For two years now, the used car market has enjoyed a period of unprecedented performance. Consumers who have grown tired of lengthy wait times on their new car orders have increasingly turned to the used market, driving record demand levels and, in turn, trade values. However, a market like this can’t last forever, and although we do not expect performance to drop off a cliff, could the bubble be about to burst?

Current signs indicate it could be. Consumer confidence is weakening, with the UK consumer confidence index showing a five-point drop to -31 index points in March, its lowest reading in 17 months. This indication that consumer spending appetites are waning should come as no surprise: inflation, soaring energy costs and national insurance hikes are causing a massive rise in the cost of living. The knock-on effect on the used car market is inevitable.

The used vehicle market remains crucial at a time when new car supplies face further pressures. Dealers will continue to rely on their used car programmes to support their businesses while they simply cannot get the new cars they need. The used market remains a crucial area of growth and investment for many, whether from current players or new disruptive entrants.

As always, used car supply relies heavily on the new vehicle market. But while today’s used car market is demand-driven, there remains continual pressures on new car supply, and this is having an impact on the used vehicle parc. The result could be a supply-driven used car market that sees prices maintain their current record levels or increase further.

But for the time being, the market is coping extremely well and has demonstrated resilience to these external pressures, with 7.5 million used car transactions in 2021. Although this may not have necessarily been a result of strong retail demand, nevertheless it’s a positive result compared to 2020.

Consumer demand still exists, but the effect that reduced consumer confidence will have on the market remains to be seen. At least for now, retailers are seeing increased stock turn and a desire from consumers who are not prepared to wait the lengthy lead times to buy a used vehicle instead – but this could all be about to change.

Used car values - the latest

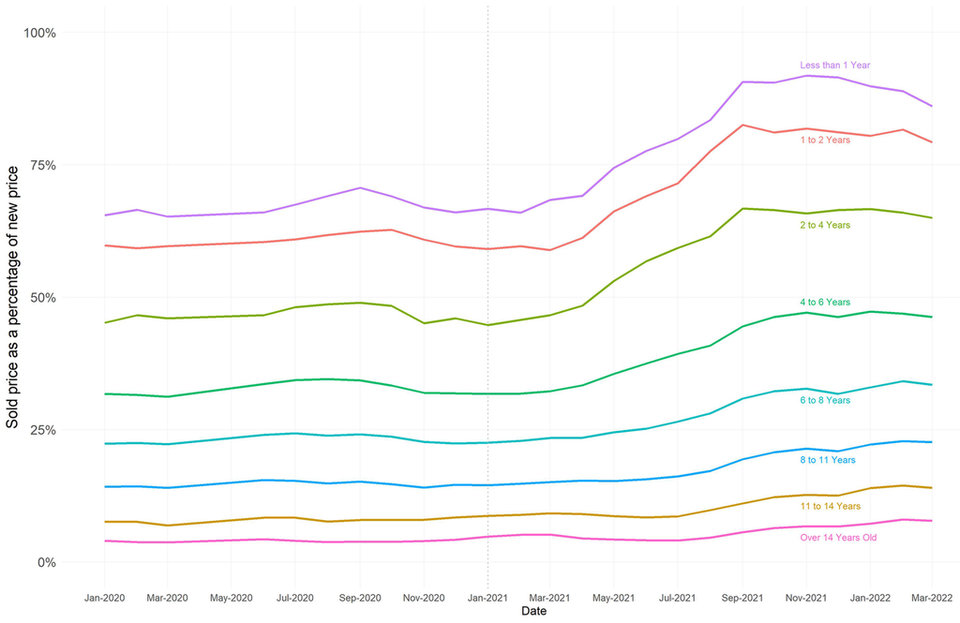

With the much-publicised increase in the cost of living, in addition to the Easter holidays, it would be remiss not to expect consumer demand to begin to ease from April onwards. And this reduced demand is already starting to impact used car values. Although we are still hearing reports of nearly new vehicles achieving above original cost new (OCN), as the chart below illustrates, the acceleration of trade values for most age bandings has begun to stabilise.

Source: Manheim data compared as values against OCN (Original Cost New inc. VAT)

Due to the headwinds facing the new vehicle market, we anticipate the sub-one and one-to-two-year brackets to be most affected immediately. But with the recent decline in used vehicle trade values and the easing of wholesale demand, we anticipate the market will see a further decline in values throughout the second quarter and possibly into Q3.

What’s clear is that we won’t see values drop off a cliff. Used vehicle values are still at a significant high point compared to the pre-pandemic market, and the effects will be different across all makes, models, and ages. For example, there is still high demand in the sub £5K and £10k sector, as well as for higher-priced vehicles, while the mid-market is feeling the most pressure as mass-market buyers tighten their belts to compensate with the rising cost of living.

Consequently, it has never been more important for retailers to analyse their pricing position, review stock profiles, and regularly monitor the retail and wholesale markets. But, as the old saying goes, the devil is in the detail.

The used van market

“The first-quarter LCV marketplace has undoubtedly felt very different with overall price robustness. LCVs currently exceed +12% (£1,249) more than in 2021, whilst age and mileage dynamics continue to rise. Nevertheless, buyers continue to shine through, with Euro 5 prices +71% (£2,252) more today on average at £5311 versus pre-pandemic and Euro 6 costing +58% (£4,366) more on average at £14,063.

However, these performances cloud the feel and temperature, with reports of a significant reduction in retail sales, enquiries, and activity versus the past 18 months of the super-heated market and buoyancy we have all witnessed.

Market and business confidence shows signs of slowing as buyers adopt a more cautious approach. Consequently, it is fair to say the above factors have brought some softening to the wholesale key indicators, with first-time conversion rates easing to 67.2% compared to the highs of 82.7% during the pandemic.

The second quarter will see values ease further, and overall volumes will remain positive. However, prices will remain robust, but business confidence and retail price patience will be crucial.”

Matthew Davock, Director of Commercial Vehicles,

Manheim Auction Services

Used car forecasts – Q2 and Q3 focus

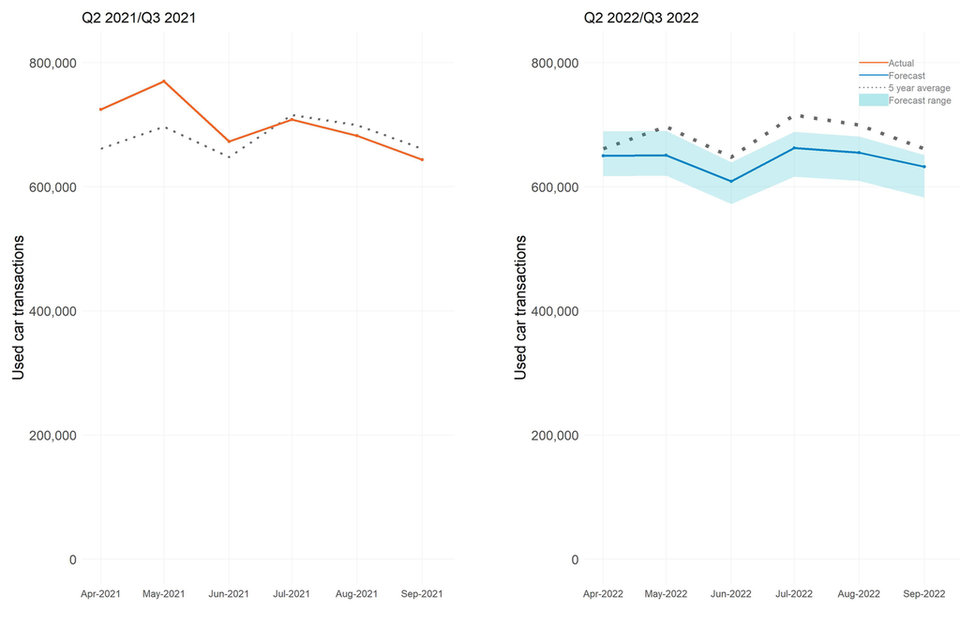

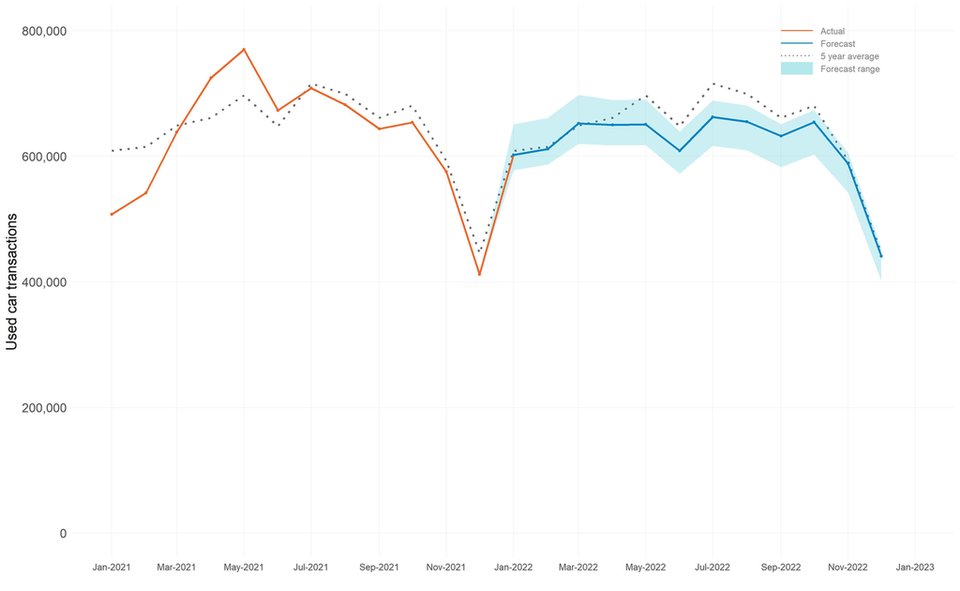

Building on recent used car sales, assumptions for the remainder of 2022, and taking into account the factors mentioned above, we have adjusted our forecast for used car sales in 2022.

Upside scenario

Our upside scenario sees Q2 2022 end on 2.02 million transactions, a -6.8% decrease year-on-year, +5.0% up on the 2001-2019 average, and -0.7% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q3 2022 ends on 2.02 million transactions, -0.7% down year-on-year, +5.0% up compared to the 2001-2019 average, and -2.7% down compared to 2019.

Baseline scenario

Our baseline scenario sees Q2 2022 end on 1.91 million transactions, a -11.9% decrease year-on-year, -0.7% down on the 2001-2019 average, and -6.1% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q3 2022 ends on 1.95 million transactions, -4.2% down year-on-year, +1.3% up compared to the 2001-2019 average, and -6.1% down compared to 2019.

Downside scenario

Our downside scenario sees Q2 2022 end on 1.81 million transactions, a -16.6% decrease year-on-year, -6% down on the 2001-2019 average, and -11.1% down when compared with the most recent pre-pandemic 2019 performance.

In this scenario, Q3 2022 ends on 1.81 million transactions, -11.1% down year-on-year, -6% down compared to the 2001-2019 average, and -12.9% down compared to 2019.

Source: Cox Automotive

Used car forecast - 2022 full year

Upside scenario

Our revised upside scenario for 2022 sees the year end on 7.78 million used car transactions, a +3.3% increase year-on-year, and a marginal +1.0% upgrade on our previous forecast due to the market factors previously mentioned.

Baseline scenario

Our revised baseline scenario for 2022 sees the year end on 7.41 million used car transactions, a -1.6% decrease year-on-year, and a -1.3% downgrade on our previous forecast.

Downside scenario

Our revised downside scenario for 2022 sees the year end on 6.95 million used car transactions, a -7.7% decrease year-on-year, and a -2.2% downgrade on our previous forecast.

Source: Cox Automotive

The US perspective

“The used market in the US also saw a much weaker than expected first quarter, but demand should improve in the second quarter and performance for the year should at least meet our original expectations in part because of the continued supply challenges in the new vehicle market. The Omicron wave and winter weather initially impacted the first quarter in January, but the defining factor for February and March was a slower start to tax refund season. The issuance of tax refunds each year drives the busiest months for used sales in the US in February, March, and April. Due to backlogs and staffing issues, the issuance of tax refunds in 2022 was more than three weeks behind normal. As of mid-March, only 40% of expected tax refunds had been issued when normally close to two-thirds would have been disbursed. As a result, used retail demand remained behind the volumes seen over the last three years. However, the average refund is tracking higher, up 13% year over year. That bodes well for strong demand in the spring once more consumers receive their refunds. However, surging inflation, particularly in food and energy costs, may reduce consumer spending on vehicles. In addition, rising interest rates are becoming more of a factor in the used market, so the spring season is likely to be more muted in 2022. However, used vehicle values are still likely to see another run of price increases, peaking in April or May. Wholesale price increases were already beginning in March as retail demand started to strengthen and as rental car companies began buying used vehicles again as deliveries of new vehicles were limited by the production challenges. We continue to expect that the second half of the year will see slower used sales and above-average depreciation in values. Still, demand is likely to be stronger than it would have been because of the continuing supply challenges in the new vehicle market. Risk is to the upside for used vehicle sales and values as long as the new vehicle market remains severely constrained.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc