Inflated used car prices – a new normal?

In this section, we discuss the primary factors driving the current used car market and share our latest used car forecasts.

Continue reading

In the last issue of AutoFocus, published in July, we asserted that the used car market has never been more important to the overall health of the automotive industry than it has been in 2021. The last few months have given more weight to this suggestion.

At the time, new car supply problems, increased public spending, and changing behaviours towards public transport had created a perfect storm, resulting in unprecedented used car demand. Unfortunately, the market couldn’t cope; the vehicles simply weren’t available in the numbers required to satisfy demand and prices for used vehicles have risen to record levels since.

These trends have only continued since the summer. Today prices remain at record levels, increasing a massive +27.5% over the previous eight months in the 3-year/60k miles bracket, meaning cars are worth nearly 30% more than they were at the start of 2021. In some cases, nearly new vehicles are selling for more than their brand-new counterparts.

It's important to be aware that averages hide a lot of activity, with increases and decreases varying massively across different makes and models, as well as age and mileage profiles. So, it's fair to say the market is in an odd state at the moment! The reasons for this are clear, and all eyes are looking towards 2022, where there are hopes some normality will return.

Used car values – what is the new normal?

While prices have now increased for eight consecutive months, recent signs point towards a potential softening in the market. For example, cap hpi values decreased 1.2% heading into December, compared to +1.2% and +5.9% for the previous two months, at the 3-year/60K miles benchmark.

And while it remains the case that prices overall have continued to rise, the situation is becoming increasingly complex, with some models starting to see significant price decreases. The October increase of +5.9% is misleading, as it doesn’t represent live market data where many models that saw an increase at the start of the month, in fact, dropped off by the end.

It’s important to remember in the final month of the year, traditionally a slow period as retail activity slows ahead of Christmas. Prices are expected to drop in line with usual market cycles, so current prices still reflect a high demand, low supply market. With prices as they are, dealers are becoming increasingly cautious, but as the year draws to a close, they will require stock for the new year, so prices are unlikely to drop significantly.

But will prices ever go back to pre-pandemic levels? We expect current market conditions to continue throughout Q1 2022, and it’s entirely possible that we are seeing a revised benchmark for the used vehicle parc. As ever, it all hangs on new vehicle supply. Once that improves, the pressure on the used market will decrease, and some equilibrium should be found.

We know there is no immediate wave of new vehicle stock on the horizon, and when it does come, it’s unclear where the UK will fall in terms of priority of supply. Some manufacturers will also fare better than others, with those that can secure vital semiconductors and materials earlier providing increased supply faster than those that have struggled.

As production ramps up in the early parts of 2022, PHEVs and BEVs will be prioritised to meet growing consumer demand in this sector, meaning ICE vehicles may experience supply shortages for even longer.

In an already strong market, EVs have stood out with +2.4% average value increase heading into November. With EVs likely to be favoured when supply increases, this could continue to prop up used prices at their current rate. With all this in mind, we anticipate used car values to continue at their current level for the short term.While prices have now increased for eight consecutive months in 2021 since the end of lockdown, recent signs point towards a potential softening in the market. For example, black book prices increased just +1.2% heading into November, compared to +5.9% and +3.7% for the previous two months.

Where is the margin?

With over 1.3 million new vehicles lost from the vehicle parc between March 2020 and October 2021, it’s clear this will have a knock-on effect in the wholesale market.

We’ve reviewed sold price data from Manheim Auction Services to reveal how wholesale values have performed as a percentage of new car price.

Source: Manheim data compared as values against OCN (Original Cost New inc. VAT)

The results show a steep incline in wholesale sold prices as a percentage of new since the start of 2021. The data illustrates stable performance throughout 2020 as the sector responded to the various levels of lockdown, adapted to a click-and-collect environment, and attempted to understand and react to the early warning of a supply and demand imbalance.

However, since showrooms reopened in April 2021, the shortage of vehicles entering the used vehicle parc and the severity of the raw material shortages creating long lead times and cancellation of models became apparent.

We can see that the biggest increases are seen in the 0 to 2-year sector, where supply and demand imbalances have been felt the most. New vehicle shortages have starved the demonstrator, courtesy car, and short-term rental sector market, which historically is a dominant source of wholesale stock in the age profile.

The used LCV market

“LCV volumes will remain constrained during Q1. For the first time in over a decade, disposal managers head into a new year with complex strategies as new vehicle delivery dates and customer extensions continue to dominate business priorities and capabilities. As a result, we expect age and mileages to continue to show significant shifts as sellers prioritise Euro 5 defleets into the wholesale market. These dynamics are evident in the remainder of 2021, with average age increasing by seven months and average mileage by 12,693, ahead of averages observed in the other three quarters of 2021. In October, age and mileage were the highest seen in nine years, with an average age of 67 months and 86,414 miles. Overall, we expect prices to continue to perform positively, as volume constraints, matched with a winter period, will continue to fuel both the retail sector and buyer demand during the first quarter of 2022.”

Matthew Davock, Director of Commercial Vehicles,

Manheim Auction Services

Used car forecasts

As discussed above, 2021 has seen continual record prices for used vehicles in the wake of poor new car supply and increased demand. This trend started in the second half of 2020, and if you look back just one year, the used car values at the time were seen as unsustainable. However, continued pressure on supply has prompted a continuation of this trend and will likely continue throughout Q1 2022.

The medium to long-term may yet see a realignment in values, with used cars finding a new baseline in comparison to an increasing new car price profile. But this is unlikely in the immediate future, as challenges remain in sourcing sufficient used vehicles to meet the current consumer demand. In addition, with the new car market seeing an increase in prices, values in the used car sector are likely to remain higher as well.

As with our new car forecasts, several scenarios have been outlined for this year. We give best, mid and worst-case scenarios.

As ever, there are significant, multiple, and complex variables at play, so dealers are advised to prepare for all possible contingencies. As with new cars, we see supply constraining the market with a lack of choice and high retail prices pushing consumers to defer purchasers.

Best-case scenario

Our best-case scenario sees 2021 end on 7.410 million used car sales after a 1.631 million Q4. This is +9.7% higher than 2020, and -6.6% lower compared to 2019. We have also forecast ahead to Q1 2022, where the quarter will end on 1.956 million sales, a +15.9% increase year-on-year, and +4.2% up on the 2001-2019 average.

Mid-case scenario

Our mid-case scenario sees 2021 end on 7.140 million used car sales after a 1.503 million Q4. This is +5.7% higher than 2020 but falls -10% down compared to 2019. We have also forecast ahead to Q1 2022, where the quarter will end on 1.903 million sales, a +12.8% increase year-on-year, and +1.3% up on the 2001-2019 average.

Worst-case scenario

Our worst-case scenario sees 2021 end on 6.857 million used car sales after a 1.366 million Q4. This is +1.5% higher than 2020 but falls -13.6% down compared to 2019. We have also forecast ahead to Q1 2022, where the quarter will end on 1.790 million sales, a +6.1% increase year-on-year, but -4.7% down on the 2001-2019 average.

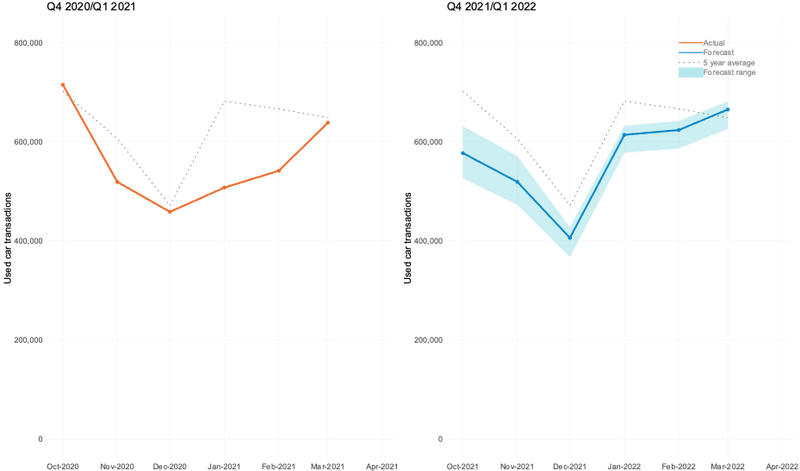

Used car forecast - Q4 2021 and Q1 2022 focus

Source: Cox Automotive & Grant Thornton

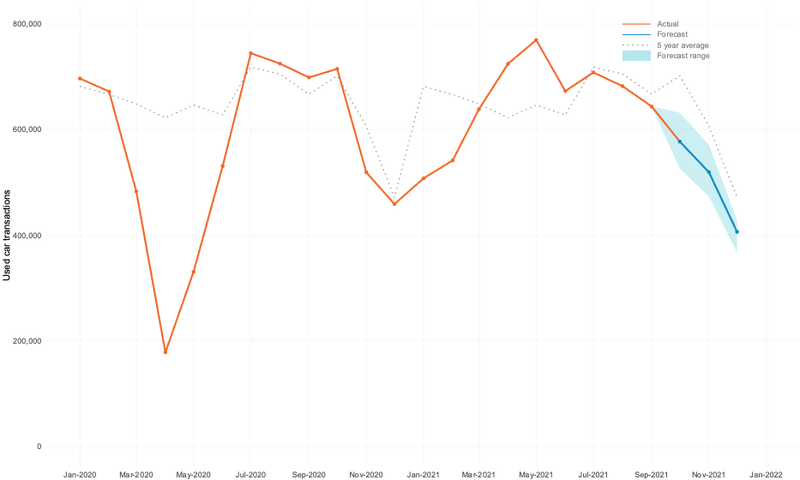

Used car annual forecast 2021

Source: Cox Automotive & Grant Thornton

The US perspective

“The used market in the US is poised for growth and continued pricing power in Q1 2022 as the traditional tax refund season fuels peak demand for the year. The used market will enter the new year with relatively tight supply as days of supply was trending down 10% below normal to end 2021. As a result, prices are likely to see additional gains on top of the record levels achieved in the fall of 2021. The peak in vehicle values is likely to occur in April, as normalising demand and improving new vehicle production should lead to depreciation returning later in 2022.”

Jonathan Smoke, Chief Economist, Cox Automotive Inc