The role of the environment and sustainability in the car buying journey

In this section eBay Motors Group exclusively reveals the findings of new research identifying how consumers are considering EVs and hybrids as their next car purchase.

Continue reading

Dermot Kelleher, Head of Marketing and Research, eBay Motors Group

September 2021 marked the inflection point whereby year-to-date registrations of both electric vehicles (EVs) and plug-in hybrid (PHEVs) began to outstrip diesel cars.1

Alternative fuelled cars are also starting to gain ground in the used market with the most recent figures from the Society of Motor Manufacturers and Traders showing that the highest ever quarterly jump in EV sales took place in Q3 2021 with 14,182 cars changing hands, a 56% year-on-year rise.2

But what’s driving the change for consumers? Are they focused on legislative changes, which have already seen the emergence of Clean Air Zones in city centres and the banning of new internal combustion engine (ICE) cars from 2030, wider environmental considerations, the growing choice of models on offer from the OEMs or the potential to reduce their mobility costs?

To help understand the current and future purchasing intentions of used car buyers, eBay Motors Group commissioned independent research to identify the role of environmental and sustainability issues in informing their decision-making processes.

The results are presented here exclusively for Cox Automotive’s AutoFocus.

About the research

The timing of the consumer research (12th to 17th November) was critical, taking place at the end of the second week of the Glasgow-hosted COP26 conference, a time of heightened debate on global environmental and sustainability responsibilities. Also, while the nationwide disruption to fuel supply was still fresh in buyers’ minds.

As part of eBay Motors Group’s ongoing Consumer Insight Panel, Insight Advantage polled the views of 1,996 in-market used car buyers visiting Motors.co.uk. Respondents were drawn from across the UK, aged from 18 to over 65, 55% male and 45% female. [CH2]

To track changing views respondents were also asked a series of questions asked back in February 2020, the last month of relative “normality” before the pandemic prompted the UK’s first ever lockdown in March 2020.

A key objective of the research was to provide used car retailers with fresh insights into how car buyers, considering their next purchase, are now factoring in alternatives to traditional ICE cars – and by so doing, give these dealers a competitive advantage.

Theme 1: Entering the mainstream: how EV and hybrids are now

the next fuel choice for over one-fifth of used car buyers.

There has been a significant increase in buyers claiming their next vehicle will be an EV

What fuel type do you expect your next car to be?

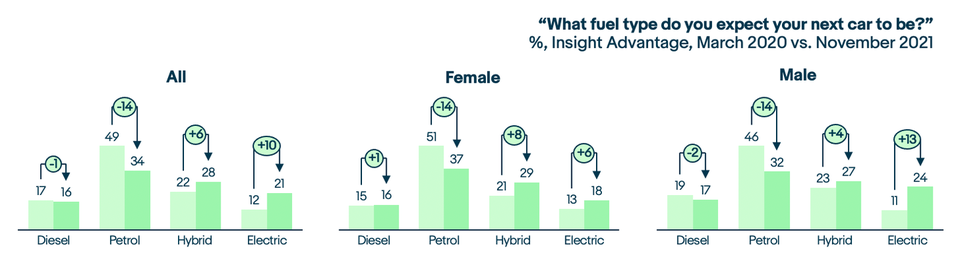

The survey identified significant changes in buyer attitudes to fuel type, by gender and age, compared to the last Consumer Insight Panel research.

The percentage of car buyers claiming their next car will be an EV increased from 12% [CH3] in March 2020 to over one-fifth (21%) in November 2021, surpassing diesel on the way and outpacing the rate of growth for hybrid, which remains the most popular alternative to ICE for 28% of buyers.

The accelerated increase in buyers keen to purchase an EV has been achieved at the expense of petrol, which fell 14 percentage points from around half of all buyers (49%) to just over a third (34%).

Over half (51%) of male buyers expect their next car to be an EV or hybrid, closely followed by 47% of women.

Furthermore, around a quarter of men (24%) now plan to go totally EV, a notable jump from just 11% in March 2020, with hybrid growing at a slower rate from 24% to 27%, whilst the inverse is true for female buyers, where appetite for hybrid vehicles has increased from 21% to 29%, growing at a faster rate than EVs, up from 13% to 18%.

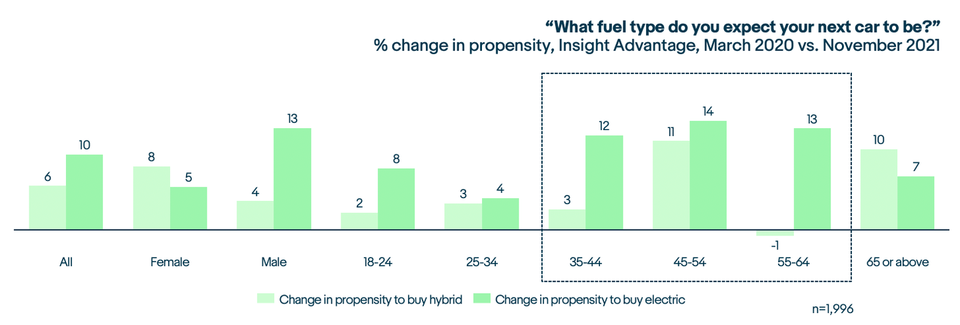

Overall, the increase in appetite for EVs is driven by older buyers aged 35-64.

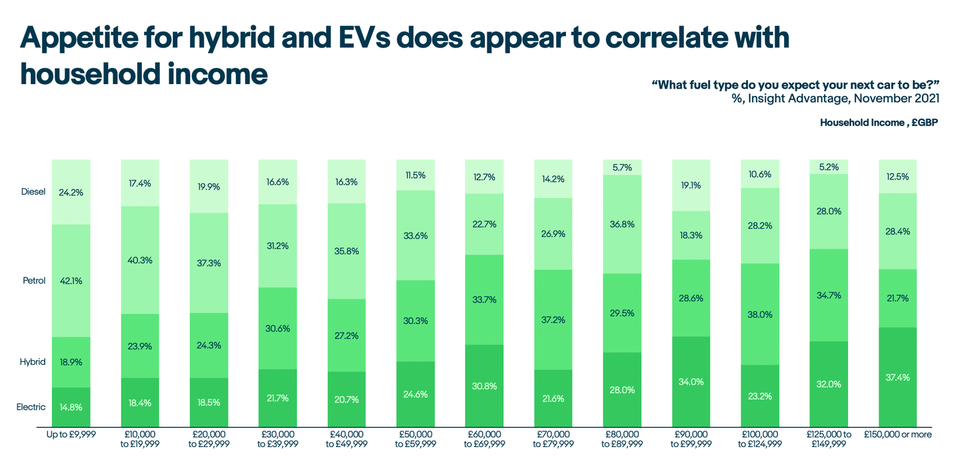

Income is also identified as an important factor influencing the transition from ICE, with higher income households naturally more able and prepared to make the higher investment required.

Hybrids are the most popular alternative fuel choice accounting for over a quarter of households generating £30,000 to £99,999, rising to 38% for those earning £100,000 to £124,999, while EVs are the next fuel choice for over 20% of households with incomes ranging from £30,000 to £89,999, peaking at 34% for those earning between £90,000 and £99,000.

Understandably, petrol and diesel are the most popular choices among lower income households, respectively accounting for 37.3% and 19.9% of households earning £20,000 to £29,999.

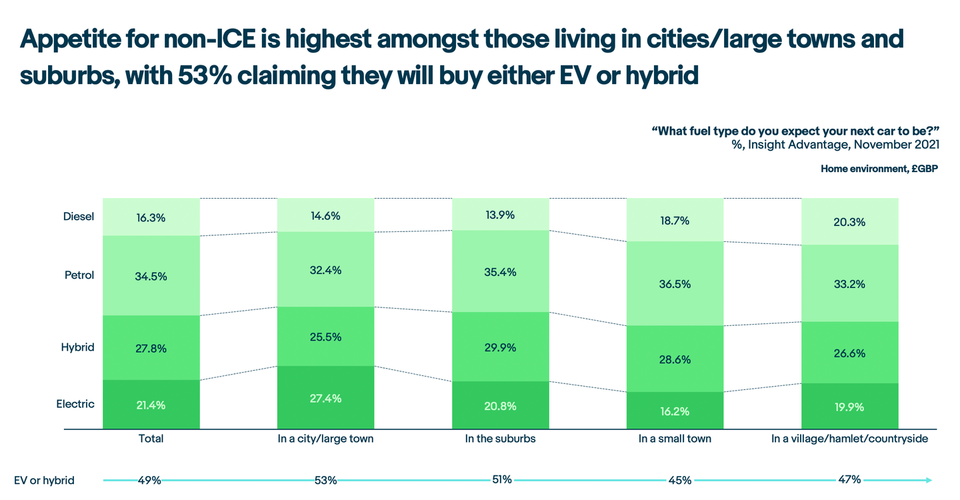

The appetite to buy non-ICE cars is highest among those consumers living in cities and large towns, where the preference for EVs (27.4%) and hybrids (25.5%) is evenly split.

However, the appeal of EVs drops, compared to hybrids, when the requirement to charge away from home becomes a consideration, dipping below diesel in small towns and countryside location.

“Consumers are giving more serious consideration to EVs and hybrids than ever before and our research identifies how it is largely at the expense of petrol. With diesel in decline for some time, we believe the recent fuel shortages, rising pump prices and even COP26 are influencing choices right now, especially among owners of petrol cars.

“Dealers planning their stock mix can now factor in those male and female buyers are fairly evenly committed to making the switch from ICE, with both favouring hybrids. However, it’s also worth considering the biggest growth by gender shows around a quarter of men now saying their next car will be an EV and we expect this figure to increase.

“Meanwhile, there persists a relationship between the desire to switch and household income, with the higher entry price understandably proving to be a deal breaker for lower income buyers.”

Dermot Kelleher, Head of Marketing and Research, eBay Motors Group

Theme 2: The impact of environmental and sustainability issues on next used car choice

75% of buyers who claim they will buy hybrid or electric next time are mainly

doing so to either reduce their carbon footprint or their emissions

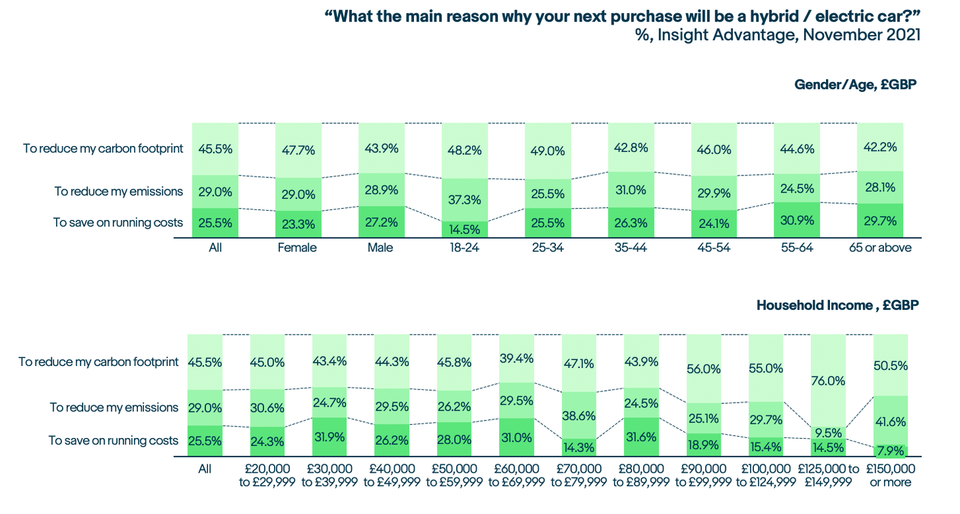

What is the main reason why your next purchase will be a hybrid/electric car?

Having identified the 49% of buyers who said they will buy an EV or hybrid as their next car, the survey then asked what was informing and driving their decisions.

Overall, nearly three-quarters (74.5%) cited environmental factors – either to reduce their emissions or carbon footprint, while the balance wanted to reduce their running costs.

The reduction of carbon footprint is the most compelling reason for 45.5% of buyers and the dominant reason regardless of gender or age.

Reduced emissions accounted for 29% of buyers and is evenly split by gender, peaking at 37.3% of buyers aged 18-24 years old.

Cost savings accounted for 25.5% of consumers, appealing more to male buyers (27.2%) than female buyers (23.3%). It is also favoured by drivers aged over 25, rising to 30.9% for those aged 55-64.

Reduced running costs are also slightly more significant for those with household incomes between £30,000 to £70,000.

The main barriers to EV adoption remain higher purchase cost,

access to charging and time to recharge/range anxiety

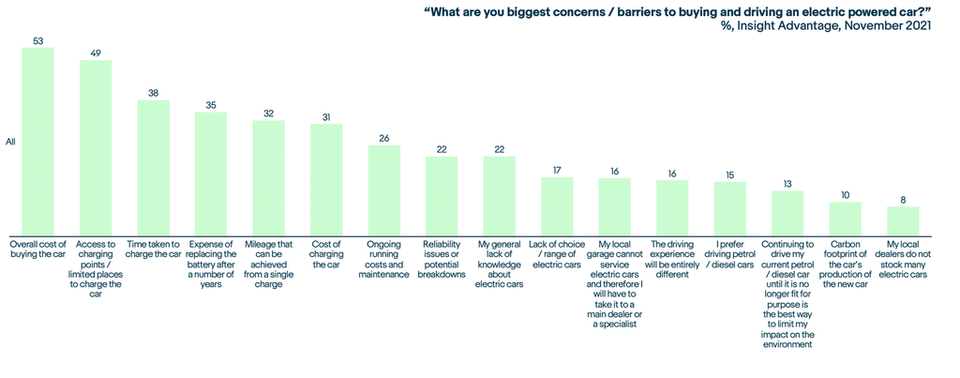

What are your biggest concerns/barriers to buying and driving an electric powered car?

Having made the decision to switch, cost of purchase is the biggest barrier to EV adoption for over half of the buyers (53%). This is closely followed by access to charging points (49%), charging times (38%) and the cost of replacing batteries (35%).

Range anxiety, once widely considered to be the major stumbling block for adoption, is only cited by 32% of respondents.

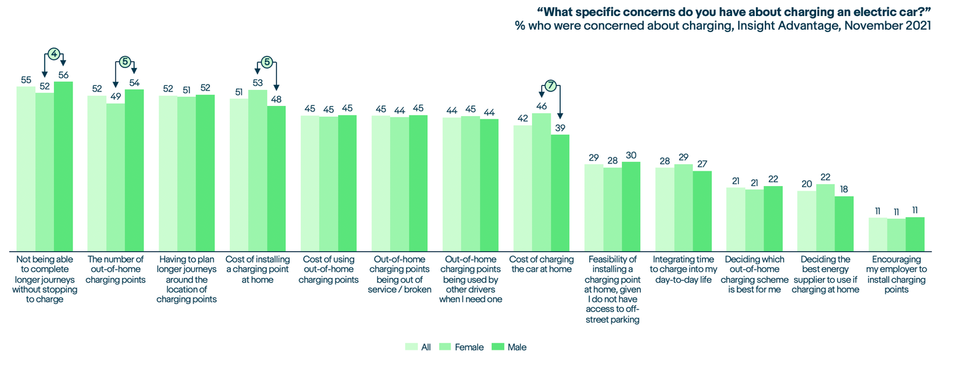

For those concerned about charging, the issues are mainly related to out of home availability and cost

To get a better understanding of concerns around charging, these buyers were asked to identify their main issues.

Not being able to complete longer journeys without stopping to recharge is the biggest concern for over half of these buyers (55%).

The recharging infrastructure is a concern for 52% of buyers along with the perceived need to plan longer journeys around charging point locations.

While the cost of installing home charging points is a concern for 51% of these buyers.

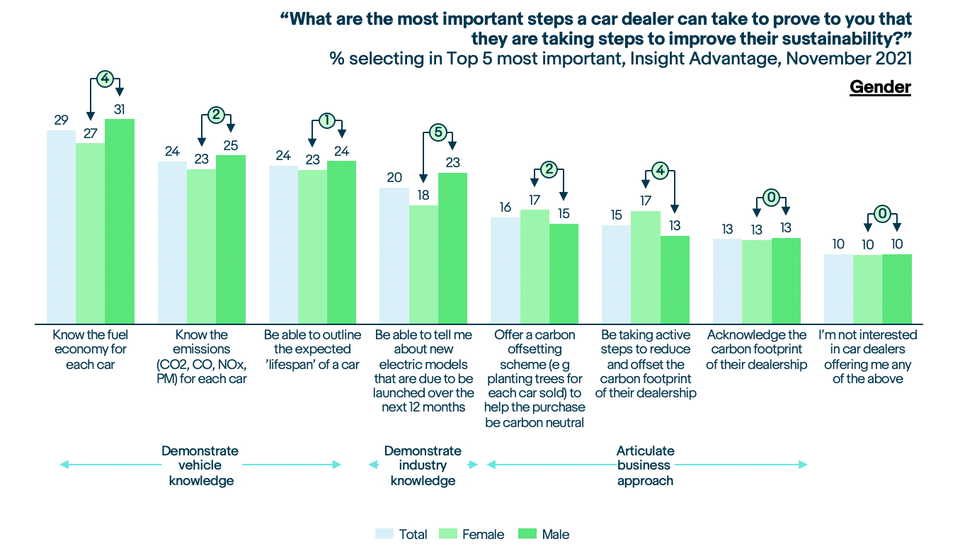

“Three-quarters of consumers currently considering buying a used EV or hybrid are doing so to reduce their emissions or carbon footprint.

“For dealers this means providing as much information as possible on the environmental and sustainability credentials of the cars they’re selling with clear messaging online, in the showroom and on the forecourt.

“With 90% of buyers saying automotive retailers do need to take steps to improve their sustainability, dealers also need to ensure their sales staff are aware of the environmental benefits of these cars and be able to convey this to buyers, especially those taking their first tentative steps away from ICE-powered cars. This is where product knowledge and expertise, supported by training, will play valuable roles in helping match the best possible EV or hybrid to a buyer’s individual requirements.

“Furthermore, dealers taking proactive measures to reduce their environmental impact through energy saving or carbon offset schemes, need to share what they’re doing online and in-person – this is powerful messaging which will resonate with buyers.”

Dermot Kelleher, Head of Marketing and Research,

eBay Motors Group

Sources

1 Society of Motor Manufacturers and Traders, September EV Registrations (5 October 2021)https://www.smmt.co.uk/2021/10/september-ev-registrations-4/

2 Society of Motor Manufacturers and Traders, Used Car Sales: Q3 2021 (9 November 2021)https://www.smmt.co.uk/2021/11/used-car-sales-q3-2021/