Philip Nothard

INSIGHT DIRECTOR

6 min read

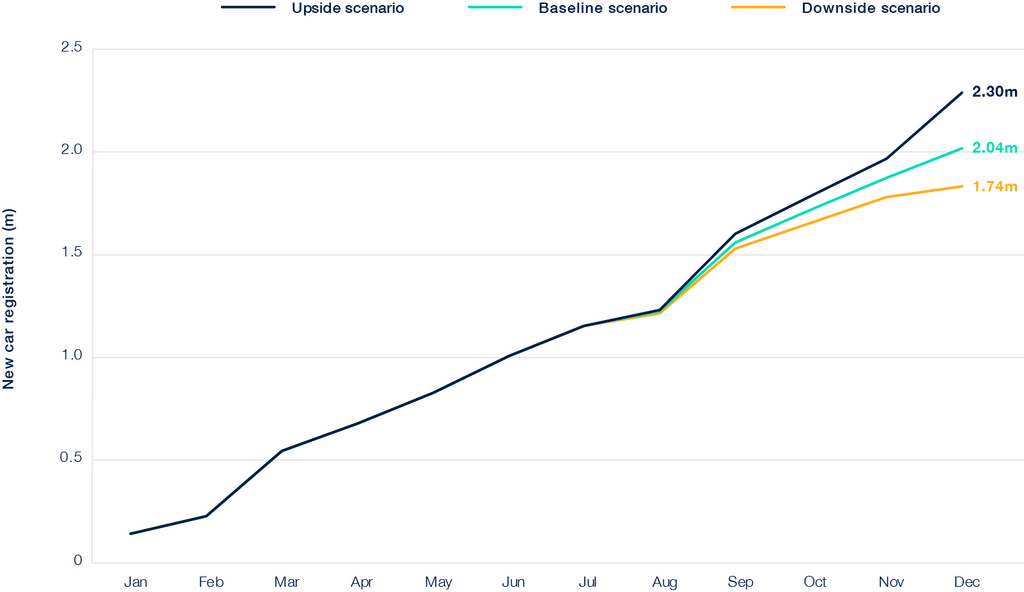

We have updated our new car forecast for 2025 using the latest new car registration data and our own proprietary insights and market intelligence. As usual, we’ve provided three scenarios – upside, baseline and downside. We believe the baseline is the most likely outcome.

Building on the accuracy of previous Cox Automotive forecasts, our baseline scenario projects 2,043,115 new car registrations by the end of 2025, representing a modest 3.6% increase over the full-year 2024 figure.

This reflects ongoing volatility driven by the transition to new energy vehicles (NEVs), including strategic shifts by traditional manufacturers and the impact of new market entrants. However, despite the predicted annual increase in new car registrations, the 2025 figure is still expected to be 11.6% below the 2000-2019 average – an indication of future sector challenges.

Source: SMMT / Cox Automotive

Upside scenario

In this optimistic scenario, business and consumer confidence has received a boost with a stronger-than-expected economic recovery on the back of the new government’s policies and Autumn Budget. While a smoother-than-anticipated shift to electric vehicles in the private market, drives consumer spending which creates a more stable and competitive environment among OEMs.

- A robust economic recovery outpaces GDP growth forecasts, reducing inflation and driving down interest rates. This leads to an increase in disposable income and heightened consumer confidence, translating to greater demand for both new and used vehicles.

- Emerging brands, especially from China, quickly establish strong consumer recognition and substantial product volumes, expanding market competition and eroding market share for established manufacturers. Especially within the growing BEV segment.

- Manufacturers and retailers meet ZEV targets with minimal financial strain or operational disruptions, aiding in a steady transition.

Baseline scenario

In the baseline scenario, the UK automotive sector faces continued economic challenges and complex adjustments to electrification regulations, set against a backdrop of cautious European and global market sentiment.

- With inflation and interest rates only slowly receding, household costs remain high, putting a strain on consumer spending. Despite these challenges, a gradual lift in consumer confidence is anticipated, with fleet sales continuing to sustain demand in the new vehicle market.

- Many OEMs have delayed the rollout of the agency sales model, reflecting a need for more transparent financial returns. As OEMs continue testing both pure and hybrid forms of the agency approach, shifting from traditional 'push' supply models, to demand-driven 'pull' sales are expected to reduce overall vehicle availability.

- Global vehicle production levels remain robust, but there is a growing mismatch between high production rates and the UK's ambitious ZEV targets. This disparity raises questions about OEMs' commitment to meeting UK mandates, particularly as the ZEV rules pressure for manufacturers to increase BEV shares.

- The drive to reduce ICE production to comply with ZEV targets presents logistical and strategic challenges. As OEMs work to balance BEV mandates with production realities, the market must adapt to new complexities in vehicle supply and demand for 2025 and beyond.

Downside scenario

In the downside scenario, the UK's new car market faces significant challenges as the economic impact of the Autumn Budget and ongoing inflationary pressures, dampen consumer confidence and spending capacity. Persistently high living costs and cautious business activity continue to strain the automotive sector's recovery, adversely affecting new car registrations.

- Despite government interventions, inflation remains stubbornly high, eroding disposable income and limiting household spending on big-ticket items like new vehicles. Rising interest rates exacerbate these pressures, further restricting consumer budgets and dampening demand in the private and fleet markets.

- The government's efforts to transition to electric, struggles to gain traction amid insufficient incentives and underdeveloped charging infrastructure. Consumer demand stagnates, limiting OEMs' ability to meet ZEV mandate targets. This sluggish transition impacts the pace of electrification and raises concerns about long-term environmental goals.

- While new entrants initially saw success, they encounter obstacles in building brand loyalty amid economic uncertainties and cost pressures. Legacy OEMs also face difficulties maintaining market share, especially with disruptions in traditional sales models and challenges in meeting BEV production targets.

- The UK's automotive sector is less attractive as OEMs face high regulatory compliance costs with the ZEV mandate. Many manufacturers shift their focus to more promising markets, leading to supply constraints in the UK. This affects fleet demand, with fewer options for companies seeking to replace ageing fleets under current economic pressures.

Source: Cox Automotive