Why is consumer confidence in decline?

In this section, Grant Thornton

discusses why inflation is on the rise, and the impact this is having on consumers.

Continue reading

Owen Edwards, Head of Downstream Automotive

at Grant Thornton UK LLP

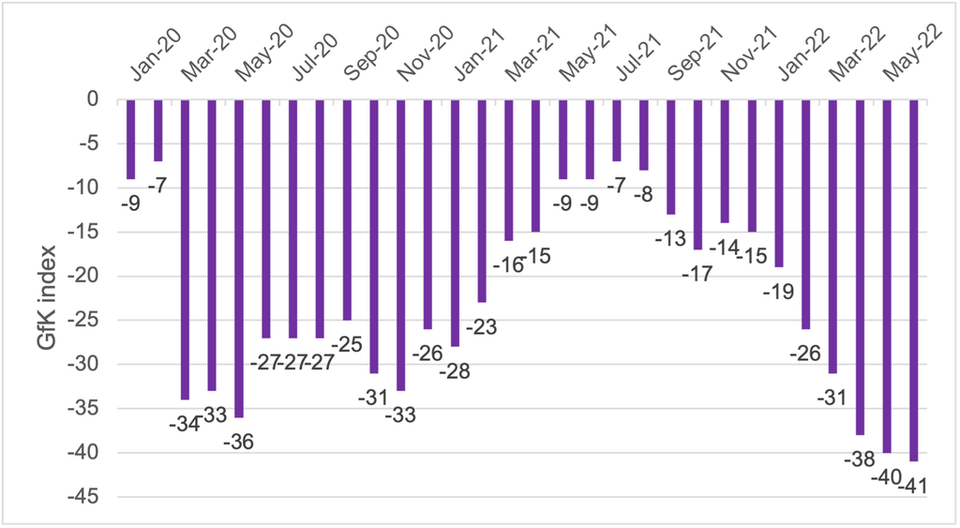

Consumer confidence has weakened and is set to continue to deteriorate. As a result, we have downgraded our new and used vehicle forecast sales for FY 2022, as you can see in the new vehicle market section of this issue of Autofocus. The chart shows that consumer confidence (GfK index) has fallen to an all-time low of -41 in June 2022, exceeding its previous low of July 2008 during the global financial crisis.

Why has consumer confidence weakened, and why is it likely to continue its decline?

Consumer confidence has been undermined by a combination of factors – the impact of the Covid-19 pandemic, Brexit, and growing pessimism towards the outlook for the UK economy.

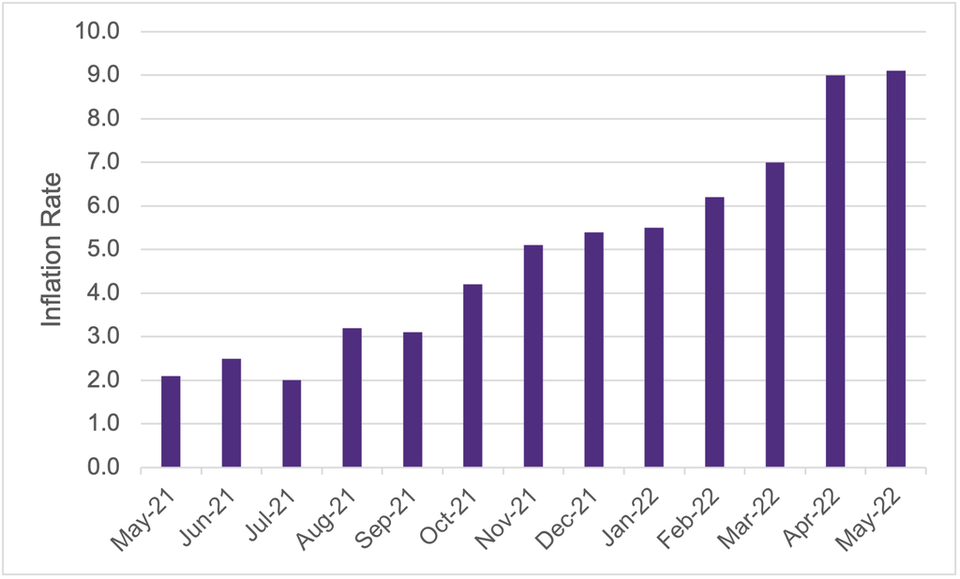

As the chart shows, inflationary pressures have continued to intensify, with annualised consumer price inflation reaching 9.1% in May 2022. As the rate of inflation increases, the cost of goods and services rises, the purchasing power of money declines, and our disposable income does not go as far. Therefore, we feel poorer in a higher inflationary environment than in a lower inflationary environment.

Consumer Confidence Index

Source: GfK

UK Inflation Rate - May 2021 to May 2022

The Bank of England (BoE) has indicated that inflation could rise as high as 11% in the coming quarters; if this is the case, the average UK consumer will feel poorer in the future than they feel now unless wages increase at a faster rate. This is unlikely to happen: wage inflation at the moment only reached 4.2% for the period of February to April 2022 (source ONS - Average weekly earnings in Great Britain - Office for National Statistics (ons.gov.uk) – excluding bonuses) and pay fell by 2.2% in real terms. As higher inflation outstrips wage growth, the average consumer will have less money to spend and feel less confident in spending their money.

What is driving up inflation?

Underlying costs in the UK economy have increased. Energy prices have surged, demonstrated not only by a sharp rise in electricity and gas prices but also by the price of the fuel we put in our vehicles. Manufacturers and providers of services have passed on higher fuel prices, alongside other costs in the supply chain, to the end consumer. Further changes to the energy price cap are expected to drive up energy costs again in October 2022; these costs have not yet filtered into consumers' pockets or the costs associated with the supply chain of goods and services, and this underpins the BoE's prediction that inflation will rise further before it begins to ease.

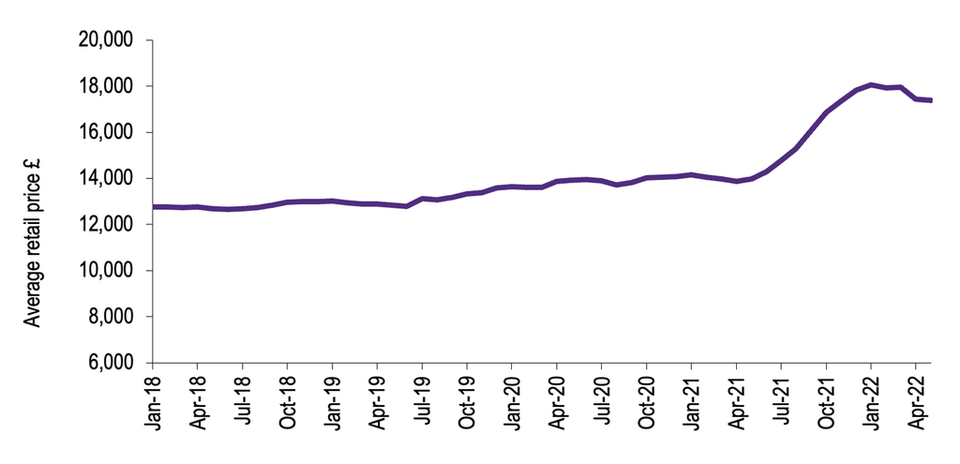

Typically, the BoE has used interest rates to help control inflation and keep it around its 2% target. Higher interest rates tend to curb inflation by pushing up borrowing costs, reducing the scope for consumers to spend and for businesses to invest. As demand for goods and services slows, the balance between demand and supply adjusts; greater supply and lower demand drives down prices. However, the current environment is slightly different to typical inflationary environments as prices have not been driven up by consumer demand but by supply shortages. Supply chain issues caused by Brexit and the pandemic generated these supply shortages in goods and services. We have seen this in the used car market as the price of vehicles has increased substantially – see the chart below on the retail price of used vehicles from Auto Trader. Used vehicle prices continued to rise strongly at the end of 2021; more recently, however, we are starting to see some weakness in the price of used retail car prices as consumer demand deteriorates.

Auto Trader Retail Prices

Source: Auto Trader

What is the outlook for interest rates?

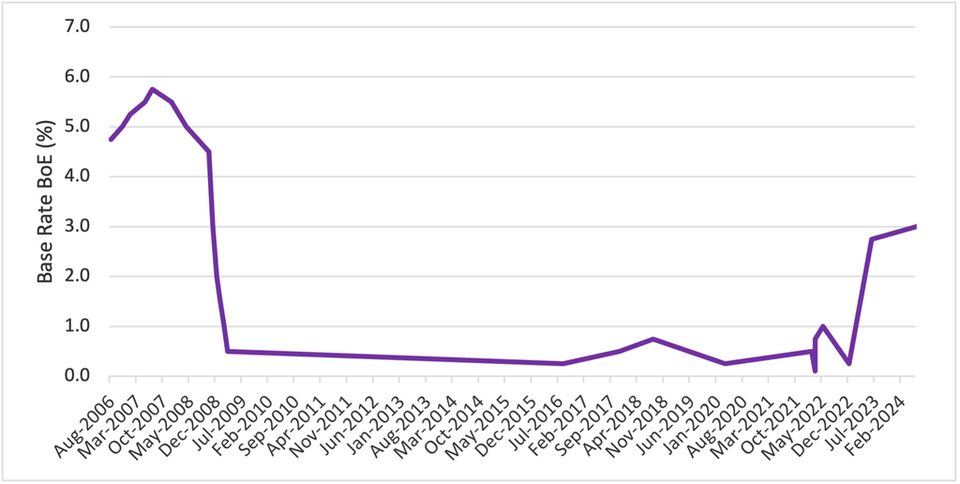

Interest rates have remained at historically low levels for some time: the chart below shows that the UK base rate remained below 1% from Feb 2009 until May 2022. As the pandemic hit the UK in March 2020, interest rates were 0.1%, triggering speculation about whether we might see negative interest rates. Since then, interest rates have risen, with five consecutive increases between December 2021 and June 2022, bringing the BoE's key rate to 1.25%. Nevertheless, interest rates remain at low levels compared with their level of 5.75% in July 2007. The BoE is looking to control inflation and ultimately to return it towards its 2% target, and further increases in interest rates are widely expected over the coming months, with comments from the BoE and other sources suggesting that rates could exceed 3% (as of 16th June 2022).

Higher interest rates mean consumers will feel less optimistic about how much money they have to spend. Borrowing costs – including mortgages and credit cards – will rise, and the future cost of automotive finance is also set to increase if the cost of borrowing is linked to the BoE base rate

With inflation on the rise and UK economic growth slowing, we face what is known as a stagflationary environment. The chart below indicates the level of growth in the UK economy and the B0E expected growth rates for the next few quarters.

Low unemployement will not provide an answer

Although the rate of unemployment is low, inflationary pressures combined with a slowing economy will force companies to take steps to maintain their profitability. As a result, businesses will likely face the prospect of cutting their wage bills amid weakening consumer demand. In addition, the BoE has already forecast an increase in unemployment that will, in turn, further dent consumer confidence.

We are already starting to see the signs of a falling new car and used car market: sales figures are declining, undermined by vehicle shortages and falling demand. As a result, Cox Automotive and Grant Thornton have reduced their new and used forecasts for 2022. As a result, there is a risk that the UK could slip into a recession, but at present, the BoE does not expect the UK economy to contract over two consecutive quarters.

Focus and grip

At the start of the pandemic, we focused very much on the steps that businesses could take in a deteriorating economic condition. Our thoughts remain the same. We still advocate that companies should employ a strategy of ‘focus’ and ‘grip’. Our focus for automotive retail companies remains:

- Daily volumes – sales teams need to make the effort to find every new and used car sale, turning over every stone to meet the required volume targets

- Gross profit – ensure that gross profits of the business – whether in new and used vehicles or aftersales – are maximised

- Overheads – review the business's overheads – what is essential and what is a ‘nice to have’? Discussions in the industry over 2022 so far suggest that overhead costs will increase by between 5% and 10% year on year for an average automotive dealer

- Working capital – minimise the level of working capital in the business, ensuring stock turn is as high as possible

- Cash – focus on the cash and ensure that this is reviewed on a regular monthly basis – and if cash becomes tight, it should be reviewed weekly. Cash is the lifeline of the business.

Our advice is to re-examine the basic controls of your business. These may have slipped in the changing environment as we have all been focusing on finding new and used vehicles and enjoying high profit margins. Vehicle shortages will remain for some time; nevertheless, rising overheads in automotive retail companies are also here to stay. If you have any questions or wish to get in touch, do not hesitate to email me at Owen.edwards@uk.gt.com