Battery technology and the ever-evolving market

In this section, Grant Thornton

discusses why inflation is on the rise, and the impact this is having on consumers.

Continue reading

Owen Edwards, Head of Downstream Automotive

at Grant Thornton UK LLP

Battery Electric Vehicle (BEV) technology continues to evolve at an increasingly rapid rate, bringing several factors that will change the automotive industry.

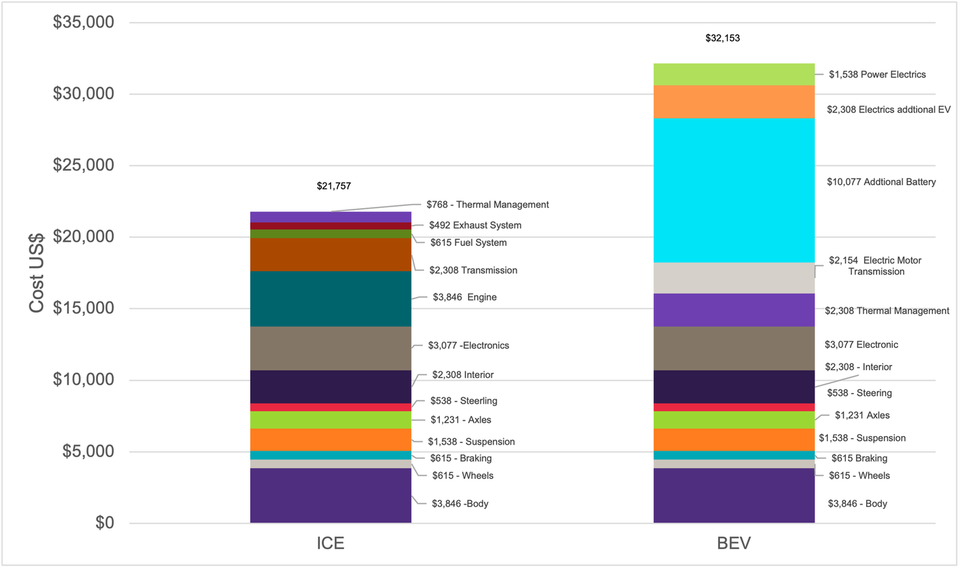

Currently, the price of BEVs is the main reason consumers are not purchasing these vehicles in greater numbers. Approximately 60% of a BEV’s price is attributable to its battery cost.

Cost of Manufacturing - Petrol vs. BEV

Source: Citifirst.com

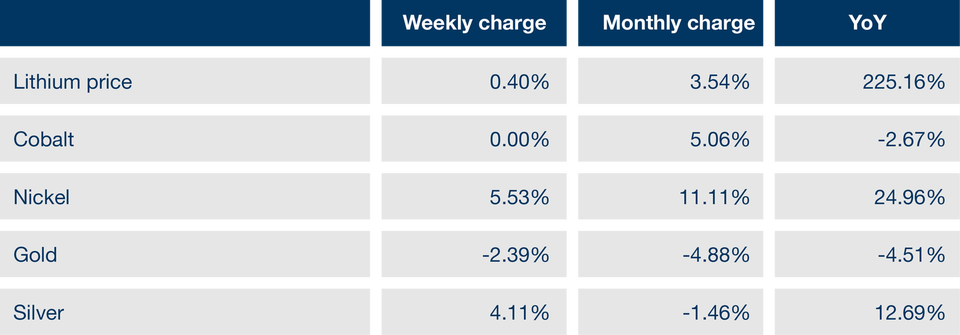

Battery prices have been driven up by rising raw material costs as demand for lithium, nickel, and cobalt increases. Higher raw material costs have been passed on to end consumers. We are aware that the manufacturers of batteries have 'pass-through' contracts, and therefore the battery manufacturers do not incur the cost of raw materials increases; these are born by the vehicle OEMs. Not wishing to see margins drop significantly, vehicle OEMs have passed on some of these increased raw material costs to consumers while taking some of them themselves. Lithium prices have been driven up by high levels of demand for BEV and other lithium-ion batteries. Lithium is the key component in all lithium-ion batteries.

Metal and Industrials prices

Source: Trading Economics

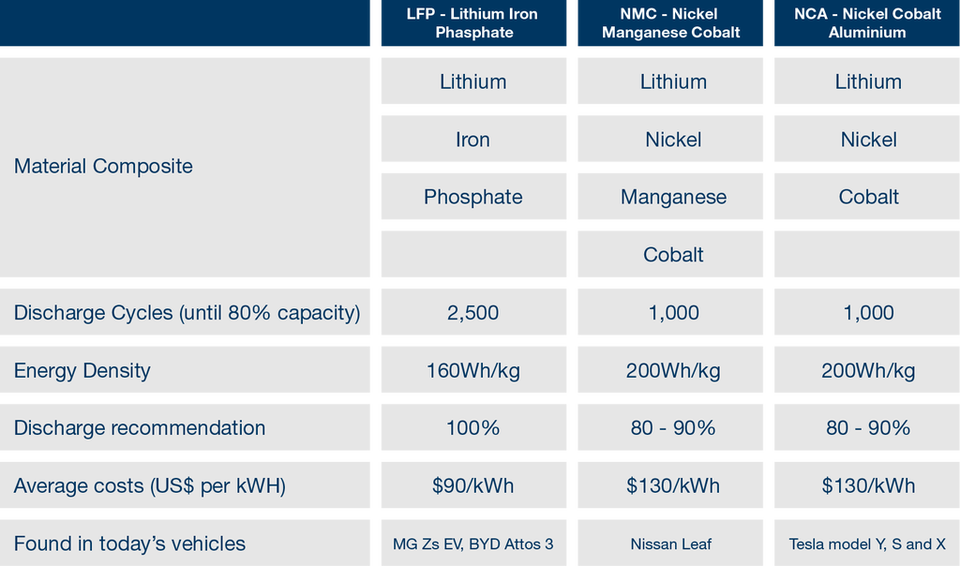

Cobalt prices have not risen as steeply as lithium which is the most used of all the above raw materials in BEVs. Cobalt is an expensive raw material that can only be found in limited areas of the world; moreover, there is growing recognition of the unsustainable methods employed in cobalt extraction in the Democratic Republic of Congo. As a result, manufacturers are moving away from using cobalt in batteries where possible and manufacturing different batteries with less or no cobalt. Such a move has generated different battery chemistry, which gives both the battery and BEVs different characteristics – charging speed, energy density, range etc.

There are three key battery chemistry technologies for BEVs: NMC, NCA and LFP

Battery chemistry has focused around NMC and NCA; looking ahead, however, demand for LFP is expected to increase. The LFP battery is not as powerful as NMC and NCA, but these are lower-cost batteries that contain no cobalt, and hence Tesla is using this technology in its batteries for the new Tesla 3 series. In addition, battery technology is improving with the size of batteries increasing. At present, the cylindrical battery 21700 (diameter 21mm 70mm length) is the primary battery type used for Tesla's vehicles; however, the move to 46800 batteries, which is significantly larger than the 21700, has reduced the cost of Tesla batteries by US$2,000 to $3,000 per vehicle, due to fewer welds between each cylindrical battery from 17,600 with 21700 batteries to 1,660 with 46800 batteries, furthermore with fewer welds means lower vehicle weight. Nevertheless, the increase in battery type and size is not as straightforward as expected. At present, Tesla is struggling to generate consistent quality in 46800 batteries; therefore, it is more expensive to manufacture these batteries than the 21700.

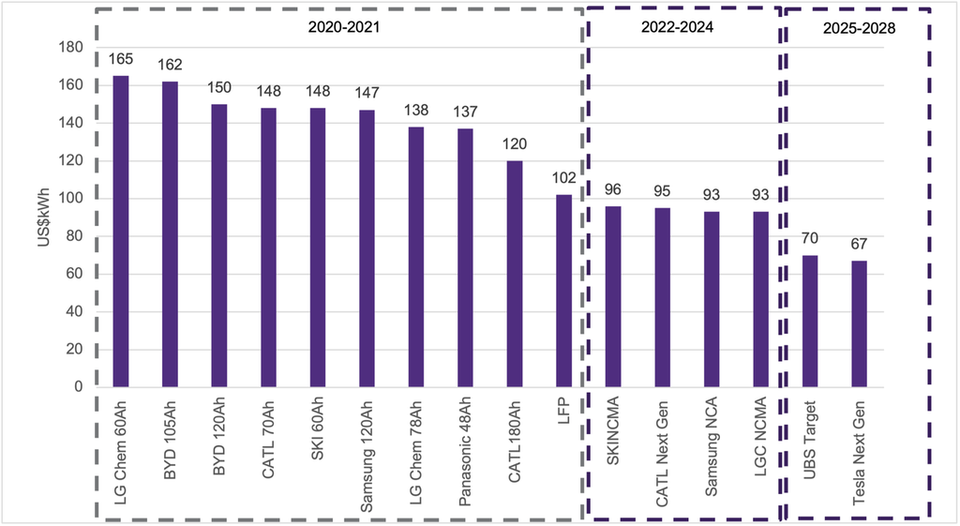

Although raw material prices are expected to continue to rise, underpinned by expected demand – not only from BEVs but also from other forms of transport, battery storage, etc. – it is not clear whether there will be sufficient supply of raw materials to meet all the requirements. Nevertheless, in order to reduce their exposure to expensive raw materials, the company has diversified its battery chemistry from NCA to NCM to LFP batteries now found in the latest Tesla Model 3 manufactured in China. The end target for all vehicle OEMs is to evolve battery technology to reduce costs through different raw materials and battery technologies and, simultaneously, generate the optimum power density while maintaining battery safety. Therefore, the pay-off between cost, power density and battery safety is key. With the reduction in battery costs due to improved technology, vehicle OEMs are moving towards the cost of manufacturing a BEV being at parity with ICE vehicles. At this future parity point, the total cost of ownership of a BEV will be lower than owning an ICE vehicle, making the BEV an attractive purchase for consumers. It is estimated that battery cost parity to ICE vehicles will be reached between 2025 and 2028.

Battery Cost Curve

Source: UBS

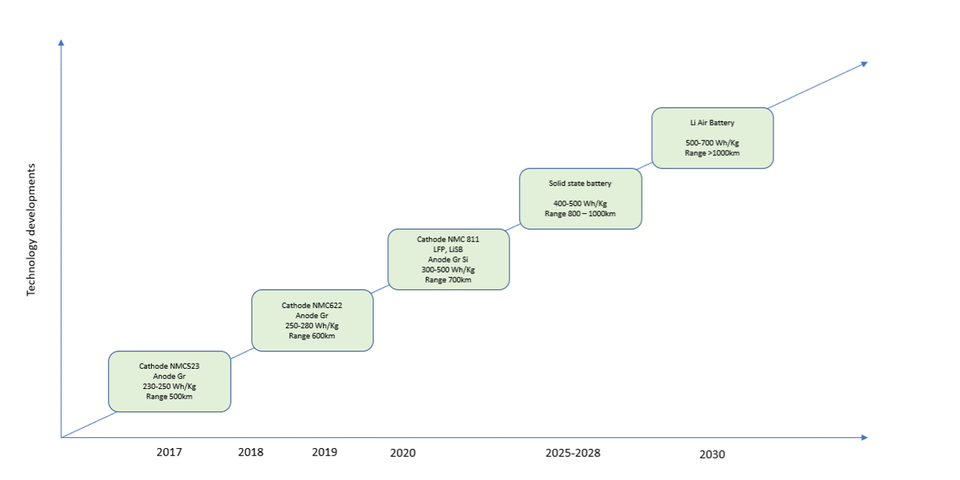

However, step changes in battery technology are expected as new battery developments are generated. At present, different battery chemistries are increasing power, range, and charging capability as well as reducing battery costs.

Lithium-sulfur battery technology - There is also investment in cheaper and more abundant raw material batteries, such as lithium-sulfur battery technology (LiSB). However, this battery chemistry is likely to be used in market such as battery storage, where there is the requirement for high energy, slow discharge, and low cost. This battery's chief benefit is its high level of sulfur, which is highly abundant globally and low-cost to extract and purchase. These batteries are expected to be ready for commercial use after 2030.

Solid state battery technology - The next set of batteries are expected to be solid state. These batteries will use an electrolyte made of solid material instead of the current liquid electrolyte batteries. Such a battery has several advantages, including a higher level of energy density, lower risk of fire, and significantly lower use of cobalt. In addition, such batteries could enable vehicles to increase their driving range from 600km to 1,000k, depending on the chemistry of the battery. Research suggests that solid state batteries will be available by 2026 – 2028; there are suggestions that some forms of solid-state batteries will be available earlier, but this technology is expected to have a gel electrolyte rather than a solid electrolyte.

Lithium-air Battery technology - This battery pairs lithium and air and is expected to have a battery density of 500-700 Wh/kg, calculated to generate vehicle ranges of more than 1,000km on a single charge. Such a battery which is in very early testing planning and testing phases, is expected to be a high energy battery output enabling vehicles to exceed 1,000km on one charge.

Current and future battery technological developments

Source: British Volt and Grant Thornton Analysis

Battery technology will not remain static. Changes in battery technology are set to create leaps in performance and range, leaving behind current battery technology. Such leaps in battery technology over short periods could lead to increased volatility in vehicle residual values, especially of leased or finance cars that have contracts over the long term. With the prospects of a significant shift in battery technology, finance and leasing companies should consider what impact this could have on their vehicle residual values, with the potential risk that some vehicles may become ‘black cars’ - vehicles which might have an insufficient range or charging capabilities and have very limited market appeal. Such vehicles will therefore command low residual values in the future. At present, without knowing when these step changes in battery technology will take place, it is difficult to determine what cars may be ‘black’. However, a good knowledge of battery technology and future battery development is recommended to minimise exposure to such vehicles.