ADAPTING TO BIG DATA, CONNECTIVITY AND TECHNOLOGY

Who owns the data?

How vehicle data will drive motor insurance and consumer engagement

Data ownership and the insurance opportunity

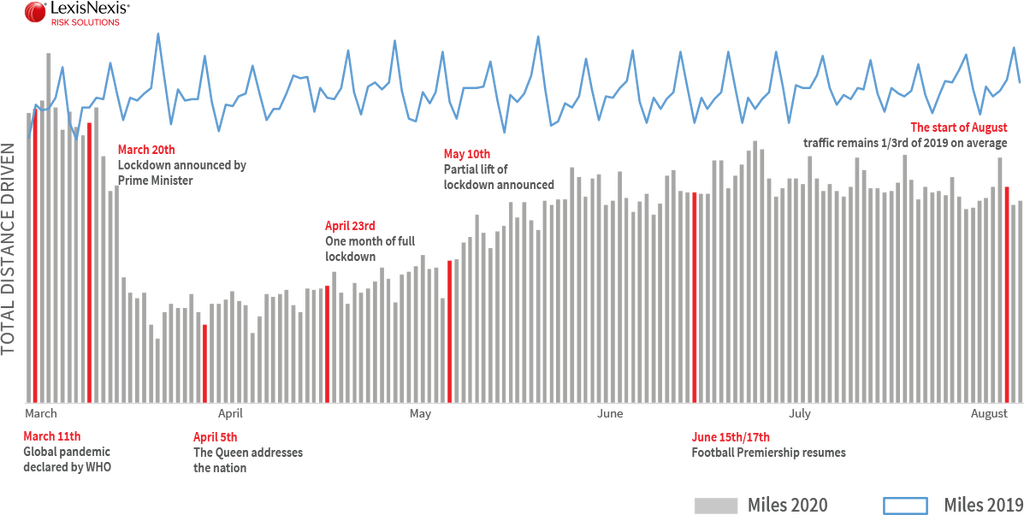

As nations globally instigated lockdown measures in Spring 2020 to control the spread of COVID-19, private cars largely went unused for weeks on end. The annual motor insurance premium calculated on a range of factors such as where the policyholder lives, their age, occupation and engine size could not factor for this sudden and prolonged change in risk. Insurance providers offering telematics or usage-based insurance products had insight the rest of the market could only guess at with reports of traffic volumes falling between 70%-85%, as cited in analysis from LexisNexis Risk Solutions and leading Telematics UK broker Autosaint of March to June 2020.

The pandemic has highlighted the value of static and dynamic vehicle data in understanding risk, delivering a fair and accurate premium and giving motorists more flexibility and control over their insurance costs. Rather than rely on estimations and proxies for risk, it could tell an insurer the car’s mileage reading, valuable insight during and post-pandemic, the car’s precise location, how it is driven, and the Advanced Driver Assistance Systems (ADAS) features on-board and activated to enable the development of more personalised, more engaging insurance cover. This is not visionary: the insurance and car manufacturing markets were coming together to make this concept a reality, well before the emergence of COVID-19.

The impact of Covid-19 national lock-down restrictions on traffic volumes

Graph: Lexus Nexus

Connectivity

LexisNexis Risk Solutions research of the automotive market highlighted that, by 2025, almost all new vehicles are expected to have connectivity feeding a wide range of data to car manufacturers. Carmakers have invested significantly in connectivity as part of their drive to provide a greater choice of mobility solutions to help improve the customer experience. Data from the car can help them understand exactly how their vehicles are used and how they can cut the cost of ownership as they invest in developing increasingly autonomous vehicles as part of their zero emissions and zero fatalities objectives. C.A.S.E., or Connectivity, Autonomous, Sharing/Subscription and Electrification, is being used as the guiding principle for the future of the auto industry.

In parallel with the development and increasing market penetration of the connected car, there is a recognition among insurance providers that they will need access to vehicle-centric data to support the provision of usage-based insurance. It is as much in insurers’ interests to understand more about the car as it is manufacturers. Consumer expectations were already changing prior to the pandemic, but the demand for more personalised products looks set to increase. Vehicle-centric data has the potential to help price insurance more fairly, cut claims costs and deliver new services such as Pay As You Drive products.

More than half (55%) of respondents in a Cox Automotive dealer sentiment survey completed for this report said they had concerns relating to the ownership of data as connectivity increases.

Vehicle-centric data

The big question has been how to bring these two major industries together so that insurance providers can access connected car data in a way that adheres to data privacy and security regulations as well as making sure that the data is useable and meaningful for insurance.

How do you ensure a consumer driving a car is given the option to share their driving data for insurance and this will be understood in the same way as their neighbour driving a completely different car? When you think about the volume of car makes and models, the number of motor insurance providers, and the quantity of motorists buying insurance, it becomes a big ‘many to many’ problem.

The solution lies in a data platform strategy that takes all the strands of vehicle-centric data, telematics data from any device or app, data from the connected car and vehicle build data then puts it into an environment where it can be standardised, contextualised, normalised and scored in a fully compliant manner for use across a variety of vehicle makes or models.

This is one Big Data project that could have a profound impact on the future of mobility.

"The increasing number of ADAS features affects not only the insurance market, but also valuations when it comes to these vehicles making their way through wholesale channels. The more information we can get about different vehicle features and systems, the more detailed the information in the remarketing process can be."

Philip Nothard, Insight and Strategy Director,

Cox Automotive

ADAS classification and risk

The starting point goes back to the investment car makers are putting in vehicle autonomy with Advanced Driver Assistance Systems (ADAS) increasingly available in vehicles and constantly being enhanced. SMMT research shows 8 in 10 new cars in the UK have driver assistance systems and over half have adaptive cruise control. In the US, internal analysis by LexisNexis Risk Solutions shows 76% of 2019 models had at least one core ADAS feature, which is up significantly compared to 18% in 2014.

To date, it has been a challenge for insurers to identify exactly what ADAS features a specific vehicle is equipped with when writing a motor insurance policy. This is because each car manufacturer has created its own unique terminology, definitions, and naming structures – sometimes releasing multiple features within the same model year. In addition, many items are chosen as optional extras when a vehicle is purchased new.

To address this challenge, data scientists at LexisNexis Risk Solutions have developed an ADAS classification system using machine learning to scan millions of lines of car manufacturer vehicle data to logically sequence and classify vehicle safety features and component’s intended operation or purpose. This classification system provides the foundation for LexisNexis® Vehicle Build.

Access to vehicle safety data will help insurance providers factor for their presence throughout the customer journey – in pricing, mid-term adjustments and renewals – and establish the differences in risk profile associated with the vehicles that have these safety features. It will also enable them to understand how specific safety features behave. For example, if a feature will provide an alert or warning to the vehicle’s driver when a potential danger or hazard is detected or if it can take active control of breaks and steering. It will allow insurers to understand the purpose of features.

At the same time, car manufacturers will be able to see what ADAS features have the most impact on their customer’s safety to help drive further enhancements.

As carmakers and insurers get a better understanding of the vehicle, how it’s driven, its performance and how semi-autonomous features work in the real world, consumers will also learn how data from and about the car can work for them. This will support market adoption, drive innovation, and help create more benefits in terms of safety and total cost of ownership.

Who owns the data?

The European Union has ruled that data generated by cars belongs to those who own, operate and drive the vehicle whilst data is being generated. It is subject to privacy rules under the EU’s General Data Protection Regulations, or GDPR. It is slightly more complicated in the US, with state data privacy laws offering up contradictions.

Debate continues around whether providing car owners with the data from their vehicles could in fact endanger other drivers of the vehicle. Conversely, car manufacturers have argued that allowing consumers to opt out may cause issues with information sharing with emergency and third-party roadside assistance organisations.

There are also challenges from the independent aftermarket, with representatives suggesting that manufacturers withholding data could prevent fair competition and even remove competition and choice for consumers. While physical access via the OBD2 port is still an option for now, the development of wireless transmission services direct to the manufacturer means this could be removed from new models in the future.

Read our overview

The Outlook

Solving the consumer compliance and

consent problem: LexisNexis® Risk Solutions

LexisNexis® Risk Solutions is playing a key role together with consortium partner Volkswagen AG in project smashHit– one of several funded projects initiated by the EU Commission designed to increase consumer confidence in the use of personal data generated by connected cars.

SmashHit is a project aimed at two specific use cases: automotive insurance and smart cities where the mass internet connected device is the connected car. The consortium has been tasked with creating a secure platform that will increase consumer trust and confidence in personal connected car data sharing for specific use cases.

Project smashHit is a three-year EU Commission funded initiative to support the emergence of data markets and the data economy. It has been tasked to create the platforms to ensure consumers remain in control of their data and its subsequent use. It will also enable secure sharing and trading of data with robust, automated controls on compliance.

The smashHit project is formed by a consortium of nine organisations drawn from analytics, data security, car manufacturing, smart city infrastructure and academia working collaboratively to deliver the benefits of shared car connectivity to millions of consumers.

Image: smashHIT Project

Solving the consumer compliance and

consent problem: LexisNexis® Risk Solutions

LexisNexis® Risk Solutions is playing a key role together with consortium partner Volkswagen AG in project smashHit– one of several funded projects initiated by the EU Commission designed to increase consumer confidence in the use of personal data generated by connected cars.

SmashHit is a project aimed at two specific use cases: automotive insurance and smart cities where the mass internet connected device is the connected car. The consortium has been tasked with creating a secure platform that will increase consumer trust and confidence in personal connected car data sharing for specific use cases.

Project smashHit is a three-year EU Commission funded initiative to support the emergence of data markets and the data economy. It has been tasked to create the platforms to ensure consumers remain in control of their data and its subsequent use. It will also enable secure sharing and trading of data with robust, automated controls on compliance.

The smashHit project is formed by a consortium of nine organisations drawn from analytics, data security, car manufacturing, smart city infrastructure and academia working collaboratively to deliver the benefits of shared car connectivity to millions of consumers.

Image: smashHIT Project