rates likely to increase by another two full percentage points before spring, the industry is preparing for another down year in used vehicle sales in 2023.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc.