Shifting manufacturer strategies - a push or pull market?

In this section, we discuss the primary factors driving the current new car market and share our latest new car forecasts.

Continue reading

Philip Nothard, Insight and Strategy Director

It seems a day no longer goes by now without another news headline concerning the automotive industry breaking. From rising fuel prices to the ongoing electrification of the vehicle parc, production downturns and cuts in global output.

This is not new. We've been commentating consistently about the headwinds our sector is navigating and why this is perhaps the most challenging time the market has ever faced.

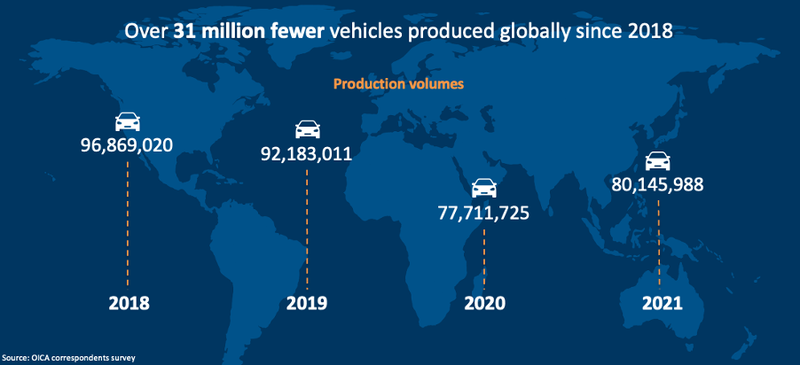

As ever, the automotive industry has persevered, adapted, and evolved in the face of adversity and will continue to do so. Still, we mustn't ignore the reality of the situation we find ourselves in. New car production issues continue to grip most manufacturers, and there is a considerable shortfall in vehicles entering the market. Our chart below highlights the severity of this downturn – in total, c. 31 million fewer vehicles were produced globally in 2020 and 2021 compared to the previous two years.

Although we believe output will increase as time goes on, this will certainly not make up for the lost vehicles, and it remains unclear whether we will ever reach the c. 90+ million vehicles produced a year figure again.

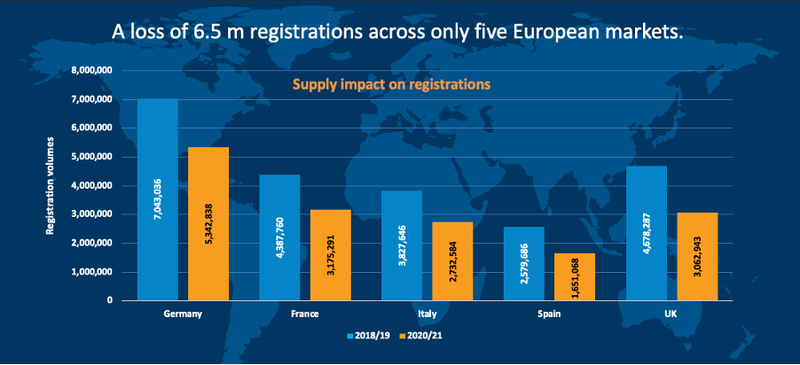

Delving deeper into these figures, we can look at how this production downturn has affected Europe's top five markets. The UK, Germany, France, Spain, and Italy have lost over 6.5 million new vehicle registrations over the last 24 months. A further 1.1 million were lost in the first quarter of this year alone.

At the same time, retailers are navigating the ongoing pressures of increased costs, rising interest rates, and a rate of inflation that – at the time of writing – is at a 40-year high. Motorpoint recently warned investors that sales are set to fall this year as consumers fall under increasing pressure to cut discretionary spend. Low consumer confidence and escalating overheads will inevitably dampen demand, weaken the market, and restrict turnover growth and the short to medium term.

Green shoots of recovery - but not uniform

Despite these pressures, order banks remain full for most brands. Even as demand weakens, manufacturers have enough of a backlog to keep production lines busy well into 2023. We anticipate supply will improve in time, albeit not at the rate initially predicted at the start of this year.

Admirably, many manufacturers are successfully finding solutions to their supply chain challenges, not just in sourcing semiconductors but also other scarce materials and overcoming global logistical hurdles and in addressing rising costs.

But while there are green shoots of recovery in supply, particularly for specific makes and models, the outcome isn't uniform, and for many, challenges will remain well into 2023 and likely beyond.

Toyota, for example, has announced a 50,000-vehicle cut to its July production plan, highlighting stark reality of the situation we find ourselves in. Not only is making vehicles harder in this current environment but moving them to where they're required is not as simple as it once was.

Consequently, new vehicle prices will remain high for the time being. Of course, not all these challenges result from the pandemic – energy costs remain inflated due to the Russian war in Ukraine, for example – but manufacturers will factor in these influences to offset costs and claw back as much margin as possible.

Shifting manufacturer strategies - a push or pull market?

Whether in response to the changing post-pandemic landscape or as a consequence of the current headwinds facing the sector, it's undeniable that manufacturers are pivoting long-maintained strategies to best capitalise on and drive new opportunities.

The direction of change isn't the same for all businesses. Some are focusing on more profitable premium models, while others are concentrating purely on volume. We're also seeing many increase their electrification efforts to capitalise on growing EV demand. However, there are added complexities to navigate in Europe. Five countries recently tried to delay the EU fossil fuel phase-out by five years, a move which has since been blocked by the European Parliament but is nevertheless indicative of the growing anxiety towards the realities of these enormously ambitious targets.

We've also seen factory shutdowns for some manufacturers, such as Ford's recent announcement to end car production at a plant in Germany; however, we aren't likely to see much more of this as it's much more expensive to shut down a factory than it is to open a new one. Therefore, in a market where output is likely to be reduced for the foreseeable future, we are beginning to see further collaborations between different manufacturers to maximise efficiencies and production.

Regardless of the types of vehicles manufacturers choose to produce, there remains a big question around the future of the new vehicle market: will it be push or pull? Will we return to a high-volume market with lots of pre-reg and tactical activity, heavy defleet programmes and unattainable targets, or will we remain demand driven as we are today?

Financials from the sector at both the manufacturer and retailer level indicate just how profitable the demand-driven market has been for the last two years. Still, some commentators believe that the industry won't learn, and as soon as supply improves, we will return to old ways.

The reality, in my opinion, is more nuanced. Likely somewhere in the middle. As ever, one size does not fit all, and while some businesses will return to what they know, others will remain demand-driven with a focus on profitability.

The new LCV market

"The UK's new light commercial vehicle market declined for the sixth consecutive month in June, falling -23.0% and rounding off a challenging first half of the year. 144,384 new vans, pickups and 4x4s were registered in the first six months of 2022, down by almost a quarter compared to the same period in 2021, amid the ongoing global supply chain challenges.

Despite the ongoing supply challenges, growth in battery electric vans continued positively in June, and we've seen a 60% increase in registrations in the first half of this year compared to 2021. With a growing choice of electric van models and derivatives on offer in 2022, manufacturers are prioritising production of their latest and greenest vehicles to meet growing demand from operators keen to make running costs and efficiency savings. Still, BEVs represent only a small proportion of new van registrations in the UK this year, and, with ambitious zero emissions regulations coming into effect in 2024 and 2030, action is urgently needed to boost consumer confidence and ensure uptake is at the speed required for a successful transition."

Matthew Davock, Director of Commercial Vehicles, Manheim Auction Services

New car forecasts – Q3 and Q4 focus

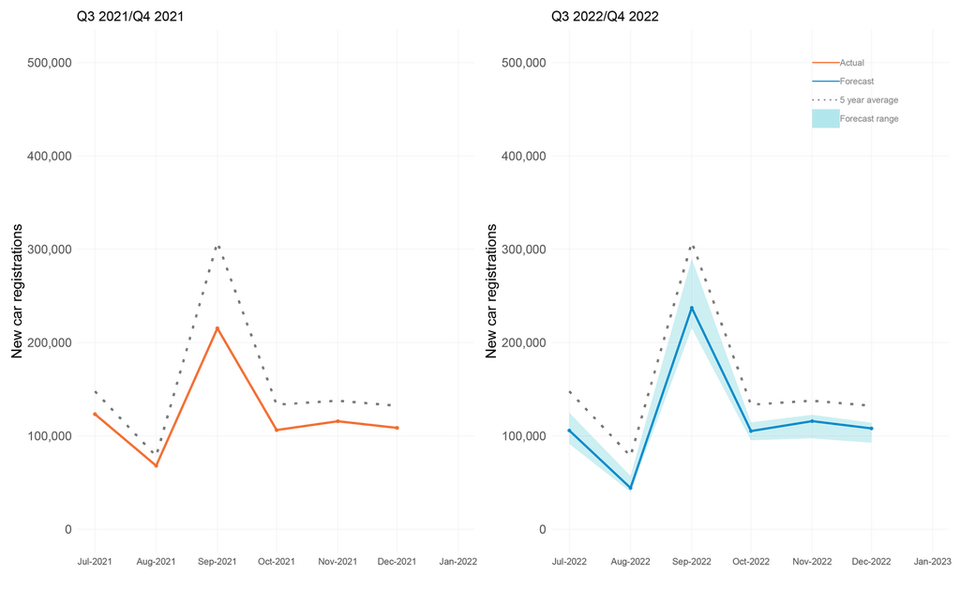

Building on recent new car figures, the market factors mentioned above, and in line with previous Cox Automotive forecasts, we have adjusted our new car registration forecasts for 2022.

Source: Cox Automotive

Upside scenario

In our upside scenario, we predict Q3 2022 will end on 471,565 registrations, a 19.0% increase year-on-year, -25.7% down compared to the 2000-2019 average, and -20.5% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q4 2022 to end on 351,171 registrations, a +6.2% increase year-on-year, but -23.5% down compared to the 2000-2019 average and -21.8% compared to the most recent pre-pandemic 2019 performance.

Baseline scenario

In our baseline scenario, we predict Q3 2022 will end on 387,217 registrations, a -2.3% decrease year-on-year, -39.0% down compared to the 2000-2019 average, and -34.7% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q4 2022 to end on 329,055 registrations, a -0.5% decrease year-on-year, but -28.3% down compared to the 2000-2019 average, and -26.7% compared to the most recent pre-pandemic 2019 performance.

Downside scenario

In our downside scenario, we predict Q3 2022 will end on 346,939 registrations, a -12.5% decrease year-on-year, -45.4% down compared to the 2000-2019 average, and -41.5% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q4 2022 to end on 285,550 registrations, -13.6% down year-on-year, but -37.8% down compared to the 2000-2019 average and -36.4% compared to the most recent pre-pandemic 2019 performance.

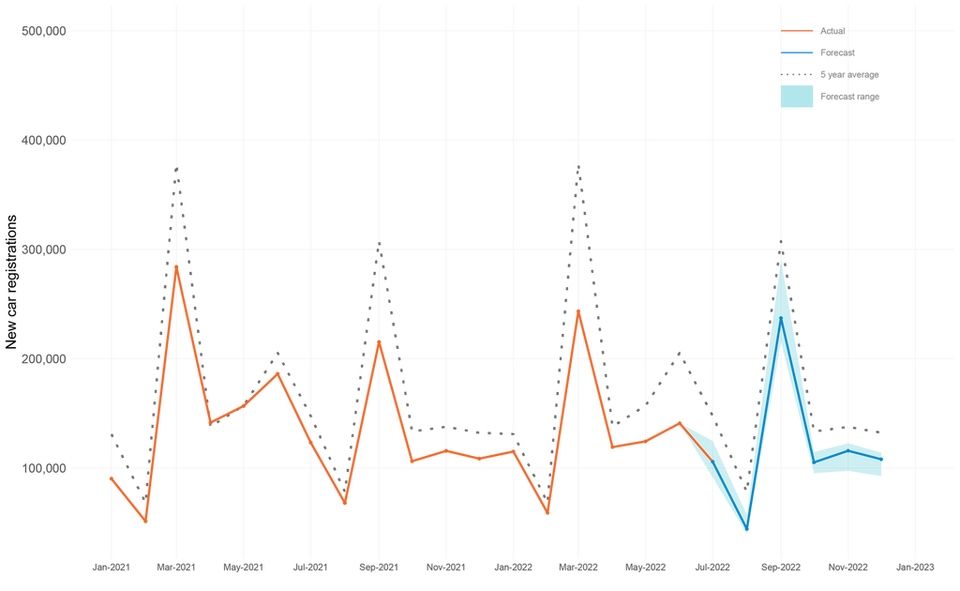

New car forecast - 2022 full year

Source: Cox Automotive

Upside scenario

Our revised upside scenario for 2022 sees the year end on 1.62 million registrations, a -1.4% decrease year-on-year, -29.7% down compared to the 2000-2019 average, and -29.7% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -11.3% downgrade on our previous forecast due to the market factors described previously.

Baseline scenario

Our revised baseline scenario for 2022 sees the year end on 1.52 million registrations, -7.8% down year-on-year, -34.3% down compared to the 2000-2019 average, and -34.3% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -8% downgrade on our previous forecast due to the market factors described previously.

Downside scenario

Our revised downside scenario for 2022 sees the year end on 1.43 million registrations, a -12.9% decrease year-on-year, -37.9% down compared to the 2000-2019 average, and -37.9% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -5.0% downgrade on our previous forecast due to the market factors described previously.

The US perspective

"The new vehicle market saw declining sales momentum in the second quarter principally from a lack of improvement in deliveries. Global vehicle production again saw more setbacks rather than improvement, resulting in static sales per day during the spring when normally sales pace accelerates. With production not likely to improve much before the end of the year, sales forecasts have been downgraded with expectations that new light vehicle sales in the US will fall 3.5% to 14.4 million, which will be the lowest volume year in a decade. Supply remains down more than 70% from normal, or about where it was to start the year. Manufacturers and dealers continue to enjoy strong pricing power that is producing a record low incentive as a share of transaction price and a record high average transaction price relative to invoice and suggested retail prices. Interest rates also continue to move higher, with the average interest rate on new vehicle loans increasing more than a percentage point since the beginning of the year. These trends lead to declining affordability and the growing concern that demand may not be able to improve as strongly once supply does improve without some corresponding change in pricing. The Federal Reserve is now on a path for even more aggressive rate increases that could lead to rates moving at least as much in the second half of the year as we have seen already."

Jonathan Smoke, Chief Economist, Cox Automotive Inc.