Lee Swinerd

DIRECTOR AND HEAD OF AUTOMOTIVE

6 min read

The European automotive sector is closing out 2024 after a bruising year of change, disruption and instability. But, as industry leaders look to 2025 for greater stability, what should they expect?

The journey so far

Since the onset of COVID 19, the market has seen its fair share of headwinds, including semiconductor shortages, elevated cost inflation on for raw materials, energy and labour, and the ongoing challenges around the adoption of battery electric vehicles (BEVs).

Within that period, the main car manufacturers (OEMs) produced some strong financial results as they focused on manufacturing vehicles with higher margins and reducing the size of their product ranges. We’ve witnessed a reduction in the range of small cars, saloons, estates and cabriolets replaced by SUVs.

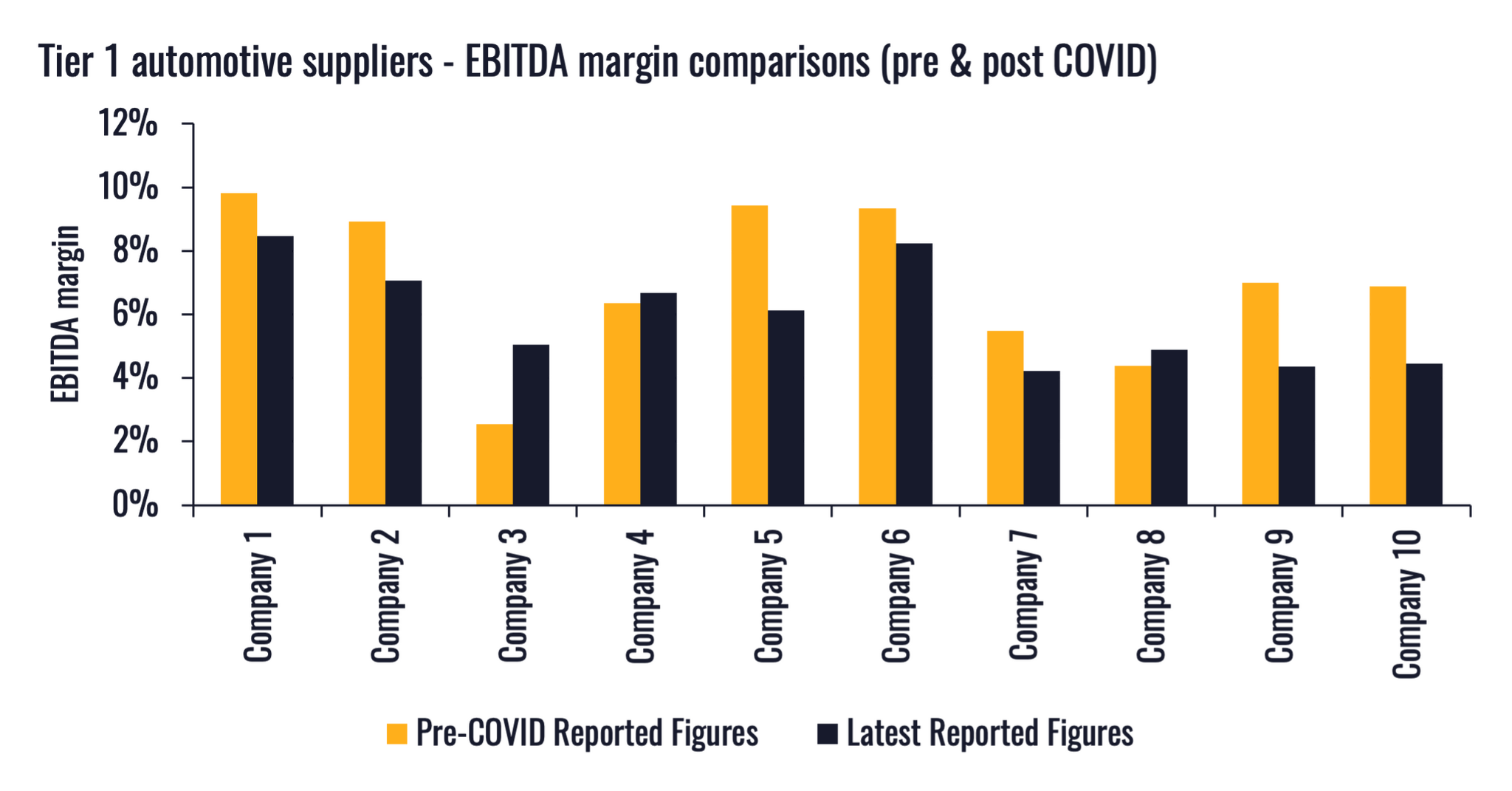

Meanwhile, the financial performance of many of the tier 1 suppliers to the OEMs has weakened as they battled with inflationary cost pressures and unstable product demand. Q2 and Q3 of 2024 have seen a wave of downbeat results updates from various tier 1 suppliers, including the likes of Lear, Forvia, Adient, Borg Warner and Aptiv, to name but a few.

Although supplier revenues have broadly returned to pre-COVID levels, EBITDA margins have not fared well. The inability to pass cost pressures through to the OEMs, coupled with lower production volumes, means that overheads cannot be fully absorbed at the levels anticipated when products were originally quoted.

Source: Interpath

The EU and International trade

A key factor in performance has been geopolitical and international economic factors, not least trade relations, specifically between the EU and China.

At face value, the EU’s announcements of import tariffs on Chinese-manufactured vehicles appear to try to protect European manufacturers from the European markets being flooded with cheap or subsidised Chinese-built cars. But, as some OEMs are already finding, it can be a case of be careful what you wish for.

Since the announcements of tariffs, several European OEMs have announced negative results earnings with pressure on their sales in China being stated as a key cause. This opens a battle on two fronts, with new entrants into Europe aggressively trying to take market share and Chinese buyers looking more favourably on local brands given the increased quality of locally manufactured product.

This weaker performance from the European behemoths has resulted in OEMs looking to restructure and optimise their European footprints, with VW being the highest profile in recent weeks with the potential closure of three plants in its stronghold, Germany.

This type of development will create uncertainty throughout the supply chain as suppliers question what volumes they can expect in the future and whether vehicle programmes will be ended early. Many suppliers are already financially weak after several years of lower margins. Balance sheet resilience will be tested, and suppliers will fail. The failure of suppliers then has a ripple effect on other suppliers on those vehicle programmes as the manufacturers battle to obtain parts and keep production lines running.

And those suppliers that are teetering on the brink have, historically, found support from their customers to maintain continuity of supply while longer-term solutions are developed. However, if the OEMs are having their own challenges, conditions may test their appetite and ability to financially contribute to the restructuring and turnaround of a financially distressed supplier.

Another risk that needs to be factored in for 2024 is the threat of strike action to try to save at-risk plants and workers’ jobs. If VW’s workers take strike action, there may well be knock-on consequences to other OEMs. Some suppliers to VW may not survive, but it raises questions on what it may mean to the supply chains of the other manufacturers who share common suppliers.

Will conditions improve in 2025?

Unfortunately, it is unlikely that we’ll see more stability in 2025. Firstly, the emissions targets set by the EU and the separate ZEV mandate in the UK are being questioned by the OEMs. The 2035 deadline for the end of all ICE vehicle sales is meeting increasing levels of opposition from senior officials within the sector.

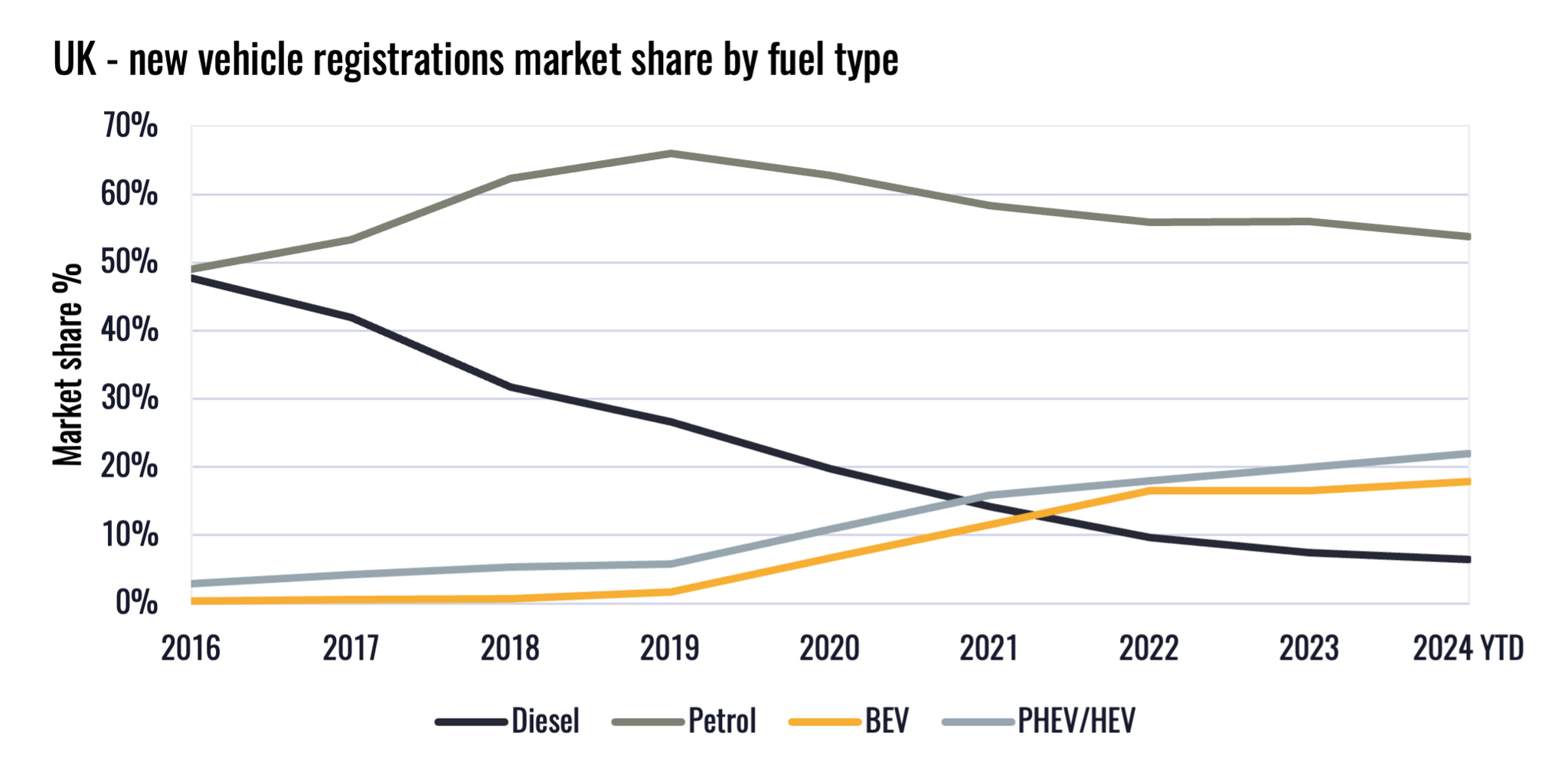

Meanwhile, the transition itself from internal combustion engines (ICE) to BEV remains a key challenge. Demand from consumers for BEVs has plateaued in 2024, but the manufacturers have tried to stimulate demand through customer incentives and specifically via the fleet sector in the UK. That’s not even to mention the shock Court of Appeal decision on commissions for Vehicle Finance, which will send reverberations around the sector and has already seen finance products suspended.

Source: Interpath

We also expect to see further consolidation within the supply chain in 2025 through acquisitions, but also footprint rationalisation to reflect lower future demand levels for European made cars. Chinese brands opening plants in Europe can potentially provide opportunities to European suppliers unless those new entrants do not embrace a largely European-based supply chain. However, the Rules of Origin should help to protect against cars being manufactured in China and then only assembled within Europe.

Overall, it feels like 2025 will be another bumpy ride for the European automotive manufacturers and their supply chains. There will be a range of pressures impacting the sector, some of which are well-known, and others are emerging as the sector responds to current issues, challenges and opportunities.