Philip Nothard

INSIGHT DIRECTOR

4 min read

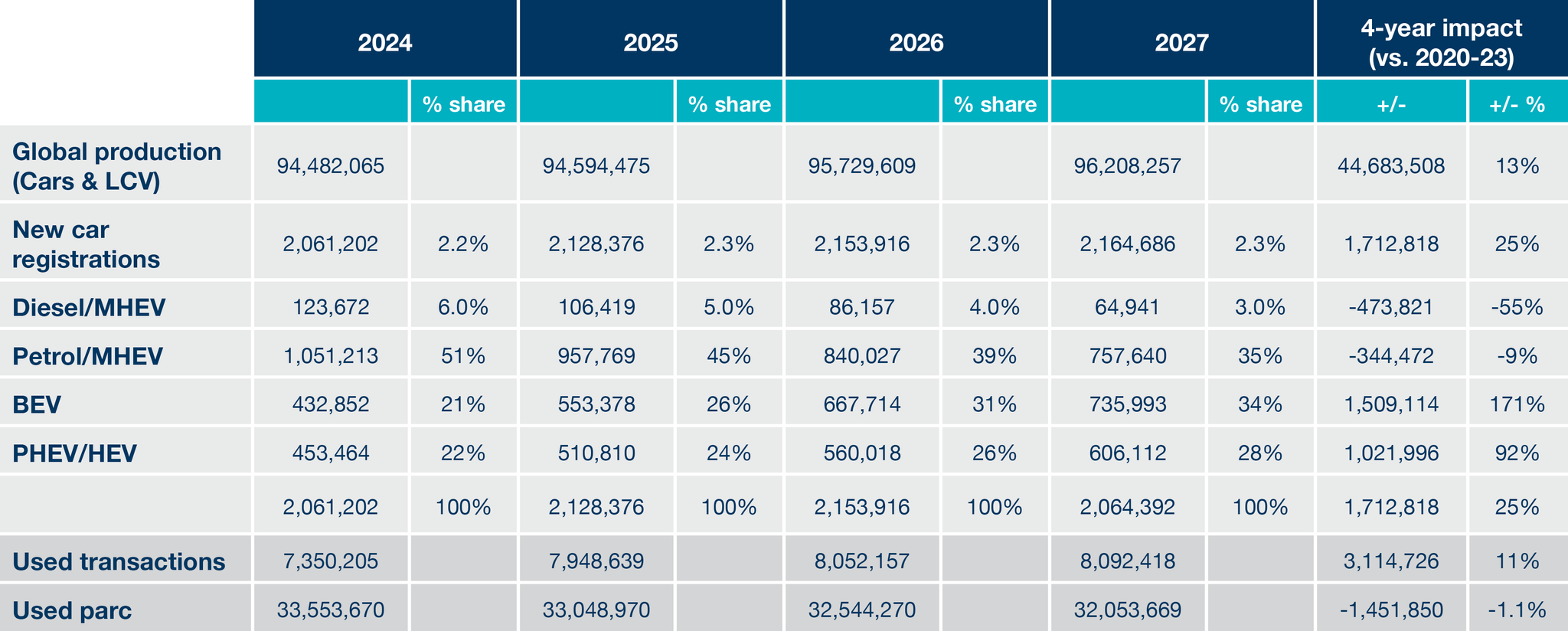

The UK new car market has demonstrated positive signs of life in the first quarter of 2024, but as ever in the automotive sector, there are reasons to be cautious. The positivity stems primarily from the relatively healthy start to the year for new car registrations which have increased by 10.4% year-on-year. That good news can’t be dismissed out of hand. Double-digit growth in the first three months is not to be sniffed at.

Based on current activity and performance witnessed in Q1, we’ve revised our baseline forecast for 2024 upwards, and now project registrations to surpass two million cars, with a potential upside scenario reaching beyond 2.2 million (read our revised new car forecast). This adjustment is contingent upon a more robust performance expected in the second half of the year that’s buoyed by promising signs of economic stabilisation and the imperative for manufacturers to gain market share while meeting ZEV Mandate objectives.

The 10.4% statistic is an encouraging one of course but it is still 17.9% behind the pre-pandemic average for registrations recorded between 2000 and 2019. Indeed, it’s 22.2% behind the figure for 2019 alone.

So, the numbers are charged with positivity but come with a caveat that the market is a long way off from a state that could reasonably be characterised as ‘normal’.

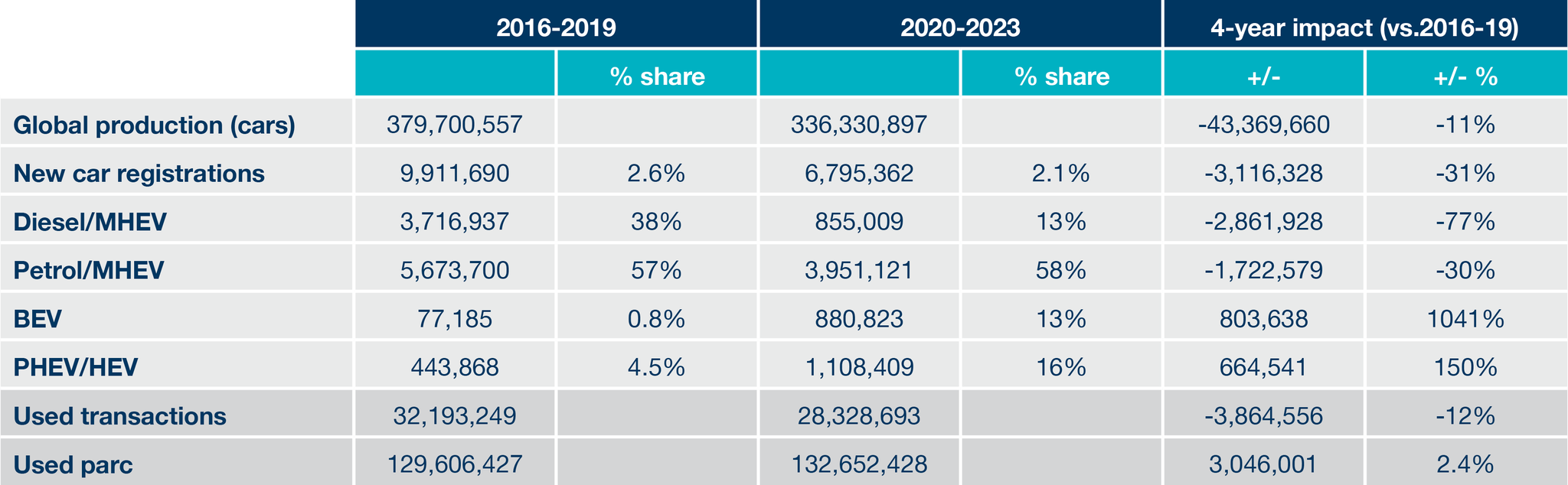

The new car market contracted by almost a third between January 2020 and December 2023, a loss of 3.1 million vehicles compared to 2016-2019.

The Q1 growth numbers are compounded by the market share figures of private registrations. In Q1 they stood at 40.4%, 8% lower than the figure year-on-year.

That’s undoubtedly a bitter pill to swallow for OEMs and dealers; private registrations are where the healthier margins can be found, as was demonstrated during the pandemic when supply was severely constrained.

Additionally, consumer doubts about the transition to electric, no doubt fuelled by EV affordability and infrastructure limitations, persist. Steadfast support from fleet operators has played a crucial role in driving the transition to an electrified market and the recovery of sales volumes. Without their continued backing, these advancements would undoubtedly be far less substantial.

So, yes, the market is moving in the right direction, a gradual recovery could arguably be said to be underway. However, it's important to acknowledge that significant challenges remain. We're not quite out of the woods yet, and a full return to pre-pandemic levels might still take some time.

ZEV mandate manoeuvres

As well as being a notable period for registrations, Q1 also marked the launch of the ZEV mandate in the UK, a regulation requiring manufacturers to sell an increasing percentage of zero-emission vehicles (ZEVs) each year until the ICE ban deadline - provided it doesn’t change again – in 2035. Designed to reduce greenhouse gas emissions and hasten the switch to electric vehicles, the instruction means car makers face a year-end target of 22% of volume while commercial vehicle brands must reckon with a 10% figure.

That is, officially at least, the plan. Manufacturers can avoid hefty per-car fines intrinsic to the mandate in a few ways, including borrowing a limited number of ZEV ‘allowances’ until 2026. This gives OEMs some breathing room if they’re struggling to meet the target in a particular year. The borrowing is capped however and comes with a considerable 3.5% annual interest fee to motivate compliance.

This is one of the avenues available to manufacturers hoping to soften the impact of the mandate, but there is talk in the industry that they could go further. One option to achieving the 22% figure is to simply reduce volume in the UK market.

Whatever volume you normally put into the UK market you reduce, so your BEV registrations count as a higher percentage share of overall volume. In other words, reduce your ICE, and the BEV share increases.

In Q1 though, EV registrations stood at 15.5% of market share, a year-on-year increase of 0.1%. The needle has moved, but only ever so slightly and private buyers remain reluctant to go electric.

With the UK’s ICE ban deadline U-turn, a palpable lack of help for the sector in the most recent budget, such as the government addressing the VAT discrepancy between domestic and public charging, it may well be that an unintended consequence of the ZEV mandate could be a drop in the supply of new vehicles. Manufacturers looking at the UK market may change tack and opt to put their cars into less-stringent markets in other parts of the world. It’s still early days, but clarity on how the sector will react in the inaugural year of the mandate is yet to materialise.

Global volume improvements

As global production surged to 93.5 million units in 2023, surpassing the pre-pandemic level of 91.8 million in 2019, it underscored a robust return to a 'push' market paradigm by global manufacturers. However, this resurgence has been accompanied by significant shifts in market dynamics, including OEMs transitioning to electric vehicles and strategic exits from specific regions. Notably, China has witnessed a notable increase in production volume, with a 3 million unit rise from 2022 to 2023 and a five million annual growth compared to 2019.

Amid this growth, pertinent questions arise regarding the sustainability of this trajectory. Is this surge merely a post-pandemic anomaly, or does it reflect a sustainable trend? Furthermore, the ability of Chinese brands to capture market share beyond their own borders remain uncertain, raising questions about long-term viability. Additionally, positioning the UK within OEM strategies is subject to various challenges, including the implications of the ZEV mandate, delayed regulatory decisions, and potential tariffs. These factors collectively challenge both new entrants and legacy OEMs, highlighting the complexities and uncertainties of the automotive sector's global landscape. There could be questions from OEMs of all denominations about their reliance on the UK automotive sector.

Budget questions and an overdue recovery

In the most recent budget, we would have liked questions about incentives and public charging infrastructure for EVs to have been addressed. Steps taken in that regard would have been both affordable and logical. However, measures that put money back in the average consumer's pocket, such as the fuel duty freeze and national insurance cut, clearly helped our sector.

The budget was designed to win votes in an election year but had zero incentives to promote zero-emission motoring further.

This is a critical time for UK automotive. Growth continues to be driven by fleet investments while manufacturers push for EV demand. Subdued consumer confidence continues to hamper private retail sales, again highlighting the urgent need for EV incentives. With an election looming, we will have to wait and see whether any new administration delivers the help needed to accelerate our sector’s overdue recovery.

New Car Registration - 2016-19 vs. 2020-23

New Car Registration Forecast 2024 - 2027