Further change in the automotive downstream market

In this section, Grant Thornton discusses the changes coming in the distribution and retailing of vehicles.

Continue reading

Owen Edwards, Head of Downstream Automotive

at Grant Thornton UK LLP

The automotive downstream industry (distribution and retailing of vehicles) will see more change in the next five years than in the last 50. Change in the market will not be caused by one single factor – for example, the agency model or BEVs, which are receiving a great deal of press –

instead, there will be numerous factors that are interlinked and will all take place simultaneously over several years. As all these changes start to converge in the future, the auto-downstream industry is set for significant change.

Consumer interest in EVs is increasing, which is generating demand for BEVs. On top of this, intensifying emission regulations and significant fines imposed on the OEMs, especially in Europe and China, is increasing the supply of vehicles with a large number of BEVs to be launched in 2022 and beyond. In the UK, the market share of BEVs reached c25% in December 2021 (source SMMT), more than double that of diesel vehicles’ market share. However, the retail price and production costs of BEVs remain high, which is one of the key reasons that will prevent an even faster take-up of BEVs in the short term.

In order to reduce the impacts of emissions fines and maintain a BEV retail price that is affordable, the OEMs have had to invest heavily in BEV and low emission vehicle technology. For the OEMs, this has increased the cost of developing new technology, which has impacted their earnings. As the OEMs strive to improve earnings in an uncertain and changing market, they are reviewing their costs in order to meet financial targets. OEMs are evaluating their cost base in the supply chain and the distribution and retail of vehicles. The desire to reduce costs has led OEMs to reassess their B2C retail model to see whether selling directly to customers will reduce costs. For many years, numerous OEMs – including Audi, BMW, VW and GM – have directly sold to fleets. However, this direct sales route for fleet customers is a different and more straightforward proposition than the B2C sale process. Tesla and Polestar brands have implemented the direct B2C model, with Tesla making the B2C direct process work through its vertically integrated retail network (VIR – the ownership of both the distribution of vehicles and all the dealer outlets). The VIR, matched with the sale of BEVs, has been a successful B2C selling route. Market share for Tesla has increased significantly in the UK, with Tesla Model 3 being the best-selling vehicle in December 2021 at 9,612 vehicles or 8.8% market share (source SMMT). Most OEMs will struggle to become VIR due to their legacy distribution processes.

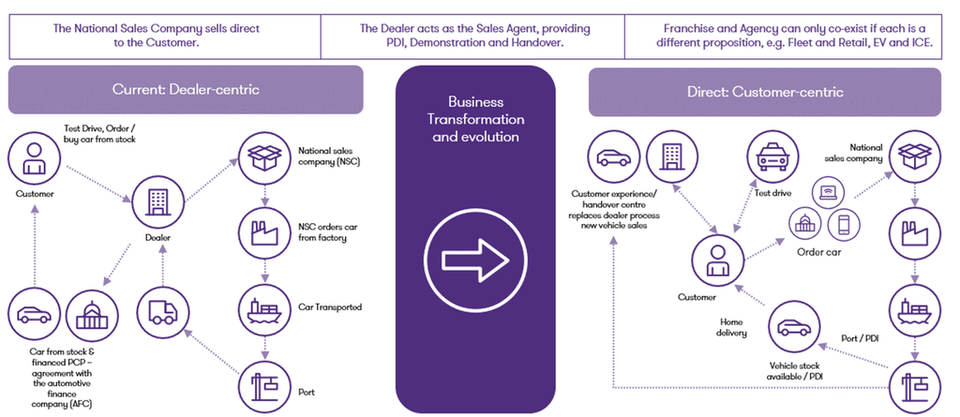

A growing number of OEMs have publicly indicated that they will be undertaking a direct sales model process for the B2C market; in particular, Stellantis, Mercedes Benz and VW have reported that they will be implementing a direct B2C process, also known as the agency model. At present, it is unclear whether this will be the full agency model –, in which all transactions will be undertaken online. The dealer receives a handover fee as part of the process versus a derivative model that includes some of the characteristics of the current franchise model. However, the OEM still sells directly to the consumers, with the dealer takes some part in the sales process. The graphic below compares the current franchise sales process and the full agency model.

Source: Grant Thornton

We believe that the full agency model is unlikely to be implemented by all OEMs; instead, the agency derivative model will be preferred. The reason for our thinking is that all OEMs and their dealer networks are different, and in order to fulfil the required growth strategy of each of the OEM and its dealer network, each OEM will need a different model; there will be no single standard agency model that fits all.

Nevertheless, under both the agency and derivative model, the customer becomes more central in the sales process. This, in turn, provides the OEM with significantly more insight into customer buying habits. Moreover, this direct connectivity with the customer gives the OEM greater scope to provide additional omnichannel services, thereby putting the customer at the centre of any transaction that takes place, from vehicle sales to service and repair. Like the agency model, it remains unclear at the moment who will control other lucrative channels to the OEMs, or its dealer network, or a combination of both.

With direct connectivity with the customer, this provides a greater understanding of the customer requirements and gives the OEM the opportunity to upsell to the customer. The OEM would also partake in the part-exchange (PX) transaction when the customer returns to purchase their next new vehicle. The knowledge of what vehicle is returning and its PX price could also enable the OEM to undertake direct sales in the used car market. Currently, the fate of the PX vehicle is determined by the dealer. The OEM could have the choice of allowing the vehicle to go to its dealer network or go to its own used car supermarket. HeyCar is owned by VW and Mercedes Benz, while Stellantis, through Aramis Group (used car subsidiary of Stellantis), has purchased a majority stake in Motor Depot Limited in the UK. It is widely understood that the OEMs want to play a larger part in the used car market as this would generate more profits through the sales of additional car finance and also additional spare parts, which are profitable for both the OEMs and its national sales companies. This raises the question: could OEMs go down the direct sale route for used vehicles? We believe that this is possible if done correctly, but it will take time and careful planning.

If these changes are not significant enough, we also believe that subscription will play a part in changes to the downstream industry. Volvo has indicated that 50% of its vehicles produced will be on subscription by 2025 (Source AutoCar - Volvo targets 33% autonomous sales and 50% subscription sales by 2025 | Autocar). The meaning of subscription is blurred between two potentials:

- The opportunity to use a vehicle over a period of a minimum of three months, exchanging vehicles regularly, e.g. an SUV is used during the week for taking the children to school. In contrast, a sports car is used at the weekend for pleasure and leisure. However, we believe that this model is not yet tenable as consumers do not want to change their vehicles, and the asset operator cannot utilise the vehicle sufficiently to make the process work

- The second option (and our preferred definition of subscription) is a minimum contract that is longer than three months – an average of 9-12 months with a monthly payment, including insurance, servicing – in simple fuel and go, similar to the above, but with less flexibility

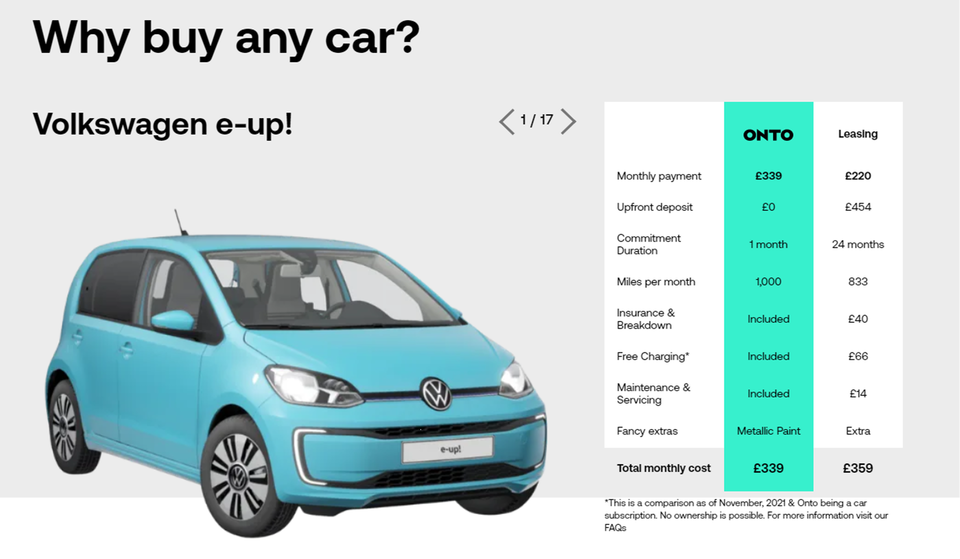

The subscription market remains small at present and fits well with the agency model and omnichannel customer process. The subscription model enables the customer to pay a monthly fee with all services included, with the exception of fueling the vehicle, and fueling could also be included with BEV - in simple terms, a one-stop-shop. 80% of subscription customers sign up for more than one term of subscription after 9-12 months (source Wagonex). Furthermore, there is no requirement for a deposit and the process online financing process: ‘know your clients’, AML checks and insurance can be undertaken online within 5-10 minutes, quickly followed by the delivery of a vehicle. Although leasing may be less expensive than subscription for an ICE vehicle, this does not appear to be the case for BEVs, according to OnTo, with a monthly subscription payment of £339 per month all-inclusive, whereas leasing the same electric vehicle (VW e-up) would cost £359 per month (see the following example). We believe that the growth of subscription will be slow, but provide the opportunity for OEMs, dealers and independent used car operators to provide another flexible service to its customers.

Source: OnTo

There is no single catalyst that has started the change for the auto-downstream market, and we are unable to address all these changes, e.g. COVID; consolidation of franchise dealer groups by non-franchise dealer automotive companies. However, all these changes are interlinked. As they play out over the coming years, the companies in the downstream automotive industry will continue to evolve in the next five years. We in Grant Thornton are fully equipped and working with a number of major OEMs and dealer groups, de-risking business models and ensuring that the full advantage is taken of the substantial opportunities that will evolve. We would be happy to discuss the implication laid out above and how we can develop winning strategies for your business.