Philip Nothard

INSIGHT DIRECTOR

6 min read

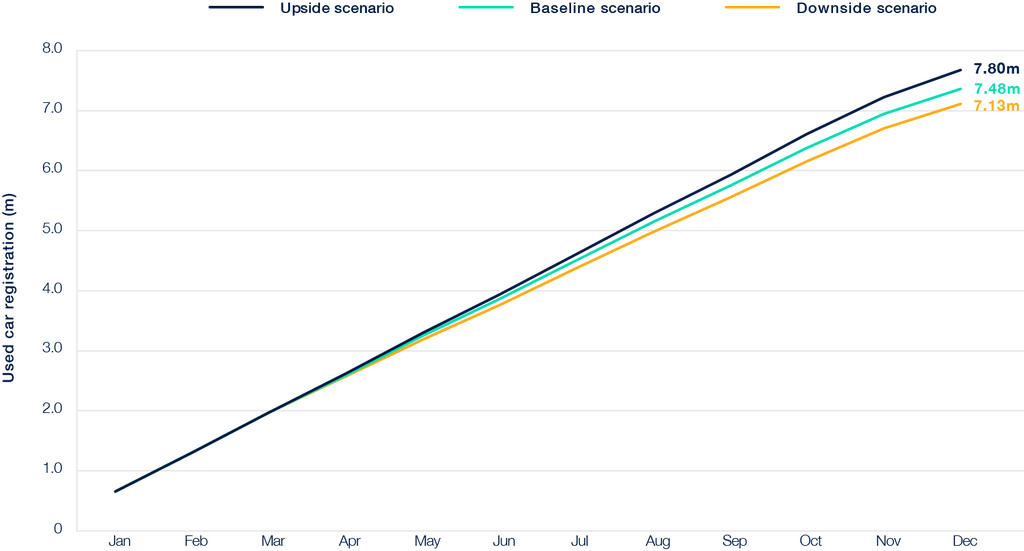

We have updated our used car forecast for 2025, using the latest used car data and our own proprietary insights and market intelligence. As usual, we’ve provided three scenarios – upside, baseline and downside. We believe the baseline is the most likely outcome.

Our baseline forecast predicts 7,477,121 used car transactions by the end of 2025. This represents a modest 0.6% increase compared to 2024, reflecting a relatively flat and continuously uncertain market environment. While this forecast marks a 1.4% increase over the average transaction figures from 2001 to 2019, it is still much slower growth than we would have expected the market to sustain, without the impact of the pandemic.

The upside scenario – our most optimistic view of the market - projects 7,804,818 transactions, a 5.0% increase over 2024, indicating robust recovery and heightened demand for used vehicles.

Source: SMMT / Cox Automotive

Upside scenario

In our upside scenario, a balanced recovery unfolds. Characterised by increased choice, heightened consumer confidence and a significant rise in Battery Electric Vehicle (BEV) ownership.

- A steady recovery in the used car market is supported by increased vehicle choice, rising consumer confidence and a significant increase in BEV ownership.

- New vehicle registrations recover, while production shortages that previously limited used vehicle options are gradually resolved, with fleet and rental inventories entering the market.

- Effective economic measures, including reduced inflation and declining interest rates, stimulate consumer confidence and boost overall spending. This relieves pressure on the automotive sector, enhancing new and used vehicle demand.

- The used EV market experiences substantial growth as consumer interest surges, driven by increased confidence in residual values, improvements in battery technology and government initiatives designed to stimulate demand.

Baseline scenario

In our baseline scenario a gradual resurgence takes place, as economic factors keep inflation at elevated levels, which are higher than ideal. Meanwhile, the new car market undergoes shifts, particularly with the entry of new players offering used vehicle propositions and the increasing adoption of electric vehicles (EVs).

- The market experiences a slow resurgence as economic factors keep inflation at higher than ideal levels, influencing consumer behaviour and spending patterns.

- Shifts in the new car market reshape consumer preferences, with new entrants starting to offer used vehicle propositions.

- The broader economy remains stable and characterised by the ongoing challenges, but with no significant downturn. Long-term recovery plans and forecasts are still viable, despite the anticipated reduction in inflation being gradual.

- While UK interest rates are beginning to ease, they remain higher than historical averages. Resulting in only small annual declines that continue to affect consumer purchasing power.

- Recovery in new vehicle production stabilises, with the potential for momentum to build. As EV adoption grows, the return of fleet, rental, and business sector discounts lessens some supply pressures on used vehicles.

- The shift toward EVs in the used car market continues. Mirroring the trends observed in 2024 where the adoption of used EVs showed steady, incremental progress without significant acceleration.

Downside scenario

In this downside scenario, the UK used vehicle market faces significant challenges driven by weakened consumer confidence and a prolonged economic downturn. High inflation and elevated financing costs create a problematic environment for potential buyers, leading to decreased demand and reduced transaction volumes.

- The economy experiences a substantial and prolonged downturn and ineffective measures to mitigate high inflation, forces the Bank of England to maintain elevated base rates.

- Fragile consumer sentiment leads to a notable contraction in the used car market, as uncertainties prompt consumers to postpone vehicle purchases.

- Financing rates for used vehicles soar, rendering ownership financially out of reach for many, particularly among the ongoing cost-of-living pressures.

- The cumulative impact of these factors results in a sharp decline in overall transaction volumes, with retailers facing increased difficulty in moving inventory.

Source: Cox Automotive