Philip Nothard, Insight and Strategy Director

With a used vehicle parc of approximately 330 million vehicles across the UK and EU, what will be the knock-on effect of a 31 million shortfall in new vehicles over the last two years?

The used car market has been grappling with a shortage of vehicles for a long time now and coupled with healthy demand as a consequence of constrained new car production, prices have been driven to record levels. But while the industry has become accustomed to fewer vehicles and higher competition, it could be in for a shock as the full extent of the global new vehicle shortfall becomes apparent in the coming months and years.

As reported in the new vehicle market section, the top five European markets registered 6.5 million fewer vehicles in 2020 and 2021 compared to the previous two years. And indications are a further 1.1 million were lost in the first quarter of this year alone. Today’s new vehicles are tomorrow's used, so it stands to reason that as we move forward, we’ll begin to see further pressures as the impacts of this shortfall become evident.

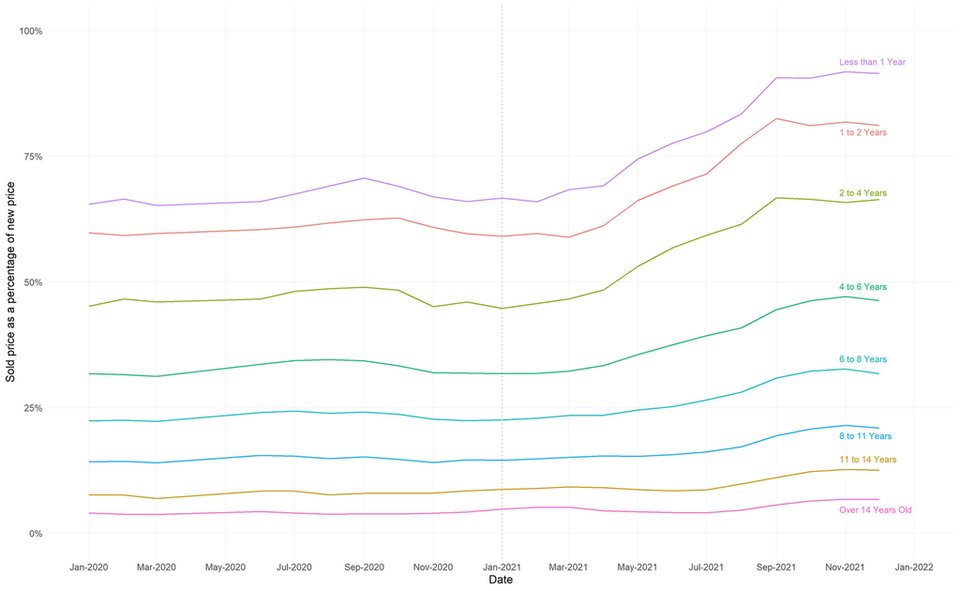

For obvious reasons, the pressure is being felt most keenly in the zero to six, and sub-12 month-market. But as time goes on, we will begin to see this affecting other age segments starting with the one to three-year sector over the next 24 months. But the effect of shortages will inevitably trickle down to the late three-year, and eventually to the three to five-year market.

Motorpoint has recently warned that its sales are set to fall this year as a result, partly due to the effect of the cost-of-living crisis on household spending, but also due to the difficulty in sourcing stock. The retailer particularly highlighted the impact of a shortage in nearly new cars on its used sales activity.

No 'cliff edge' for used values

The used car market is contending with pressures outside of supply. There are signs that the high levels of demand levels the industry has enjoyed for years is starting to dwindle.

The current economic factors are likely to last for at least the next 12 months and with consumer confidence in decline, we are likely to see a reduction in the number of units sold this year. These factors combined are causing a realignment in used vehicle values and prices in both wholesale and retail markets are softening. We’ve been warning the significant rise in used vehicle values was unsustainable and it finally looks like the end is in sight.

But while prices may be easing, the lack of vehicles entering the market means they aren’t falling off a cliff. Rather we’re seeing prices plateau, particularly for sub-one-year and one-to-two-year cars as indicated in our chart below.

Source: Manheim data compared as values against OCN (Original Cost New inc. VAT)

The weakening in headline values we’ve seen in the second quarter of this year is now showing signs of stabilising. Retailers face stiff competition for product from new competitors who have adjusted their stock profile during the pandemic – daily rental companies who have turned to the used market to compensate for the lack of new vehicles joining their inventories. This will help to maintain prices at their current strong level in the short to medium term, however, a downwards trajectory is inevitable and will become more pronounced as new vehicle volumes return.

All this being said, we don’t anticipate the values for the majority of sub-sectors to return to pre-pandemic levels for several years, if at all. So, while current pricing conditions remain, and stock supply remains low for many manufacturers, it’s more important than ever for retailers to have a clear understanding of the dynamics of supply at a model and derivative level.

As ever, retailers have adapted remarkably well to the circumstances presented to them, and most have seen remarkable profits during this period on the back of increased margins, full retail prices for new, minimum discounts and a lack of targets – a dynamic the industry hasn’t had for a long time. While the headwinds facing the new and used markets are many, the industry has proven resilience time and time again over the years and will continue to do so.

The used van market

“The first half of 2022 in the LCV market has undoubtedly felt very different compared to last year. The record-breaking acceleration and prices we witnessed throughout 2021 were never sustainable long term, and over the past six months we’ve seen used van prices realigning to a new but still strengthened norm. Vans this year have made on average £418 more than the same period in 2021, while being on average older and with higher mileage as more ‘pandemic-worn’ vans enter the market.

However, these performance headlines risk clouding the general market temperature, and overall, we are seeing reduced wholesale demand and less retail activity. With the cost of living rising, surging fuel prices and less financial support incentives dominating the UK headlines today, it is no surprise this is having a knock-on effect and impacting consumer and business confidence.

To conclude, I expect the overall market to remain robust during the summer period as the new van supply headlines support the used market supply and demand dynamics. Still, overall business and economic confidence needs to show some signs of improvement if the used van market is to continue riding this positive wave.”

Matthew Davock, Director of Commercial Vehicles,

Manheim Auction Services

Used car forecasts – Q3 and Q4 focus

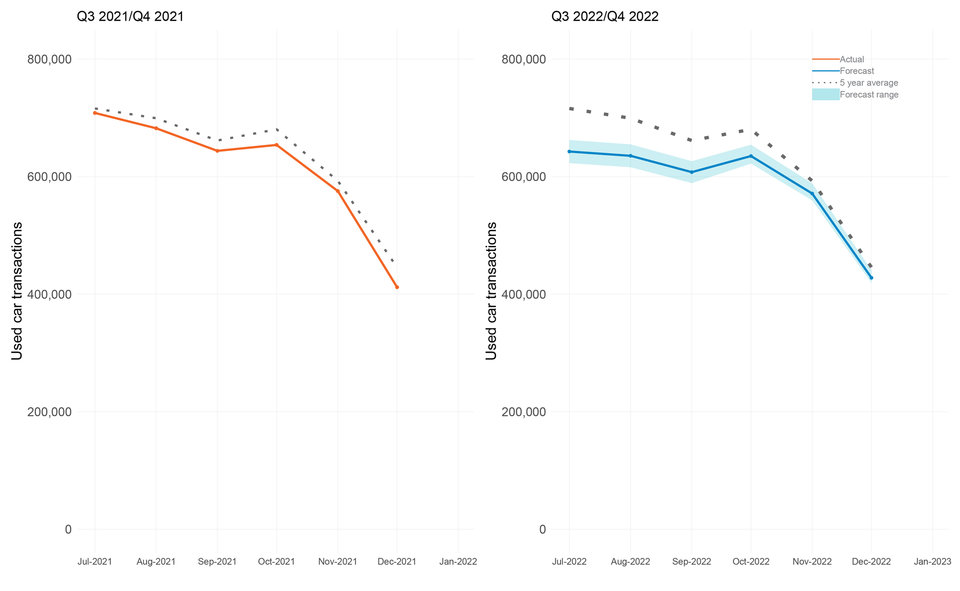

Building on recent used car sales, assumptions for the remainder of 2022, and taking into account the factors mentioned above, we have adjusted our forecast for used car sales in 2022.

Source: Cox Automotive

Upside scenario

Our upside scenario sees Q3 2022 end on 1.94 million transactions, a -4.5% decrease year-on-year, 1.0% up on the 2001-2019 average, and -6.4% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q4 2022 ends on 1.68 million transactions, a 2.6% increase year-on-year, +2.0% up compared to the 2001-2019 average, and -6.7% down compared to 2019.

Baseline scenario

Our baseline scenario sees Q3 2022 end on 1.89 million transactions, a -7.3% decrease year-on-year, -2.0% down on the 2001-2019 average, and -9.2% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q4 2022 ends on 1.63 million transactions, -0.4% down year-on-year, -1.0% down compared to the 2001-2019 average, and -9.4% down compared to 2019.

Downside scenario

Our downside scenario sees Q3 2022 end on 1.83 million transactions, a -10.1% decrease year-on-year, -5.0% down on the 2001-2019 average, and -12.0% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q4 2022 ends on 1.60 million transactions, -2.4% down year-on-year, -3.0% down compared to the 2001-2019 average, and -11.3% down compared to 2019.

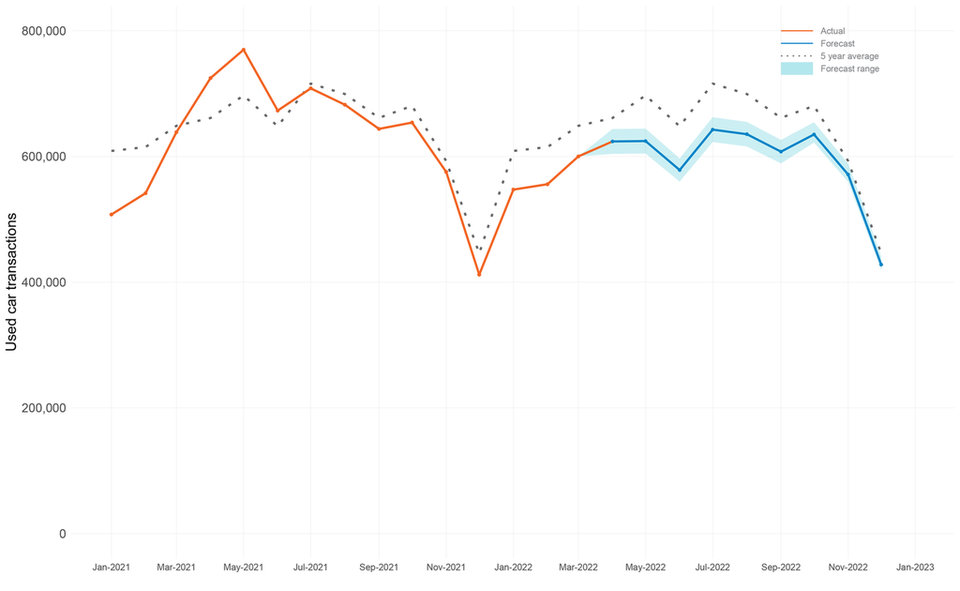

Used car forecast - 2022 full year

Source: Cox Automotive

Upside scenario

Our revised upside scenario for 2022 sees the year end on 7.21 million used car transactions, a -4.2% decrease year-on-year, -2.2% down on the 2001-2019 average, and -9.1% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -7.3% downgrade on our previous forecast due to the market factors previously mentioned.

Baseline scenario

Our revised baseline scenario for 2022 sees the year end on 7.05 million used car transactions, a –6.4% decrease year-on-year, -4.4% down on the 2001-2019 average, and -11.2% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -4.8% downgrade on our previous forecast.

Downside scenario

Our revised downside scenario for 2022 sees the year end on 6.90 million used car transactions, a –8.4% decrease year-on-year, -6.4% down on the 2001-2019 average, and -13.0% down when compared with the most recent pre-pandemic 2019 performance. Resulting in a -0.7% downgrade on our previous forecast.

The US perspective

“The used market in the US did not see the normal surge in demand during the spring as tax refund issuance was materially behind its typical schedule, while consumers were contending with record high fuel prices, the highest overall inflation in more than four decades, and higher interest rates. Despite those headwinds, used retail sales saw improving momentum in the second quarter relative to what volumes typically look like for the time of year. With limited supply and record high prices in the new market, the used market should remain relatively strong throughout the summer, especially at higher price points. However, the market is slowing in sales at lower price points where lower income and subprime credit consumers are under the most financial stress from the inflationary conditions. Both wholesale and retail supply measures reflect normal conditions as the market enters the summer. As a result, vehicles continue to depreciate at a predictable and normal pace. Younger-aged vehicles have seen more volatility, as they saw more aggressive buying by fleet companies again in the spring, but that aggressive buying ended during the month of June. Older vehicles have best held their values all year. At retail, vehicles have seen steady and normal depreciation all year.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc.