Another blow

to new car recovery hopes

In this section, we discuss the primary factors driving the current new car market and share our latest new car forecasts.

Continue reading

We entered the new year knowing that new car supply would remain constrained for the foreseeable future but hopeful of a smooth and progressive recovery throughout the year as semiconductor and raw material supplies steadily returned. However, with the appalling conflict in Ukraine impacting the automotive supply chain and the entire logistics and distribution network, that recovery looks murkier than ever.

None of us foresaw the Ukraine conflict at the start of the year, but it’s added an additional layer of risk to the market, and as a result, our predictions for the year must be revised.

But even without the Ukraine crisis, we would have been looking at a revision to the forecasts. While there have been anecdotal reports that manufacturers have begun to fulfil orders from a supply-starved leasing sector and even reports of of tactical registrations (albeit nowhere near pre-pandemic levels), supply has not picked up in the volumes anticipated.

More supply headaches

Much of the registration activity in quarter one came from the long-awaited fulfilment of orders made 12 or even 18 months ago, and this is likely to be the case going into quarters two and three. There are also reports of this year’s order books already being full, so it’s clear the backlog of orders will only grow, and new orders won’t turn into actual registrations until at least H2 2022 or even into 2023. Even as raw material supplies improve, it will take a long time for this backlog to be cleared.

Many of the cars eventually rolling off the production line are missing specifications such as touch screens, heated seats, and sat-nav. This workaround is a short-term solution many manufacturers are implementing due to the ongoing semiconductor shortage but means consumers are often compromising on what they initially wanted in order to receive a car they ordered over a year before. The effect of this on residual values is as yet an unknown but it’s inevitable there will be an consequence when cars manufactured during this period find themselves competing with correctly specified cars in the used market several years from now.

Looking ahead, where we do see green shoots of supply entering the market, this will continue to vary from one manufacturer to the other, and even down to specific models and derivatives.

Those fulfilling their backlog of orders first will the manufacturers that have fared better at securing crucial orders of chips and raw materials. But no manufacturer can currently produce all the models and derivatives they would like to, so we will continue to see businesses focusing on those models that fulfil consumer demand and bring higher profitability.

In these uncertain times, the supply-driven new vehicle market will continue to operate differently from the more demand-driven used market.

More new car price increases?

Price rises have been a feature of the used car market for over two years now, and now the new car market is no longer immune. We had already seen evidence of price increases coming from manufacturers as they realised their pricing power. However, with the continued increase in the cost of raw materials and energy due to a fractured global supply chain and increased demand from non-automotive sectors, will these price increases be enough?

We believe that residual values could support new vehicle schemes for some time as there is no weakness on the horizon for used car prices, but how long can the used car market make up for dealer shortfalls in the new car market? It’s impossible to predict until we know how the various economic and geopolitical factors will play out in the coming months. But what we do know is that new vehicle incentives continue to fall to record lows across global markets, pushing more and more consumers towards the used market, so for at least the short to medium term, used vehicles will remain crucial.

The new van market

“The new LCV market is perfectly balanced, with the early stages of 2022 showing a 14.6% increase in the pre-pandemic volume levels. The robustness of the LCV sector is clear, and 2022 has started healthily. The new market continues to be fuelled further by the major fleet, rental and leasing sector placing thousands of orders as the manufacturers try and find solutions to keep up with the strong demand in the UK today.

Demand for new battery-electric vans grew exponentially during the early stages of 2022 as a result of some significant fleet orders, with an impressive 1,741 units registered in one month, up +347.6%.

As many as 405,000 have been ordered but not yet built for the UK market; therefore, if the manufacturers find the perfect solutions to accelerate these production volumes, 2022 could be one of the strongest ever new van markets on record for the UK.”

Matthew Davock, Director of Commercial Vehicles, Manheim Auction Services

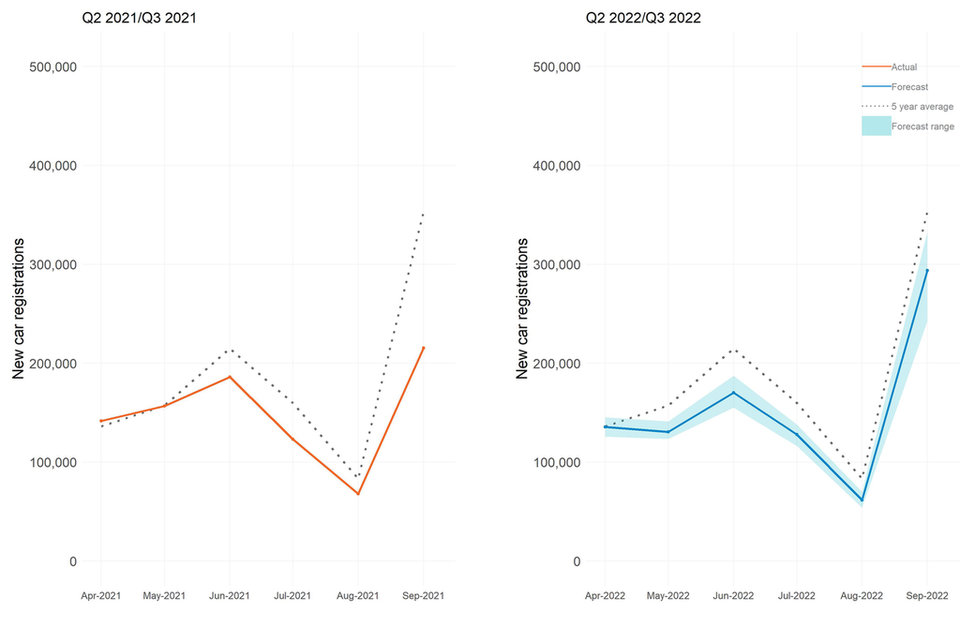

New car forecasts – Q2 and Q3 focus

Building on recent new car figures, the market factors mentioned above, and in line with previous Cox Automotive forecasts,

we have adjusted our new car registration forecast for 2022.

Source: Cox Automotive

Upside scenario

In our upside scenario, we predict Q2 2022 will end on 473,785 registrations, -2.2% down year-on-year, -14.4% down compared to the 2000-2019 average, and -16.6% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q3 2022 to end on 541,045 registrations, a +36.5% increase year-on-year, but -14.8% down compared to the 2000-2019 average, and -8.8% compared to the most recent pre-pandemic 2019 performance.

Baseline scenario

In our baseline scenario, we predict Q2 2022 will end on 436,286 registrations, -9.9% down year-on-year, -21.1% down compared to the 2000-2019 average, and -23.2% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q3 2022 to end on 483,433 registrations, a +22% increase year-on-year, but -23.9% down compared to the 2000-2019 average, and -18.5% compared to the most recent pre-pandemic 2019 performance.

Downside scenario

In our downside scenario, we predict Q2 2022 will end on 404,469 registrations, -16.5% down year-on-year, -26.9% down compared to the 2000-2019 average, and -28.8% down when compared with the most recent pre-pandemic 2019 performance.

We forecast Q3 2022 to end on 413,171 registrations, a +4.2% increase year-on-year, but -34.9% down compared to the 2000-2019 average, and -30.3% compared to the most recent pre-pandemic 2019 performance.

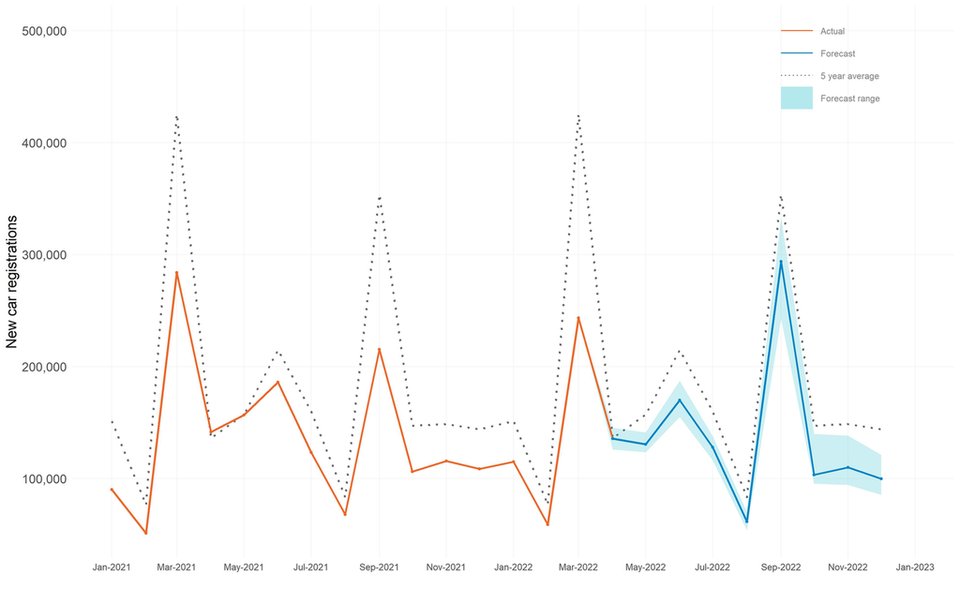

New car forecast - 2022 full year

Source: Cox Automotive

Upside scenario

Our revised upside scenario for 2022 sees the year end on 1.83 million registrations, a +11.2% increase year-on-year, but a -14.1% downgrade on our previous forecast due to the market factors described previously.

Baseline scenario

Our revised baseline scenario for 2022 sees the year end on 1.65 million registrations, a +0.2% increase year-on-year, but a -13.8% downgrade on our previous forecast.

Downside scenario

Our revised downside scenario for 2022 sees the year end on 1.51 million registrations, a -8.3% decrease year-on-year, and a -11.3% downgrade on our previous forecast.

The US perspective

“The new vehicle market failed to see improving trends in the first quarter as new production and supply chain issues emerged, which caused deterioration in sales when expectations for the year had been for modest improvement. The first quarter started with challenges from record COVID cases driven by the Omicron variant as well as waves of harsh winter weather. When the Omicron wave of COVID receded and winter weather became less of a factor, the conflict in Ukraine, a surge in COVID in China, and a series of production and supply chain setbacks led to declining sales on a seasonally adjusted basis as the market was unable to deliver the normal seasonal lift in February and March. The quarter ended with supply down more than 70% from normal, or about where it was to start the year. With supply challenges likely to linger into the second half of the year, sales expectations for the year have been downgraded to, at best, a slight improvement over the 2021 results. As a result of the reduced production expectations, manufacturers and dealers will continue to enjoy strong pricing power even if demand fades with pressures from inflation and higher interest rates slowing the pace of economic growth in the US Indeed, interest rates moved more than expected in the first quarter and will likely see even more movement over the rest of the year as the Federal Reserve pursues a hawkish monetary agenda likely to feature seven or eight rate increases for the year. Such moves will make demand conditions more challenging in the second half of the year.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc