Philip Nothard

INSIGHT DIRECTOR

4 min read

Stories about the growth of the new car market and EV registrations have continued to dominate trade media news feeds in the first quarter of 2024. And in the used market, price volatility remains a significant topic of debate.

As official figures for used sector performance in Q1 are not yet available, dealers would do well to reflect on issues currently affecting new and keep these, as well as that of price volatility, front and centre. What’s happening in new will always become a hurdle for used operators further down the line.

In this ever-evolving automotive industry landscape, fleet and leasing sector operators face increasing challenges as they navigate shifts in the new vehicle market. Incumbent OEMs strive to adjust prices to stay competitive against emerging players, particularly in the electric vehicle segment, while also grappling with the cost of entry. These ongoing adjustments introduce unprecedented uncertainty, complicating future forecasting for residual values and overall defleet management. Amidst this complexity, the used market emerges as a focal point, demanding agile strategies and informed decision-making from everyone. This dynamic environment underscores the need for adaptability and strategic planning to thrive in today's automotive market.

Fuel type considerations

As the volume of battery electric vehicles surges, largely propelled by the fleet sector, there's mounting pressure and complexity surrounding the prediction and management of future residual values. OEMs, grappling with production volume constraints and the looming threat of new entrants, are being forced to navigate the supply chain to find new efficiencies. Price adjustments have become a key defence strategy, which is evident in recent actions by Tesla and BYD as they grapple with missed targets. Balancing these factors poses a significant challenge for the used vehicle sector.

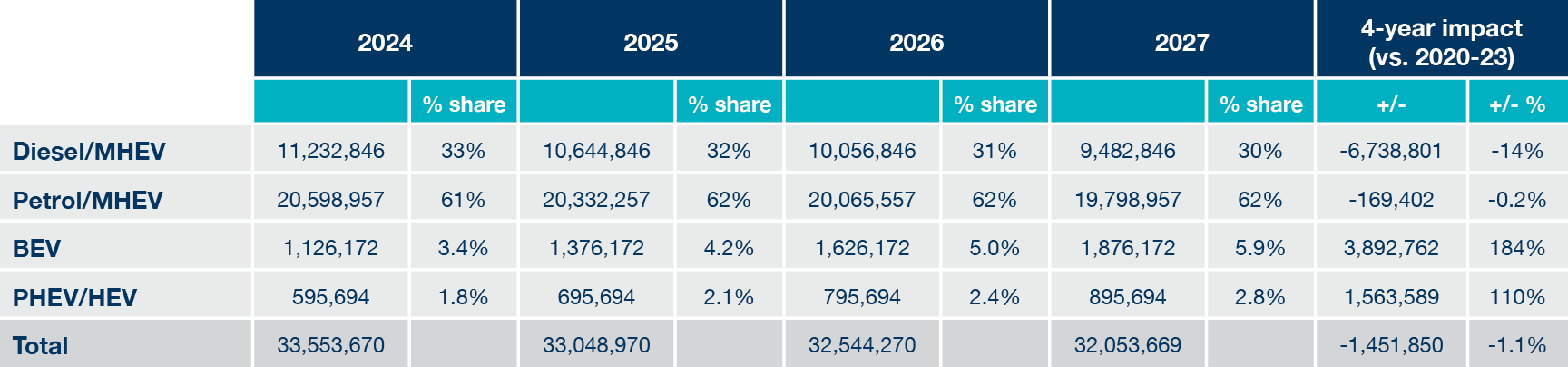

While the medium to long-term economic outlook appears optimistic, our recent four-year fuel type forecast predicted an overall rise, albeit a modest one, for the used market in 2024 (read our revised used car forecast). Retailers are facing a raft of challenges stemming from higher interest rates and the cost of ownership for used vehicles. Compared to the heavily subsidised, well-supported new car market, driven by OEMs striving to allocate the elevated levels of production currently accumulating in compounds and ports across the market, these challenges represent a significant number of challenges to used.

As a result, retailers are grappling with the dual pressures of a shifting economic landscape and the dynamic demands of an increasingly complex automotive market. Balancing these factors requires strategic adaptation and innovative solutions to sustain profitability and navigate a morphing marketplace.

Used car dealers must adapt to that transformation. It’s worth considering what proportion of UK operators have a noticeable lack of EVs and hybrid variants on their forecourt. That sector is becoming increasingly competitive with each passing year but how many dealers are ready for what’s coming down the pipe?

Savvy dealers, if they haven’t already, need to give their stock profile serious consideration, especially as the ICE car park is ageing year-on-year. That trend is impacting availability and choice in vehicles up to four years old. Retailers should consider how their forecourt looks now, what percentage of it is ICE and how will that look a year from now and in the years that follow. Can that profile be sustained, when the availability of ICE vehicles is shrinking at a rate of 10-16% a year going forward?

We stand by our prediction that diesel’s new car market share will plummet to 3% by 2028: yet another firm reason to embrace the EV wave more enthusiastically. This comes with opportunity. Are dealers maximising the margin opportunity on sub-one-year-old diesel stock now? The transition to electric and hybrid variants now, more than ever, must indeed involve more training and better tech know-how. Consumer behaviour over the past few years tells us that availability, not preference, is pushing many buyers to choose hybrid as opposed to full-blown BEV. Could hybrid be the stepping stone dealers and their customers need in the wholesale shift to electric? And if so, are your sales team members equipped to help them?

Still, we must remember that 94% of used cars sold last year were ICE and the majority of buyers will stay loyal to petrol and/or diesel for many years to come. They may not yet be ready to make the leap into EV for financial, infrastructure or use-case reasons. That means customers eager to get their hands on an ICE must have their questions about availability and price answered by clued-up dealers.

All fuel types - %OCN (wholesale value as a Percentage of Original Cost New)

It’s also worth noting that unstable used EV prices, already under pressure from shifting market dynamics, will only be compounded by OEM pricing tactics in the new market. The pricing strategies of manufacturers, keen to shift their new vehicles and spurred on by the arrival of new entrants and the 2035 ICE ban deadline, will likely continue to give used retailers headaches.

BEVs only - %OCN (wholesale value as a Percentage of Original Cost New)

Time for recalibration

While news coverage has often highlighted financial pressures and compressed margins in the automotive sector, the reality encompasses a broader spectrum of challenges.

Indeed, businesses face increasing pressures on their balance sheets, driven by factors such as interest rates and rising labour and energy costs.

However, it's essential to contextualise these challenges within the broader narrative of industry dynamics. Comparing current performance to previous years, it's evident that the sector previously enjoyed robust margins amid constrained new vehicle supply and high demand for used cars.

However, these conditions were unsustainable, and as depreciation returns and stock write-downs become more prevalent, operators must recalibrate their strategies. Embracing a "back to basics" approach while keeping a watchful eye on what’s happening in the new market, will be crucial for navigating the current landscape, allowing businesses to adapt to evolving market dynamics while maintaining resilience and profitability.

Used Vehicle Parc Forecast 2024 - 2027