Philip Nothard

INSIGHT DIRECTOR

6 min read

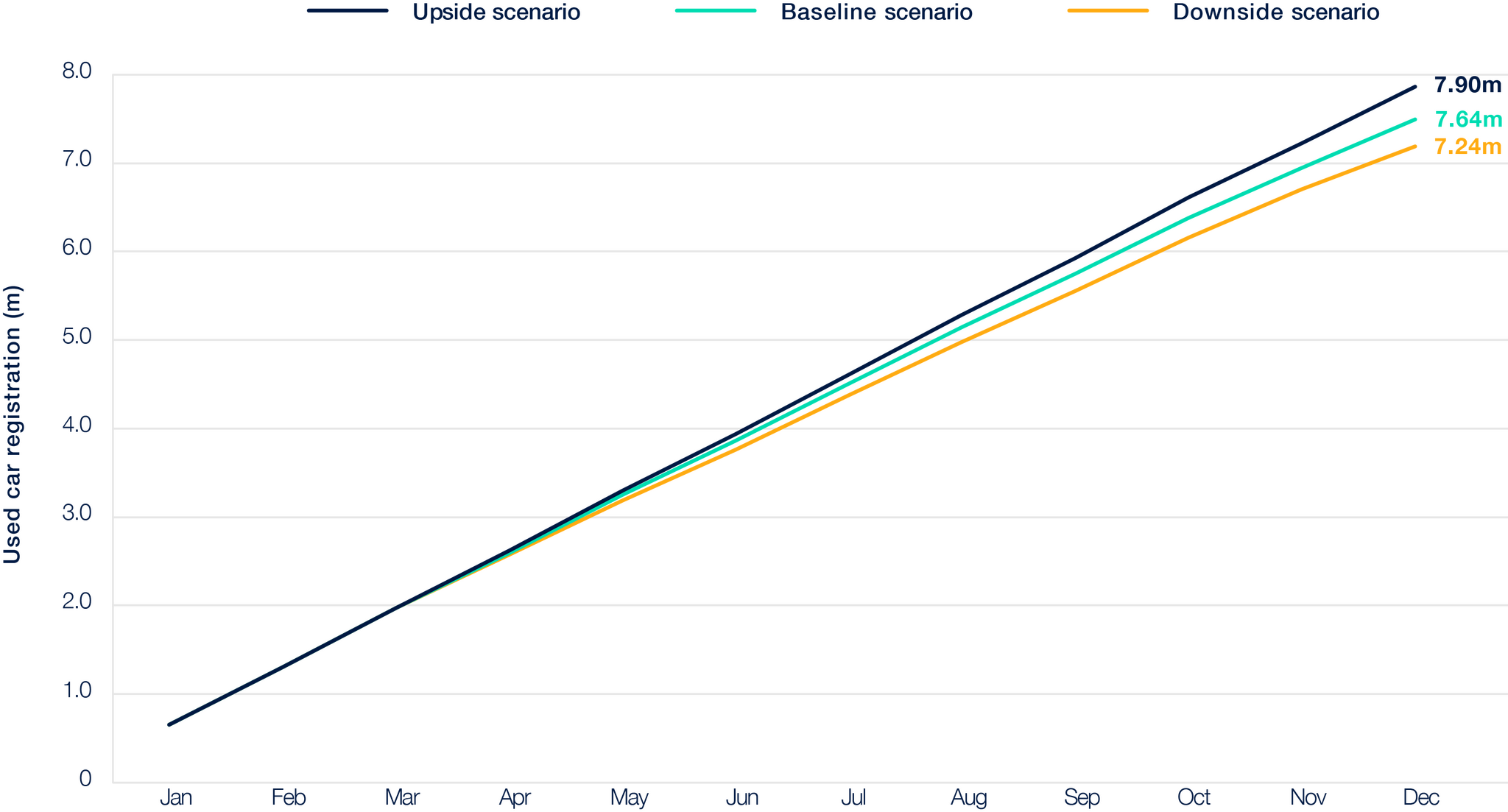

Our latest used car forecasts for 2025 shed light on what the next year may have in store for the market. Using our own proprietary insights and market intelligence, we have prepared three scenarios – upside, baseline and downside – to visualise how the market may evolve in line with a variety of changing factors.

Our baseline forecast predicts 7,643,043 used car transactions by the end of 2025. This would represent a flat growth rate, maintaining parity with performance in 2024. This reflects an environment marked with challenges to navigate and hurdles to clear. However, with incremental growth in wholesale supply predicted, the outlook by the end of the year may be significantly more positive.

Source: SMMT / Cox Automotive

Upside scenario

In this optimistic, upside scenario, the UK economy could exceed expectations in 2025, driven largely by faster-than-anticipated base rate cuts and easing inflation, which stabilise at 3%. These factors help to reduce cost-of-living pressures create a more favourable environment for growth, which is reflected across the used car market.

Improved market conditions make way for improved consumer confidence, spurring demand for used vehicles, including electric vehicles (EVs), as supply levels return to near pre-pandemic levels. In anticipation of this shift, dealers adjust their stock profile to reflect rising consumer interest in EVs.

Normalising vehicle depreciation rates also support improved market stability, while legacy supply disruptions have a minimal impact.

Together, these factors result in a positive outlook for the used car market.

Baseline scenario

Our baseline scenario sees moderate recovery for the UK economy, characterised by steady growth and controlled inflation, aligning with IMF forecasts of 1.6%. Consumer spending grows cautiously as households continue to adjust to persistent cost pressures. Challenges persist which impact how retailers conduct their businesses, however, moderate optimism remains.

The first half of 2025 sees a constrained wholesale supply volume, with gradual improvements in H2. This is felt especially in quality used vehicles and non-electric models, especially in the 3-5 year range.

Retailers face continued pressure from recent tax policies and rising operational costs, while consolidation trends persist among mid-sized operators. For larger-scale operations, stability is maintained, supported by international investment.

Despite a rocky outlook, incremental growth in wholesale supply volumes and stable consumer spending provides some optimism for the used car market.

Downside scenario

The UK economy faces significant headwinds in our baseline scenario, delaying its recovery and prolonging inflationary and cost-of-living pressures. Interest rate cuts are slower than anticipated, suppressing consumer confidence and spending while GDP growth lags at 1.2%, below initial forecasts.

Supply constraints persist, with a mismatch between available vehicles and consumer demand exacerbating pricing pressures

Recent taxation changes further dampen consumer spending and business investment, while uncertainty surrounding policy initiatives such as ZEV mandates stall the transition to EVs. This results in weaker sales volumes, compressed margins, and a fragmented market.

Retailers face declining sales volumes and tighter margins, with mid-sized operators at greatest risk.

Source: Cox Automotive