Owen Edwards

HEAD OF DOWNSTREAM AUTOMOTIVE

6 min read

Rising inflation and high interest rates in the UK and worldwide have driven up manufacturers’ (OEM) costs, some of which have affected the consumer through higher new vehicle prices (see Chart 1). Adding to this weak consumer demand, falling disposable income has impacted consumer propensity to purchase vehicles, resulting in an oversupply. Finally, growing global emissions legislation has driven the supply of higher-priced battery electric vehicles (BEVs), which tend to be positioned at the premium vehicle end of the market. The increase in average vehicle price and mix has led to an improvement in OEM margins.

Historical OEM net profit margins have increased from an average of 4% in the 2002-2007 cycle to 7% in the 2011-19 cycle and 8.5% in the 2021-2024 cycle (source BNP Paribas). This most recent economic cycle for vehicles (post-COVID) has benefited from the knock-on effect of the shortage of vehicles, which allowed the OEMs to maintain more of their profit margins over this period. Such high margins are not expected to be seen in future years.

Chart 1: Price inflation in the US and Europe

Source: Edmunds, Eurostat, Bloomberg, BNP Paribas Exane estimates

Chart 1 shows the strong growth that has taken place in the average price of vehicles in the US and Europe. However, the big question is: can the average price of vehicles continue to grow at this rate? Average wages have not experienced the same increase as average vehicle prices, and there has been a return to a more normal supply of vehicles, suggesting that the new vehicle market should come under pressure and new vehicle prices should fall. With such high prices for new vehicles, it is believed that the used car market will continue to grow as consumers switch their spend from new to used vehicles, both internal combustion engine (ICE) and BEV. Although average new vehicle prices are expected to fall over time, other global market trends are at play. The mix of vehicles between volume and premium is also changing, with premium vehicle growth under pressure. However, the premium mix to volume differs from continent to continent.

Focusing on average new vehicle prices, this decline is expected to be caused by several key structural changes in the automotive industry.

The key structural changes that are likely to impact the price of new vehicles in Europe negatively include:

- Slowing sales of premium brands – Sales of premium vehicles are peaking in selected markets.

- Slowing sales of SUVs in certain markets – The SUV sales peak has reached its limit in certain countries (see Chart 2).

- Chinese competition – In the short term, the expected increase in the supply of Chinese competitor brands may slow in response to the implementation of sizeable tariffs, especially for BEVs. However, there is still uncertainty over the UK Government’s reaction and whether the UK will also impose tariffs on Chinese-made BEVs.

Premium brands have reached their peak

Global demand for premium vehicles has increased; however, this increase in demand has not been uniform across the world, with the strongest growth coming from China. This growth in China appears naturally to be running out of steam. It could further decelerate with increased tariffs applied in China on premium European vehicles as the Chinese Government reciprocates with tariffs on European and US vehicles imported into China, many of which are premium brand vehicles.

Chart 2: The decline of the premium brands in Europe and slowing growth in China and USA

Source: S&P Mobility BNP Paribas

Demand for Geman premium brands has declined in China since 2015, with a drop in market share for both BEV and ICE vehicles. However, it must be highlighted that the greatest decline is for New Energy Vehicles (NEVs) – an area in which the European brands do not have a technical advantage and rely more on brand names and reputation than the latest technological development for the sale of the vehicle.

Chart 3: The decline of the German brands in China

Source: EV Volumes, S&P Mobility, BNP

The SUV plateau

SUV sales have experienced substantial growth and have grown consistently since 1999, however the growth trend for such vehicles is starting to falter and flatten. The rise in SUV sales in recent years has been generated mainly by China, as the wealthy Chinese have moved from smaller segmented vehicles to larger ones. Now, demand seems to have flattened, with a penetration rate of about 46% in China, whilst demand for SUVs in Europe has levelled out at about 50%, with evidence of the start of a decline in this segment of the market. Higher interest rates and inflationary pressures may have been a key cause for softening European demand pricer SUVs.

Chart 4: The plateau of the SUV mix across Europe, US and China

Source: Motor Intelligence S&P and BNP

Chinese competition

China is slowly starting to enter the UK and European markets and this is expected to continue due to demand for lower-priced, value-for-money vehicles. Falling prices for these vehicles could be due to a number of reasons:

- Government-backed support for Chinese brands

- Changes in battery technology (the move from NMC to LFP batteries)

- The change in the production process for BEVs which reduces manufacturing costs and increases vertical integration of the Chinese supply chain, adding value to a more efficient cost equation for building a BEV. Owen Edwards has explored this in more detail in the Unboxing Process, which can be read in more detail in the following article: Unboxed: A new way to manufacture BEVs | Grant Thornton

- The high level of vertical integration of the Chinese automotive manufacturers reduces manufacturing and logistics costs

Tariffs on Chinese BEVs imported into the EU will likely slow demand. With these tariff increases, some Chinese BEV OEMs, such as BYD, have indicated that they will absorb 100% of the tariff in the short term before starting to build vehicles in the EU in the medium-to-longer term. Producing vehicles in the EU will mean that costs will rise versus a Chinese-built vehicle, but Chinese “made in EU” will still be at a lower price than most Western European OEMs. A move to produce Chinese “made in EU” vehicles is estimated to occur in 2026/27.

While China starts to increase vehicle capacity across the globe, European OEMs are expected to cut capacity in response to falling demand and diseconomies of scale generated by fewer ICE vehicle manufacturers and the ramping up of BEVs, which are not current at sufficient volumes to generate significant economies of scale. (See Chart 5).

Chart 5: Capacity growth by OEMs nationally (000 new produced vehicles)

Source: S&P Mobility

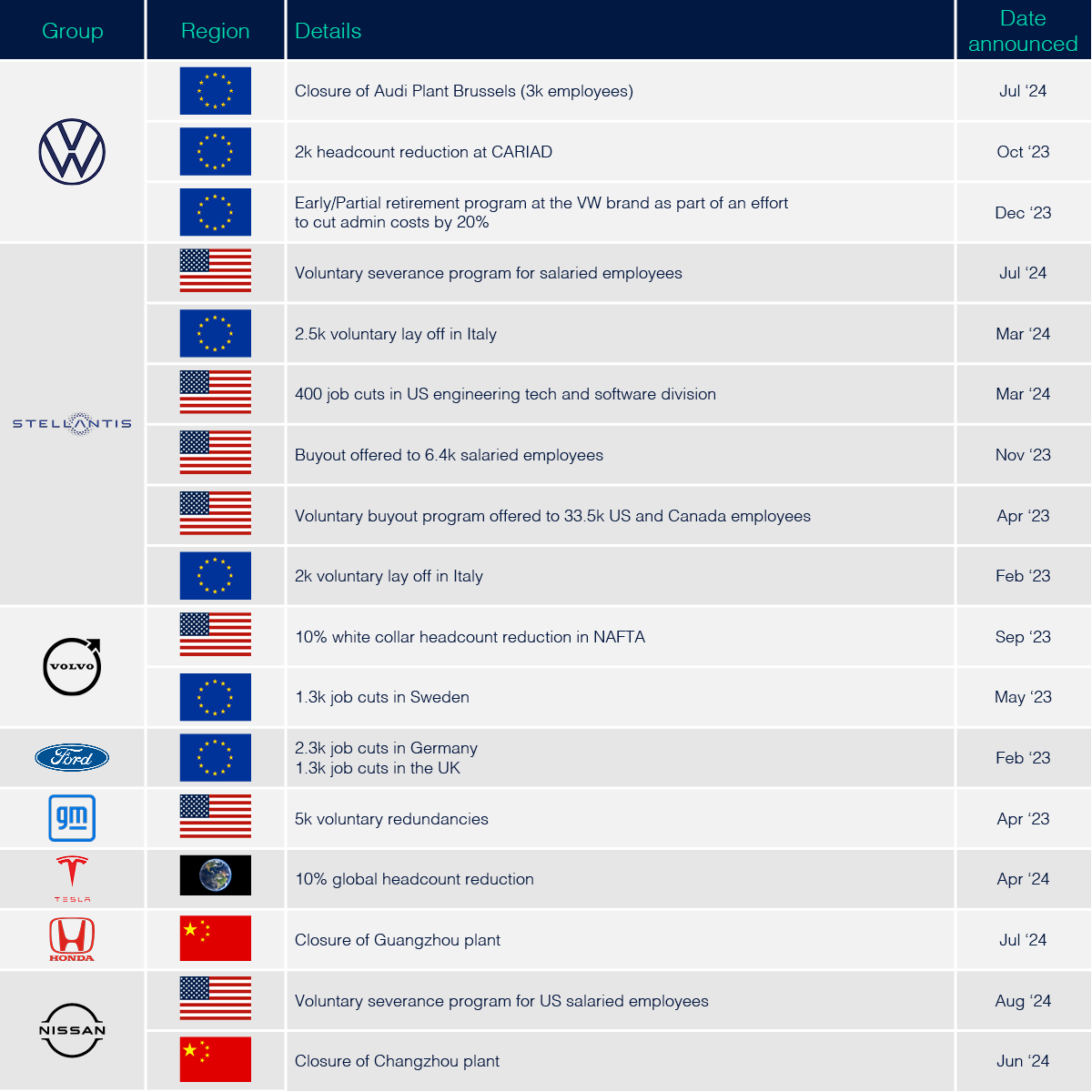

Chart 5 indicates that capacity worldwide is on the increase, with China leading the way, meanwhile, US availability is driven by investment due to the Inflation Reduction Act. However, there has been a decline in the number of vehicles in Europe, which is currently at 1.298m. Globally, the rise in capacity in an already oversupplied market and weak demand makes it necessary to reduce costs to maintain profitability growth in the automotive industry. Hence, there has been an increased focus on cost reduction over the last 12-24 months. Table 1 indicates the cost reduction programmes that have taken or are taking place.

Table 1 - Headcount cuts and plant closures announced in 2023 and 2024

Source: Web and BNP

In the short term – namely next 12-24 months – the automotive industry will continue to undergo cost reduction and change as both legacy and new OEMs start to wrestle with lower volumes driven by weaker global consumer demand, increased competition from Chinese brands and a shift in the mix of vehicles to lower-price vehicles. The highest cost reduction level is expected in Europe, followed by the US. It will be interesting to see how the supply chain bears up under the pressure of declining demand alongside the development of new technological vehicles, the fall in production of ICE, generating additional diseconomies of scale and the move to BEVs, which are not being produced in sufficient numbers to offset the losses from the falling production of ICE vehicles. The European OEMs will have to pivot from their main bloodline of ICE vehicles to BEVs, developing new ways of designing and manufacturing to ensure their survival in the medium-to-long term. Change is coming on a scale that has not been seen before, with many moving parts affecting the industry at the same time, and it won’t be long until this change results in the closure or “mothballing” of capacity. To reduce costs further and grow profits. OEMs across the globe will be reviewing their production processes and costs and focusing on how efficient and cost-effective their 1-4 parts suppliers are.

Nevertheless, a further risk remains for the OEMs. If they push their suppliers too hard, some may not be able to survive, and this is what we have seen with the insolvency Recaro Seats has had on Ineos Automotive production. Therefore, OEMs must understand their supply chain even better than before, as without fully understanding their supply chain, this could generate consequences which could cause distribution in the supply of vehicles.